2025 WALLET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: WALLET's Market Position and Investment Value

Ambire wallet (WALLET) is a full-featured open-source non-custodial DeFi wallet designed for users ranging from absolute beginners to DeFi enthusiasts. As of December 22, 2025, WALLET has established itself as a utility token within the Ambire ecosystem with a market capitalization of approximately $11.09 million and a circulating supply of around 704.24 million tokens, currently trading at $0.015751. This innovative digital asset is increasingly playing a critical role in incentivizing Ambire Wallet users and facilitating decentralized governance within the platform.

This article will provide a comprehensive analysis of WALLET's price trajectories and market dynamics, combining historical price patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

Ambire Wallet (WALLET) Market Analysis Report

I. WALLET Price History Review and Current Market Status

WALLET Historical Price Evolution Trajectory

-

February 2022: WALLET reached its all-time high (ATH) of $0.199652 on February 4, 2022, marking the peak of early market enthusiasm following the token's launch phase.

-

September 2023: The token experienced its all-time low (ATL) of $0.00329061 on September 6, 2023, reflecting a significant market correction of approximately 98.35% from its historical peak, indicating substantial volatility during the crypto market downturn period.

-

2024-2025 Period: WALLET demonstrated recovery momentum, with the token appreciating by 26.82% over the past year, suggesting gradual market sentiment stabilization despite remaining significantly below historical highs.

WALLET Current Market Status

As of December 22, 2025, WALLET is trading at $0.015751, representing a market capitalization of approximately $11.09 million with a fully diluted valuation (FDV) of $11.56 million. The token maintains a circulation ratio of 70.42%, with 704.24 million tokens currently in circulation out of a maximum supply of 1 billion tokens.

Short-term price dynamics show positive momentum in the immediate term, with the token gaining 6.33% over the past 24 hours (high: $0.015779, low: $0.014812) and recording a modest 0.21% increase in the past hour. However, medium-term weakness is evident, with WALLET declining 27.66% over the 7-day period, indicating recent selling pressure.

Trading activity remains relatively modest, with 24-hour trading volume reaching approximately $12,739.96, supported by presence on 2 major cryptocurrency exchanges. The token maintains 8,839 unique holders, demonstrating a distributed but specialized holder base.

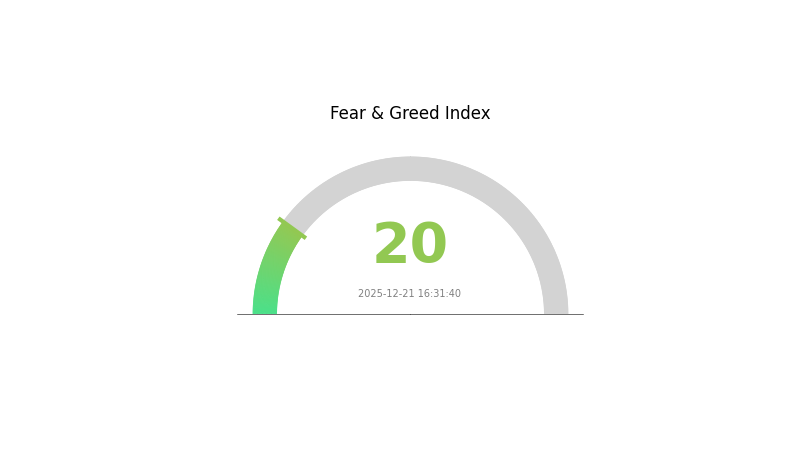

Market positioning places WALLET at rank 1121 by market capitalization, with a market dominance of 0.00035%, indicating its niche status within the broader cryptocurrency ecosystem. The current market sentiment reflects "Extreme Fear" conditions (VIX: 20) as of December 21, 2025, which may be contributing to the recent 7-day price decline despite positive year-to-date performance.

Click to view current WALLET market price

WALLET Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 20. This exceptionally low score indicates intense market pessimism and risk aversion among investors. During such periods, asset prices often reach attractive entry levels for long-term investors, though short-term volatility remains elevated. Market participants should remain cautious while considering this as a potential opportunity window. Monitor Gate.com's market data tools to stay informed about sentiment shifts and make informed investment decisions during this volatile phase.

