2025 UNO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: UNO's Market Position and Investment Value

Lunos (UNO), as a next-generation decentralized risk protection platform, has been making strides in the crypto insurance sector since its inception. As of 2025, Lunos has a market capitalization of $350,858.58, with a circulating supply of approximately 232,049,327.96 tokens, and a price hovering around $0.001512. This asset, often referred to as the "AI-driven risk assessor," is playing an increasingly crucial role in providing automated on-chain coverage and expert security solutions for blockchain protocols.

This article will comprehensively analyze Lunos's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. UNO Price History Review and Current Market Status

UNO Historical Price Evolution Trajectory

- 2021: Initial launch, price reached all-time high of $1.24 on June 4

- 2025: Market downturn, price dropped to all-time low of $0.00148656 on October 31

UNO Current Market Situation

As of October 31, 2025, UNO is trading at $0.001512, representing a significant decline of 87.18% over the past year. The token's market capitalization stands at $350,858, ranking 3765th in the overall cryptocurrency market. In the last 24 hours, UNO has experienced a 12.09% decrease in price, with a trading volume of $15,212. The current price is 99.88% below its all-time high and 1.71% above its all-time low. The circulating supply of UNO is 232,049,327.96 tokens, which is 60.33% of its maximum supply of 384,649,206 tokens.

Click to view the current UNO market price

UNO Market Sentiment Indicator

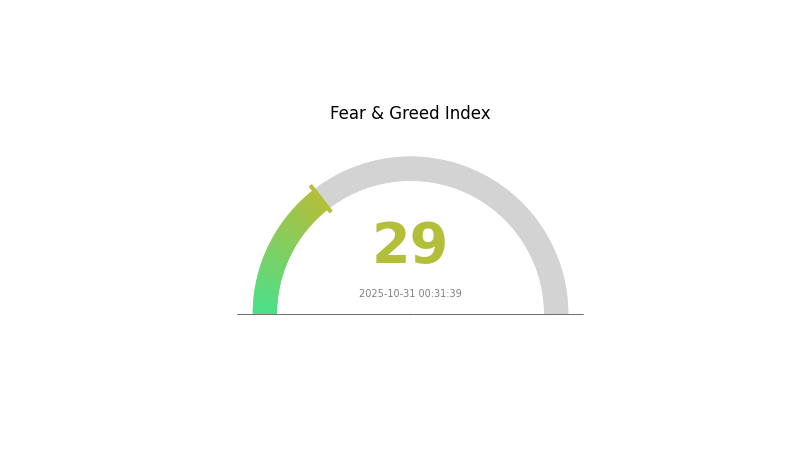

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 29. This indicates a cautious mood among investors, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider using risk management tools available on Gate.com to navigate these uncertain times.

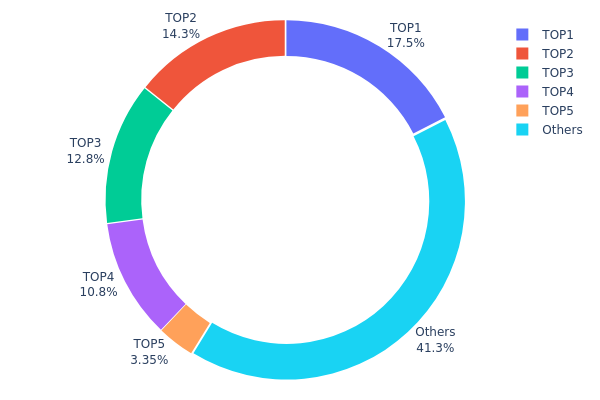

UNO Holdings Distribution

The address holdings distribution data for UNO reveals a significant concentration of tokens among a few top addresses. The largest holder, a burn address (0x0000...00dead), contains 17.46% of the total supply, effectively removing these tokens from circulation. The next four largest addresses collectively control 41.22% of the supply, with individual holdings ranging from 3.35% to 14.27%.

This concentration pattern indicates a relatively high level of centralization in UNO token ownership. With the top 5 addresses holding 58.68% of the supply, there is potential for these large holders to exert significant influence on market dynamics. Such concentration could lead to increased price volatility if any of these major holders decide to sell or accumulate more tokens.

The current distribution structure suggests that UNO's on-chain stability and decentralization level may be compromised. While the presence of a substantial burn address is positive for scarcity, the concentration among a few large holders could pose risks to market integrity and may require careful monitoring by investors and analysts.

Click to view the current UNO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 67178.75K | 17.46% |

| 2 | 0xcbce...7b2635 | 54899.42K | 14.27% |

| 3 | 0x58ed...a36a51 | 49319.17K | 12.82% |

| 4 | 0xd621...d19a2c | 41496.78K | 10.78% |

| 5 | 0x8978...f19fa2 | 12898.17K | 3.35% |

| - | Others | 158856.92K | 41.32% |

II. Key Factors Influencing UNO's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central banks' policies are expected to have a significant influence on UNO's price. The speed and extent of interest rate changes have been exceeding expectations, rapidly affecting market sentiment.

