Previsão do preço VVS em 2025: análise de mercado e perspetivas futuras para investidores em criptomoedas

Introdução: Posição competitiva da VVS e potencial de investimento

A VVS Finance (VVS), pioneira e maior plataforma de troca descentralizada com formadores automáticos de mercado (AMM) na blockchain Cronos, consolidou uma posição de destaque desde o seu lançamento. Em 2025, regista uma capitalização bolsista de 194 515 891 $, com cerca de 46 668 879 859 403 tokens em circulação e um preço em torno de 0,000004168 $. Apelidada de "Plataforma DeFi mais Simples", a VVS assume um papel cada vez mais determinante nas finanças descentralizadas e nas operações de swap de tokens.

Neste artigo, apresentamos uma análise aprofundada da evolução dos preços da VVS Finance entre 2025 e 2030, conjugando padrões históricos, dinâmicas de oferta e procura, progresso do ecossistema e fatores macroeconómicos, para fornecer projeções profissionais e estratégias práticas de investimento aos investidores.

I. Análise histórica dos preços da VVS e contexto atual de mercado

Trajetória histórica de preços da VVS

- 2021: Lançamento da VVS Finance; máximo histórico de 0,00033093 $ em 15 de novembro

- 2025: Mínimo histórico de 0,00000168 $ a 28 de fevereiro

- 2025: Recuperação de mercado, preço subiu 67,19 % no último ano

Situação de mercado atual da VVS

Em 24 de setembro de 2025, a VVS negocia a 0,000004168 $. O token registou forte volatilidade nas últimas 24 horas, com máximo de 0,000004492 $ e mínimo de 0,000004101 $. O volume negociado em 24 horas ascende a 36 749,21 $.

A performance da VVS varia consoante o horizonte temporal. Nos últimos 60 minutos caiu 2,45 % e, na semana, recuou 11,68 %. Contudo, valorizou 19,67 % nos últimos 30 dias e 67,19 % no último ano, indiciando um ciclo favorável a médio e longo prazo, apesar das oscilações de curto prazo.

Atualmente, a capitalização da VVS é de 194 515 891 $, ocupando o 302.º lugar no ranking cripto. Apresenta uma oferta de tokens em circulação de 46 668 879 859 403, equivalente a 46,67 % da oferta máxima de 100 triliões.

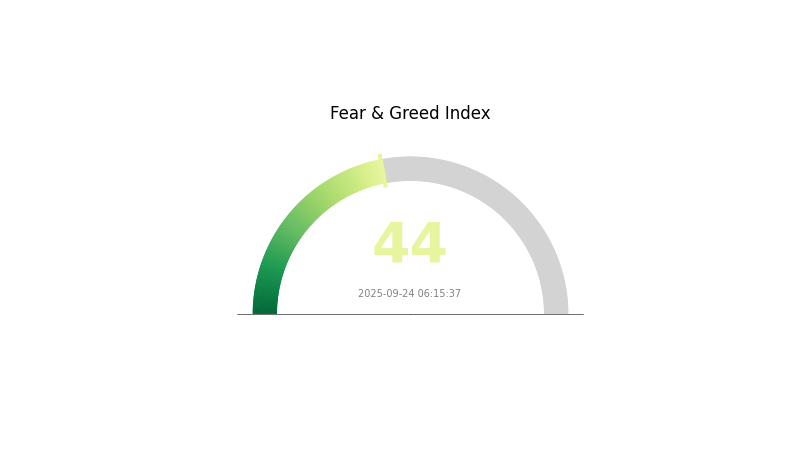

No mercado cripto, prevalece um sentimento de "Fear", com VIX em 44, o que poderá impactar a dinâmica de preço da VVS.

Clique para consultar o preço de mercado da VVS

Indicador de sentimento de mercado da VVS

24-09-2025 Fear and Greed Index: 44 (Medo)

Clique para consultar o Fear & Greed Index

O ambiente do mercado mantém-se prudente, com o Fear & Greed Index nos 44 pontos, sinalizando predominância de medo. Os investidores evidenciam hesitação e aversão ao risco, criando possíveis oportunidades para estratégias contrárias. No entanto, é essencial realizar uma análise rigorosa e gerir o risco de forma prudente. O contexto pode alterar-se rapidamente, pelo que o acompanhamento contínuo e a adaptação estratégica são cruciais. Lembre-se que extremos de medo podem indicar aproximação de mínimos de mercado, mas recomenda-se investir com responsabilidade.