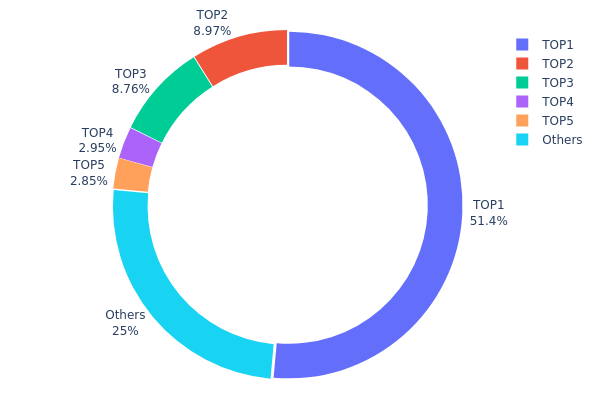

WALLET Holdings Distribution

The address holdings distribution chart illustrates the concentration of token supply across different wallet addresses on the blockchain. It reveals how tokens are allocated among top holders and the broader holder base, serving as a critical metric for assessing token decentralization, market structure stability, and potential concentration risks.

The current distribution data exhibits pronounced concentration characteristics. The top holder commands 51.43% of total supply, representing a significant centralization point. When combined with the second and third largest holders, these three addresses collectively control 68.14% of all tokens in circulation. The top five addresses account for approximately 75% of the total holdings, while the remaining addresses distribute just 25.07% among themselves. This configuration indicates a highly skewed distribution pattern typical of projects in early development stages or those with substantial pre-allocation to core stakeholders.

This concentrated holding structure presents notable implications for market dynamics. The dominance of the largest address creates inherent price volatility risks, as substantial sell-offs from this wallet could exert downward pressure on valuation. Additionally, the thin distribution among smaller holders limits natural market depth and liquidity resilience. While such concentration may reflect legitimate treasury management, team allocations, or institutional positioning, it underscores the importance of monitoring large holder movements through on-chain analytics available on platforms like Gate.com. The current structure suggests limited decentralization maturity and highlights the necessity for ongoing token distribution development to achieve healthier market equilibrium and reduce systemic concentration risks.

For detailed real-time holdings tracking and on-chain analytics, visit WALLET Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x47cd...c12935 | 377567.79K | 51.43% |

| 2 | 0xfde6...2664d1 | 65813.41K | 8.96% |

| 3 | 0x1870...dda12e | 64273.21K | 8.75% |

| 4 | 0x55e0...43a4fa | 21619.66K | 2.94% |

| 5 | 0x53bb...875a66 | 20943.31K | 2.85% |

| - | Others | 183790.17K | 25.07% |

Core Factors Influencing WALLET's Future Price

Supply Mechanism

-

Bitcoin Halving Effect: The 2024 halving event reduced block rewards from 6.25 BTC to 3.125 BTC, significantly decreasing new supply increases. This mechanism cuts Bitcoin's inflation rate to below 1%, creating supply scarcity that supports price appreciation.

-

Historical Patterns: Post-halving periods have historically driven substantial price increases. Following the 2024 halving, the typical one-year cycle suggests renewed upward pressure on prices.

-

Current Impact: The fixed supply of 21 million BTC combined with declining exchange reserves (from 3.1 million to 2.4 million BTC) creates supply-demand imbalance that should support future price appreciation.

Institutional and Major Holder Dynamics

-

Institutional Holdings: Bitcoin ETF approvals have attracted major institutional players including BlackRock and Fidelity. These vehicles have significantly lowered investment barriers, enabling institutional and retail investors to access Bitcoin through regulated channels.

-

Enterprise Adoption: Companies like MicroStrategy continue substantial Bitcoin accumulation, demonstrating corporate treasury strategies increasingly favor Bitcoin as a strategic asset.

-

Government Policy: The Trump administration maintains a positive stance toward cryptocurrency, with officials committed to making the United States a "global Bitcoin center." Potential SAB-121 regulation revisions could enable banks to directly hold digital assets, triggering institutional participation expansion.

Macroeconomic Environment

-

Monetary Policy Impact: Future Federal Reserve rate decisions and quantitative tightening (QT) pace directly influence dollar liquidity, affecting risk asset demand including Bitcoin. Treasury fiscal policy and general account (TGA) dynamics create additional flow variables.