-

Inflation Hedging Properties: Gold remains the preferred safe-haven asset, with increasing distrust in fiat currencies driving its price strength. UNO may exhibit some savings substitute properties, but with higher volatility and regulatory risks.

-

Geopolitical Factors: Global geopolitical tensions, particularly between Western and Eastern blocs, are reshaping economic roles and impacting investment flows. This shift could affect UNO's perceived value as a potential alternative asset.

Technical Development and Ecosystem Building

- AI Integration: The widespread application of artificial intelligence is expected to significantly boost productivity levels. This technological advancement could potentially impact UNO's utility and adoption in various sectors.

III. UNO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00125 - $0.00140

- Neutral prediction: $0.00140 - $0.00160

- Optimistic prediction: $0.00160 - $0.0016 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00140 - $0.00223

- 2028: $0.00110 - $0.00266

- Key catalysts: Increased adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00231 - $0.00246 (assuming steady market growth)

- Optimistic scenario: $0.00262 - $0.00269 (assuming strong bullish trends)

- Transformative scenario: $0.00269+ (extreme favorable market conditions)

- 2030-12-31: UNO $0.00269 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0016 | 0.00151 | 0.00125 | 0 |

| 2026 | 0.00185 | 0.00156 | 0.0014 | 3 |

| 2027 | 0.00223 | 0.00171 | 0.0014 | 12 |

| 2028 | 0.00266 | 0.00197 | 0.0011 | 30 |

| 2029 | 0.00262 | 0.00231 | 0.0013 | 53 |

| 2030 | 0.00269 | 0.00246 | 0.00131 | 63 |

IV. Professional Investment Strategies and Risk Management for UNO

UNO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate UNO tokens during market dips

- Set price targets and take partial profits at predetermined levels

- Store tokens in secure wallets with backup measures

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to decentralized insurance

- Set stop-loss orders to manage downside risk

UNO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for UNO

UNO Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Limited trading volume may impact ability to enter/exit positions

- Competition: Emerging projects in decentralized insurance space

UNO Regulatory Risks

- Uncertain regulations: Changing legal landscape for crypto insurance products

- Cross-border compliance: Varying rules across jurisdictions

- Licensing requirements: Potential need for insurance-related certifications

UNO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network load

- Oracle dependence: Reliance on external data sources for claims processing

VI. Conclusion and Action Recommendations

UNO Investment Value Assessment

Lunos (UNO) presents a high-risk, high-potential opportunity in the emerging decentralized insurance sector. Its innovative approach combining AVS and AI technologies offers long-term value, but short-term volatility and adoption challenges persist.

UNO Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Allocate a portion of high-risk portfolio, implement stop-losses ✅ Institutional investors: Conduct comprehensive due diligence, consider as part of a diversified crypto insurance basket

UNO Trading Participation Methods

- Spot trading: Purchase UNO tokens on Gate.com

- Staking: Participate in staking programs if available

- DeFi integration: Explore decentralized finance protocols that support UNO

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Uniswap reach $1000?

It's highly unlikely for Uniswap to reach $1000 in the foreseeable future. Given its current price of $2.70, such a massive increase would require unprecedented growth and market conditions.

What is the value of Uno coin?

As of October 31, 2025, the value of Uno coin is $1.25. It has shown steady growth, with a 24-hour trading volume of $45 million.

What will Uniswap be worth in 2025?

Based on current forecasts, Uniswap (UNI) is expected to reach a minimum price of $6.27 and an average price of $6.38 per token in 2025. This projection indicates potential growth from current levels.

Will Shiba hit $1 in 2040?

No, it's highly unlikely. Shiba Inu would need a $589.53 trillion market cap to reach $1, which is improbable. By 2040, SHIB may trade significantly higher, but reaching $1 remains unrealistic.

Is Hey Anon (ANON) a Good Investment?: Analyzing the Potential Returns and Risks of This Emerging Cryptocurrency

Is Hive AI (BUZZ) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 GIZA Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

2025 ALCH Price Prediction: Bullish Outlook as DeFi Adoption Surges

Is Velvet (VELVET) a good investment? : Analyzing the potential and risks of this new cryptocurrency

2025 FYDE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Emerging Cryptocurrency

Is Linea (LINEA) a good investment?: A Comprehensive Analysis of the Layer 2 Ethereum Solution's Potential and Risks

Is 0xProject (ZRX) a good investment?: A Comprehensive Analysis of Its Market Potential, Technology, and Future Prospects

Is Dog (DOG) a good investment?: A Comprehensive Analysis of Price Trends, Market Fundamentals, and Future Prospects

Is Axelar (WAXL) a good investment?: A comprehensive analysis of cross-chain connectivity and token potential

Is Fluid (FLUID) a good investment?: A Comprehensive Analysis of Market Potential, Technology, and Risk Factors