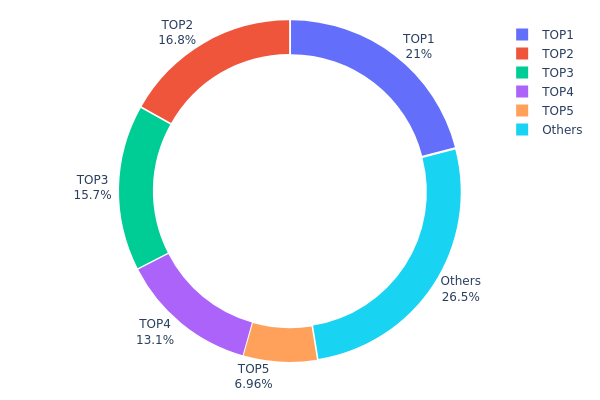

Distribuição de detentores da VVS

A análise de distribuição dos endereços da VVS revela elevada concentração: os 5 maiores detêm 73,5 % da oferta total, sendo o principal responsável por 20,96 %. Esta estrutura levanta dúvidas sobre o grau de descentralização do projeto e potencia riscos de manipulação de mercado.

A concentração pode acentuar a volatilidade e a propensão a movimentos bruscos. Os grandes detentores influenciam fortemente a liquidez e a estabilização do preço, sendo este fator dissuasor para alguns investidores devido ao risco de centralização e manipulação por parte dos maiores.

Por outro lado, há 26,5 % de tokens distribuídos por outros endereços, o que transmite alguma dispersão. Esta maior base de detentores aumenta a resiliência face a movimentos extremos impulsionados pelos principais, embora a atual estrutura exija atenção contínua dos participantes quanto à estabilidade on-chain e à descentralização.

Clique para consultar a Distribuição de Detenções da VVS

| Top | Endereço | Quantidade Detida | Percentagem (%) |

|---|---|---|---|

| 1 | 0x0253...25c1ea | 20 397 544 490,08K | 20,96 % |

| 2 | 0xbf62...50270b | 16 387 719 575,22K | 16,84 % |

| 3 | 0xdccd...9564bc | 15 272 006 864,42K | 15,69 % |

| 4 | 0x109d...3a38a2 | 12 702 500 000,00K | 13,05 % |

| 5 | 0x852f...fb4e49 | 6 775 466 302,87K | 6,96 % |

| - | Outros | 25 760 872 236,99K | 26,5 % |

II. Fatores determinantes para os preços futuros da VVS

Mecanismo de oferta

- Tecnologia de cultivo: O avanço na tecnologia do cultivo de diamantes deverá aumentar a oferta e pressionar os preços em baixa.

- Padrão histórico: O desenvolvimento tecnológico reduziu a diferença de preços entre diamantes naturais e cultivados.

- Impacto atual: A contínua evolução tecnológica tende a ampliar a oferta, intensificando a pressão sobre os preços dos diamantes VVS.

Ambiente macroeconómico

- Capacidade de proteção contra inflação: Tradicionalmente vistos como reserva de valor, os diamantes podem ver a sua função de proteção contra inflação mitigada pelo aumento da oferta cultivada.

- Fatores geopolíticos: A estabilidade económica e política internacional influencia o segmento dos bens de luxo, incluindo diamantes VVS de topo.

Desenvolvimento tecnológico e do ecossistema

- Melhoria da qualidade: Técnicas de cultivo mais sofisticadas permitem produzir diamantes VVS de qualidade superior.

- Aceitação do mercado: O reconhecimento crescente dos diamantes cultivados como opção legítima está a expandir a procura.

III. Projeção do preço da VVS entre 2025 e 2030

Perspetiva para 2025

- Previsão conservadora: 0,000009 $–0,00001 $

- Previsão neutra: 0,00001 $

- Previsão otimista: 0,000011 $–0,000012 $ (dependente de forte expansão de mercado e adoção)

Perspetiva para 2027-2028

- Fase de crescimento potencial com adoção crescente

- Intervalo previsto:

- 2027: 0,000011 $–0,000013 $

- 2028: 0,000013 $–0,000015 $

- Catalisadores: Expansão do ecossistema DeFi, otimização da tokenomics, recuperação de mercado

Projeção de longo prazo para 2029-2030

- Cenário base: 0,000015 $–0,00002 $ (crescimento sustentado e desenvolvimento do projeto)

- Cenário otimista: 0,00002 $–0,000025 $ (caso se verifique forte expansão e novas parcerias)

- Cenário disruptivo: 0,000025 $–0,00003 $ (com inovações tecnológicas e adoção massiva)

- 31-12-2030: VVS 0,00002 $ (potencial máximo para cenário bullish)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,00001 | 0 | 0 | 2 |

| 2026 | 0,00001 | 0,00001 | 0 | 25 |

| 2027 | 0,00001 | 0,00001 | 0 | 27 |

| 2028 | 0,00001 | 0,00001 | 0 | 56 |

| 2029 | 0,00001 | 0,00001 | 0 | 72 |

| 2030 | 0,00001 | 0,00001 | 0 | 101 |

IV. Estratégias profissionais de investimento e gestão de risco em VVS

Metodologia de investimento em VVS

(1) Estratégia de longo prazo

- Perfil indicado: Investidores com maior tolerância ao risco e visão de longo prazo

- Recomendações práticas:

- Investir de modo fracionado ao longo do tempo

- Guardar tokens em wallet segura, visando valorização futura

- Considerar staking dos tokens VVS na plataforma VVS Finance para rendimentos adicionais

(2) Estratégia de negociação ativa

- Ferramentas técnicas:

- Médias móveis: Identificação de tendências e reversões

- RSI (Índice de Força Relativa): Avaliação de sobrecompra e sobrevenda

- Pontos essenciais para swing trading:

- Acompanhar volume para validar movimentos de preço

- Definir ordens de stop-loss para limitar prejuízos

Estratégias de gestão de risco para VVS

(1) Princípios de alocação de ativos

- Investidor conservador: 1–3 % da carteira cripto

- Investidor agressivo: 5–10 % da carteira cripto

- Investidor profissional: até 15 %, conforme perfil de risco

(2) Soluções para cobertura de risco

- Diversificação: Investir em múltiplas criptomoedas e ativos distintos

- Stop-loss: Implementar limites automáticos para controlar perdas

(3) Soluções de armazenamento seguro

- Hot wallet recomendada: Gate Web3 wallet

- Armazenamento frio: Wallets hardware para proteger grandes volumes a longo prazo

- Regras de segurança: Ativar autenticação dupla, criar passwords robustas e evitar esquemas de phishing

V. Riscos e desafios para a VVS

Riscos de mercado

- Volatilidade elevada: Preços da VVS podem oscilar de forma significativa

- Risco de liquidez: Ordens de grande volume podem ter impacto substancial

- Concorrência: Protocolos DeFi concorrentes podem conquistar quota de mercado

Riscos regulatórios

- Cenário legal incerto: Possível aumento do escrutínio às plataformas DeFi

- Desafios de conformidade: Necessidade de adaptação contínua às normas regulamentares

- Restrições geográficas: Potenciais limitações à disponibilidade da VVS em determinados países

Riscos técnicos

- Vulnerabilidades de smart contracts: Potenciais bugs ou ataques ao protocolo

- Escalabilidade: Desafios na gestão de elevado volume de transações

- Dependência da blockchain Cronos: O desempenho e segurança da rede são determinantes

VI. Conclusão e recomendações práticas

Avaliação do potencial de investimento da VVS

A VVS Finance apresenta potencial para valorização no longo prazo como plataforma líder DeFi na Cronos, mas enfrenta riscos significativos no curto prazo, devido à volatilidade e incerteza regulatória.

Recomendações de investimento para VVS

✅ Iniciantes: Apostar em posições reduzidas e investir na aprendizagem do ecossistema DeFi

✅ Investidores experientes: Alocar parte da carteira DeFi à VVS e gerir as posições de forma ativa

✅ Institucionais: Integrar a VVS numa abordagem diversificada e efetuar due diligence exaustiva

Formas de participar na VVS

- Spot trading: Compra e venda de tokens VVS em Gate.com

- Yield farming: Provisão de liquidez em pools da VVS Finance para obtenção de recompensas

- Staking: Imobilização de tokens VVS para receber rendimento adicional

Os investimentos em criptomoedas são altamente especulativos. O presente artigo não constitui aconselhamento financeiro. Cada investidor deverá agir de acordo com a sua tolerância ao risco, devendo recorrer a consultores financeiros profissionais. Nunca invista mais do que pode perder.

FAQ

Qual a projeção de preço para a VVS em 2040?

Segundo a análise de mercado atual, estima-se que a VVS possa atingir um pico de 0,0002189 $ em 2040.

A VET poderá atingir 1 $?

Até 2030, é improvável que a VET alcance 1 $. Um crescimento de 35 vezes relativamente ao valor atual é pouco plausível, embora no universo cripto tudo seja possível. A fasquia dos 0,50 $ é mais realista, considerando a adoção empresarial e o potencial de expansão do mercado.

A VVS é uma boa aposta de investimento?

A VVS evidencia potencial, prevendo-se, segundo projeções, uma valorização para 0,00000435 $ até 2028. O preço atual é 0,00000435 $ por token, o que implica margem para crescimento.

Qual será a próxima Bitcoin em 2025?

Em 2025, a Ethereum surge como principal candidata a suceder à Bitcoin, apoiada por robustez tecnológica e forte suporte do mercado.

Análise de Preço e Mercado do Token MYX na Gate.com em 2025

Previsão do Preço PNG para 2025: Análise das Tendências de Valorização dos Ativos Digitais no Mercado NFT em Transformação

BMEX vs UNI: Comparação das plataformas líderes de negociação para derivados de criptomoedas e exchange descentralizada

Previsão do Preço DODO em 2025: Análise do Potencial de Crescimento e dos Fatores de Mercado para o Valor Futuro do Token DeFi

SUPE vs SNX: Análise Comparativa de Desempenho e Potencial no Sector dos Ativos Sintéticos

GRAIL vs BAT: A Corrida para Revolucionar a Tecnologia de Deteção do Cancro

Como Navegar pelas Diretrizes de Day Trading no Mercado de Criptomoedas

O que é GRIFFAIN: Guia Completo para Entender Esta Plataforma Tecnológica Revolucionária

O que é ZKJ: Guia Completo sobre Tecnologia de Prova de Conhecimento Zero e Aplicações