-

Inflation Hedge Characteristics: Bitcoin serves as a value preservation mechanism against currency depreciation. Its fixed supply contrasts with unlimited fiat expansion, positioning it as a long-term inflation hedge in uncertain economic environments.

-

Geopolitical Factors: Global economic uncertainties, trade tensions, and regional conflicts enhance Bitcoin's appeal as a risk mitigation tool and alternative to traditional safe-haven assets.

Technology Development and Ecosystem Building

-

Tokenization Wave: 2025 represents a potential breakthrough year for asset tokenization, with ETHereum emerging as the foundational infrastructure for future financial systems. This trend could substantially increase cryptocurrency utility and adoption.

-

staking Infrastructure: Ethereum staking mechanisms generate sustainable yield (approximately 2.9% on major positions), creating economic incentives for institutional accumulation and long-term holding.

III. 2025-2030 WALLET Price Forecast

2025 Outlook

- Conservative Forecast: $0.00914 - $0.01575

- Base Case Forecast: $0.01575

- Optimistic Forecast: $0.02142 (requires sustained market momentum and ecosystem expansion)

2026-2028 Medium-term Outlook

- Market Phase Expectations: Consolidation and gradual recovery phase with incremental adoption growth

- Price Range Predictions:

- 2026: $0.01580 - $0.02639 (18% potential upside)

- 2027: $0.02069 - $0.02744 (42% potential upside)

- 2028: $0.02421 - $0.03395 (58% potential upside)

- Key Catalysts: Increased institutional adoption, enhanced ecosystem partnerships, technological upgrades, and broader cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02716 - $0.03299 (assumes steady market conditions and moderate adoption growth with 87% cumulative gains by 2029)

- Optimistic Scenario: $0.03122 - $0.04278 (assumes accelerated mainstream adoption and positive regulatory environment with 98% cumulative gains by 2030)

- Transformative Scenario: $0.04278+ (assumes breakthrough developments in blockchain infrastructure, major institutional integration, and paradigm shifts in digital asset utilization)

- December 22, 2030: WALLET projected at $0.03122 average (normalized market valuation with sustained utility growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02142 | 0.01575 | 0.00914 | 0 |

| 2026 | 0.02639 | 0.01859 | 0.0158 | 18 |

| 2027 | 0.02744 | 0.02249 | 0.02069 | 42 |

| 2028 | 0.03395 | 0.02496 | 0.02421 | 58 |

| 2029 | 0.03299 | 0.02946 | 0.01502 | 87 |

| 2030 | 0.04278 | 0.03122 | 0.02716 | 98 |

Ambire Wallet (WALLET) Token Professional Analysis Report

I. Executive Summary

Ambire Wallet is a browser-based cryptocurrency wallet application designed to serve users from absolute beginners to experienced DeFi participants. The WALLET token serves dual purposes: rewarding Ambire Wallet users and enabling governance participation within the ecosystem. As of December 22, 2025, WALLET is trading at $0.015751, representing a significant decline from its all-time high of $0.199652 reached on February 4, 2022.

II. WALLET Token Fundamentals

Token Overview

| Metric | Value |

|---|---|

| Current Price | $0.015751 |

| Market Capitalization | $11,092,553.47 |

| Fully Diluted Valuation | $11,561,352.77 |

| Circulating Supply | 704,244,395.16 WALLET |

| Total Supply | 734,007,540.30 WALLET |

| Maximum Supply | 1,000,000,000 WALLET |

| Market Rank | #1121 |

| 24H Trading Volume | $12,739.96 |

| Number of Holders | 8,839 |

Price Performance Analysis

Recent Price Movements:

- 1-Hour Change: +0.21% (+$0.000033)

- 24-Hour Change: +6.33% (+$0.000938)

- 7-Day Change: -27.66% (-$0.006023)

- 30-Day Change: +1.85% (+$0.000286)

- 1-Year Change: +26.82% (+$0.003331)

Historical Price Range:

- All-Time High: $0.199652 (February 4, 2022)

- All-Time Low: $0.00329061 (September 6, 2023)

- 24-Hour High: $0.015779

- 24-Hour Low: $0.014812

- Decline from ATH: -92.10%

Token Distribution

- Circulating Supply Ratio: 70.42% of total supply

- Remaining Unlock Potential: 29.58% of total supply

III. Ambire Wallet Ecosystem Overview

Platform Features

Ambire Wallet distinguishes itself through several innovative functionalities:

