2025 XAUT Price Prediction: Analyzing Gold-Backed Stablecoins in the Evolving Digital Currency Landscape

Introduction: XAUT's Market Position and Investment Value

Tether Gold (XAUT), as a gold-backed stablecoin, has established itself as a significant player in the cryptocurrency market since its inception in 2020. As of 2025, XAUT has achieved a market capitalization of $1,371,740,074, with a circulating supply of approximately 375,572 tokens, and a price hovering around $3,652.4. This asset, often referred to as "digital gold," is playing an increasingly crucial role in providing a bridge between traditional gold investments and the digital asset space.

This article will provide a comprehensive analysis of XAUT's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment, offering professional price predictions and practical investment strategies for investors.

I. XAUT Price History Review and Current Market Status

XAUT Historical Price Evolution

- 2020: XAUT launched, price started at $1,447.84 (all-time low)

- 2022: Gold prices surged due to global economic uncertainties, XAUT reached $2,000+

- 2025: XAUT hit all-time high of $3,673.73 on September 9th

XAUT Current Market Situation

As of September 12, 2025, XAUT is trading at $3,652.4, with a 24-hour trading volume of $2,549,852.58. The token has seen a 0.61% increase in the last 24 hours and a significant 45.31% rise over the past year. XAUT's market cap currently stands at $1,371,740,074.94, ranking it 93rd in the overall cryptocurrency market. The circulating supply matches the total supply at 375,572.247 tokens. With its price closely tracking the value of physical gold, XAUT continues to attract investors seeking a digital representation of the precious metal.

Click to view the current XAUT market price

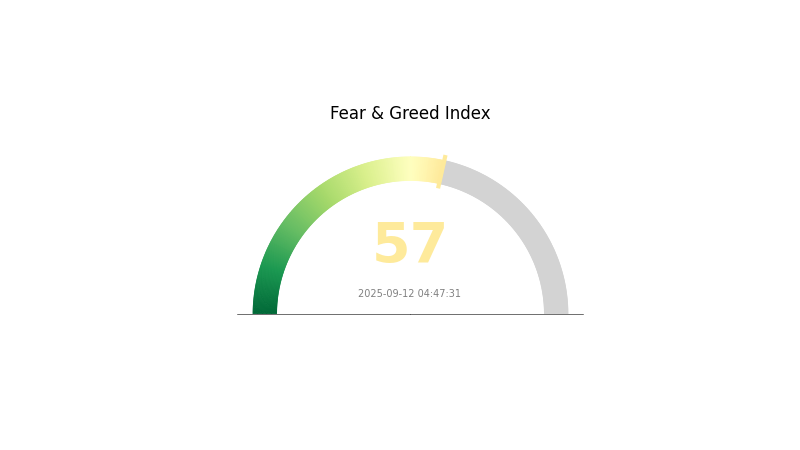

XAUT Market Sentiment Indicator

2025-09-12 Fear and Greed Index: 57 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently exhibiting signs of greed, with the Fear and Greed Index at 57. This suggests investors are becoming increasingly optimistic, potentially driven by recent positive market developments. However, traders should remain cautious as heightened greed can lead to overvaluation and increased volatility. It's crucial to maintain a balanced approach, conducting thorough research and risk assessment before making investment decisions. As always, diversification and proper risk management are key in navigating the dynamic crypto landscape.

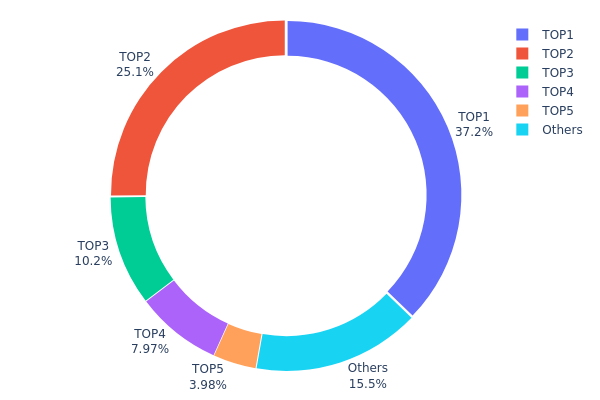

XAUT Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for XAUT. The top five addresses collectively control 84.44% of the total supply, with the largest holder possessing 37.22% of all tokens. This level of concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution suggests that XAUT's market structure is vulnerable to the actions of a few large holders. Any significant movement by these top addresses could have a disproportionate impact on the token's price and liquidity. Moreover, this concentration undermines the principle of decentralization, which is often valued in cryptocurrency markets.

From a market stability perspective, the current XAUT holdings distribution indicates a relatively fragile on-chain structure. The dominance of a small number of addresses could lead to increased market volatility and potentially affect the token's ability to maintain a stable peg to gold, which is crucial for its intended function as a digital gold equivalent.

Click to view the current XAUT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5754...07b949 | 139.80K | 37.22% |

| 2 | 0x785f...4eff76 | 94.35K | 25.12% |

| 3 | 0xf9b3...098057 | 38.18K | 10.16% |

| 4 | 0xba18...df717b | 29.94K | 7.97% |

| 5 | 0x742d...38f44e | 14.94K | 3.97% |

| - | Others | 58.35K | 15.56% |

2. Key Factors Affecting XAUT's Future Price

Supply Mechanism

- LBMA Gold Benchmark: XAUT's price closely follows the LBMA gold benchmark.

- Historical Pattern: The gold benchmark price has increased by 40% year-over-year.

- Current Impact: The rising gold prices are expected to positively influence XAUT's value.

Institutional and Whale Movements

- Institutional Holdings: XAUT has achieved significant growth, with its market capitalization exceeding $800 million.