- Email Authentication: Simplified access without traditional seed phrases

- Open Source Architecture: Transparent and community-auditable codebase

- Automatic Gas Management: Optimized transaction fee handling

- Stablecoin Fee Payment: Option to pay network fees in stable currencies

- Hardware Wallet Support: Integration with professional-grade security devices

- Human-Readable Transactions: Enhanced user protection through clear transaction information display

Use Cases of WALLET Token

- User Rewards: Incentive mechanism for Ambire Wallet users

- Governance Participation: Token holders can participate in protocol governance decisions

- Ecosystem Engagement: Rewards for protocol usage and participation

IV. WALLET Professional Investment Strategy and Risk Management

WALLET Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors:

- Cryptocurrency believers committed to DeFi wallet adoption

- Governance-focused participants in blockchain ecosystems

- Risk-tolerant investors with extended time horizons (3-5+ years)

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Accumulate WALLET gradually during market weakness to reduce entry price volatility

- Position Building: Establish positions gradually rather than lump-sum purchases, given current market liquidity of approximately $12,740 in 24-hour volume

- Storage Solutions: Utilize Ambire Wallet itself for self-custody, demonstrating confidence in the platform's security features and supporting ecosystem adoption

(2) Active Trading Strategy

Technical Analysis Tools:

- Support/Resistance Levels: Monitor $0.014812 (24H low) as support and $0.015779 (24H high) as resistance

- Moving Averages: Apply 20-day and 50-day moving averages to identify medium-term trends given the significant negative 7-day performance (-27.66%)

- Volatility Indicators: Track historical price swings from $0.199652 (ATH) to $0.00329061 (ATL) to calibrate position sizing

Wave Trading Key Points:

- Current Market Phase: Monitor recovery from 7-day decline; positive 24-hour movement (+6.33%) may indicate potential short-term bounce

- Entry Signals: Consider technical confirmation patterns during consolidation phases above support levels

- Exit Discipline: Establish clear profit-taking levels and stop-losses given current illiquidity (ranked #1121 by market cap)

WALLET Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-2% portfolio allocation maximum

- Aggressive Investors: 2-5% portfolio allocation maximum

- Professional Investors: 5-10% allocation with rigorous monitoring and risk controls

Rationale: Limited trading volume ($12,739.96 in 24H), low market capitalization rank (#1121), and extreme historical volatility necessitate conservative allocation percentages.

(2) Risk Hedging Strategies

- Stablecoin Collateral: Maintain stablecoin reserves to capitalize on potential downside opportunities or secure gains during rallies

- Portfolio Diversification: Limit WALLET concentration within broader cryptocurrency holdings; avoid over-concentration in single-chain tokens

(3) Secure Storage Solutions

- Self-Custody Option: Utilize Ambire Wallet's browser-based application for direct token management while supporting ecosystem usage

- Cold Storage Consideration: For significant holdings, consider hardware wallet integration features offered by Ambire Wallet to enhance security

- Security Best Practices:

- Never share private keys or seed phrases

- Enable all available security features within Ambire Wallet

- Verify authentic website URLs before accessing wallet interfaces

- Use hardware wallet integration for holdings exceeding personal risk tolerance

V. WALLET Potential Risks and Challenges

Market Risk

- Extreme Historical Volatility: The token has declined 92.10% from all-time high, indicating vulnerability to significant price swings; current market conditions may not support sustained recovery without fundamental ecosystem development

- Limited Trading Liquidity: 24-hour volume of $12,739.96 relative to market capitalization creates potential illiquidity during large sell orders, amplifying price impact

- Market Capitalization Ranking: Position at #1121 suggests limited institutional interest and reduced market resilience during crypto sector downturns

Regulatory Risk

- Cryptocurrency Regulatory Uncertainty: Evolving global regulatory frameworks for wallet applications and governance tokens create potential compliance challenges

- Jurisdictional Variations: Different regulatory approaches across regions may impact token utility and distribution mechanisms

- Governance Token Scrutiny: Regulatory bodies may increase oversight of governance token mechanisms, potentially affecting WALLET utility functions

Technology Risk

- Browser-Based Wallet Security: Web-based architecture introduces potential vulnerabilities compared to native applications or hardware solutions; users must maintain endpoint security

- Smart Contract Risk: Any updates to token mechanics or governance systems carry potential technical risks; open-source nature enables community auditing but requires developer diligence

- Platform Dependency: Token utility tied to Ambire Wallet ecosystem adoption; network effects remain unproven relative to established wallet platforms

VI. Conclusion and Action Recommendations

WALLET Investment Value Assessment

Ambire Wallet represents a specialized investment opportunity within the wallet infrastructure segment. The WALLET token's core value proposition derives from Ambire's innovative feature set (email authentication, automatic gas management, stablecoin fee payments) and open-source architecture. However, the token faces significant headwinds: a 92.10% decline from all-time highs, limited trading liquidity, and an uncertain path to substantial ecosystem adoption.

The 1-year positive performance (+26.82%) suggests potential recovery momentum, yet the severe 7-day decline (-27.66%) highlights continued market skepticism. Success depends critically on Ambire Wallet's ability to scale user adoption and establish WALLET token utility beyond speculative trading.

WALLET Investment Recommendations

✅ Beginners: Conduct extensive due diligence on Ambire Wallet's competitive positioning before investing. Start with minimal allocations (0.5%) if interested in wallet infrastructure sector exposure. Consider WALLET only as part of diversified portfolio approach to blockchain infrastructure.

✅ Experienced Investors: Evaluate WALLET as a speculative position with strict risk management protocols. Employ dollar-cost averaging during weakness rather than lump-sum purchases. Set clear maximum loss thresholds at 30-40% below entry points. Monitor ecosystem development metrics quarterly.

✅ Institutional Investors: Current market capitalization and trading volume make institutional positions impractical without creating significant price impact. Track for potential participation only if ecosystem reaches substantial scaling milestones and trading infrastructure improves.

WALLET Trading and Participation Methods

- Exchange Trading: Trade WALLET tokens on Gate.com and one additional listed exchange; verify current trading pairs before executing orders given limited exchange distribution

- Direct Wallet Integration: Participate in Ambire Wallet ecosystem by holding WALLET for governance participation and receiving user rewards through the Ambire platform

- Staking or Reward Programs: Monitor Ambire Wallet announcements for any upcoming staking mechanisms or reward distribution programs that may enhance token utility

Cryptocurrency investment carries extreme risk. This analysis does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult qualified financial advisors. Never invest more than you can afford to lose. Market conditions, regulatory environments, and project fundamentals can change rapidly, creating substantial downside risk.

FAQ

What's the future of wallet tokens?

Wallet tokens will enhance security, increase authentication rates, and facilitate seamless platform integration. Growing adoption trends suggest a promising future with expanded utility and mainstream use.

What is the best wallet token price prediction for 2025?

Based on project milestones and market conditions, the Best Wallet Token price prediction for 2025 ranges around $0.022–$0.027. This forecast reflects current market trends and development progress.

What factors influence WALLET token price movements?

WALLET token price is influenced by market liquidity, supply and demand dynamics, trading volume, and overall market sentiment. Automated Market Makers (AMMs) set prices based on token supply in liquidity pools, while speculative trading and adoption trends also impact price movements.

How does WALLET token compare to other wallet cryptocurrencies?

WALLET token operates on its own native network, distinguishing it from other wallet cryptocurrencies that run on existing blockchains. This independent infrastructure provides unique ecosystem advantages and greater autonomy in its development and governance.

What are the risks associated with investing in WALLET tokens?

WALLET token investments carry risks including market volatility, regulatory uncertainty, liquidity challenges, and potential smart contract vulnerabilities. Prices can fluctuate significantly based on market sentiment and adoption rates.

Is TrustWallet (TWT) a good investment?: Analyzing the potential and risks of the native token of a popular crypto wallet

Crypto Presale Insights: Exploring Early Investment Opportunities and Strategies

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

FTT Explained

Comparing Blockchain Platforms: Sui and Solana for Developers

Explore CAT Gold Miner: Availability Dates, Price Insights & Purchase Guide

Giới thiệu Capybara Coin (CAPY) — Liệu Token Meme Tiếp Theo Của Solana Có Xuất Hiện?

OGC Coin: Price Forecast and Market Insights

Exploring Licensed Event Prediction Platforms: Bridging Real-World Events with Blockchain