Macroeconomic Environment

- Monetary Policy Impact: Despite the Federal Reserve's long-term tightening policy traditionally weakening the appeal of precious metals, gold has seen a 44% year-over-year increase by September 2025.

- Inflation Hedging Properties: XAUT demonstrates strong performance in inflationary environments, mirroring gold's traditional role as an inflation hedge.

- Geopolitical Factors: Global economic uncertainties and geopolitical tensions contribute to increased interest in gold-backed assets like XAUT.

Technical Development and Ecosystem Building

- Tokenization of Gold: XAUT represents a bridge between traditional gold investments and the cryptocurrency market, allowing gold to circulate globally in digital form.

- Ecosystem Applications: While XAUT has limited adoption in major DeFi lending platforms, it remains a significant player in the tokenized gold market alongside competitors like PAXG.

III. XAUT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2,228 - $3,000

- Neutral prediction: $3,000 - $3,800

- Optimistic prediction: $3,800 - $4,712 (requires strong gold market performance)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $3,848 - $6,974

- 2028: $4,183 - $7,483

- Key catalysts: Increasing institutional adoption, global economic uncertainties

2029-2030 Long-term Outlook

- Base scenario: $6,687 - $7,925 (assuming steady growth in gold market)

- Optimistic scenario: $7,925 - $9,161 (strong gold performance and increased crypto adoption)

- Transformative scenario: $9,161 - $9,906 (exceptional gold rally and mainstream XAUT acceptance)

- 2030-12-31: XAUT $7,924.64 (116% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4712.11 | 3652.8 | 2228.21 | 0 |

| 2026 | 5437.19 | 4182.46 | 3764.21 | 14 |

| 2027 | 6974.25 | 4809.82 | 3847.86 | 31 |

| 2028 | 7482.88 | 5892.03 | 4183.34 | 61 |

| 2029 | 9161.82 | 6687.46 | 6018.71 | 83 |

| 2030 | 9905.8 | 7924.64 | 5388.75 | 116 |

IV. XAUT Professional Investment Strategies and Risk Management

XAUT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking gold exposure

- Operational suggestions:

- Accumulate XAUT during market dips

- Set up regular purchase plans

- Store in secure hardware wallets or custodial solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Monitor gold market sentiment and macroeconomic factors

- Set strict stop-loss and take-profit levels

XAUT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-15%

- Aggressive investors: 15-20%

(2) Risk Hedging Solutions

- Diversification: Combine XAUT with other assets

- Options strategies: Use protective puts for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage option: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for XAUT

XAUT Market Risks

- Gold price volatility: Fluctuations in gold markets affect XAUT value

- Liquidity risk: Limited trading volume may impact large transactions

- Counterparty risk: Reliance on Tether's gold reserves and management

XAUT Regulatory Risks

- Changing regulatory landscape: Potential new rules for gold-backed tokens

- Cross-border restrictions: Varying regulations in different jurisdictions

- Compliance challenges: Ensuring adherence to AML and KYC requirements

XAUT Technical Risks

- Smart contract vulnerabilities: Potential for code exploits

- Blockchain network issues: Congestion or high fees on Ethereum network

- Integration risks: Compatibility issues with wallets or exchanges

VI. Conclusion and Action Recommendations

XAUT Investment Value Assessment

XAUT offers digital exposure to gold, providing a hedge against inflation and market volatility. However, investors should be aware of regulatory uncertainties and technical risks associated with blockchain-based assets.

XAUT Investment Recommendations

✅ Beginners: Start with small allocations as part of a diversified portfolio ✅ Experienced investors: Use XAUT for gold exposure and potential arbitrage opportunities ✅ Institutional investors: Consider XAUT for digital gold allocation and treasury management

XAUT Participation Methods

- Spot trading: Purchase XAUT on Gate.com

- Custody solutions: Use institutional-grade custody services for large holdings

- DeFi integration: Explore yield opportunities in decentralized finance protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is xaut a stable coin?

Yes, XAUT is a stablecoin backed by physical gold. Its value is tied to gold prices, making it stable relative to gold but not to fiat currencies.

What will the price of gold be in 2025?

Based on Bloomberg Terminal predictions, gold price in 2025 is expected to range between $1,709.47 and $2,727.94, influenced by current market conditions.

Will xauusd reach 3000?

Yes, XAUUSD is likely to reach $3000 by 2025. Analysts predict gold prices could hit this target due to economic factors and market trends.

Is xaut backed by gold?

Yes, XAUT is fully backed by gold. Each XAUT token represents one troy ounce of physical gold held in secure vaults.

How Does XAUT's Community Engagement Impact Its Ecosystem Growth?

2025 PAXG Price Prediction: Analyzing Gold-Backed Token's Growth Potential in an Uncertain Economic Landscape

What is PAXG: Understanding the Gold-Backed Digital Asset and Its Role in Modern Investment Portfolios

Ondo Finance: What It Is and How ONDO Token Works

Is Tether Gold (XAUT) a good investment?: Analyzing the Risks and Potential of Gold-Backed Stablecoins

GUSD: A stablecoin backed by real-world assets for secure wealth management on Gate.

Beginner’s Guide: How to Create a MetaMask Wallet and Use a Web3 Wallet Safely

FDIC Stablecoin Issuance Plan: How Banks Can Apply to Issue Stablecoins

Is AI Companions (AIC) a good investment?: Analyzing Market Potential, Risk Factors, and Future Growth Opportunities in the AI Companion Industry

Is Kava (KAVA) a good investment?: A comprehensive analysis of market potential, risks, and future prospects

COW vs SHIB: Which Meme Coin Offers Better Investment Potential in 2024?