2025 TAO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: TAO's Market Position and Investment Value

Bittensor (TAO) has established itself as a pioneering decentralized machine learning network since its inception. As of 2025, Bittensor's market capitalization has reached $4.29 billion, with a circulating supply of approximately 9,597,491 tokens, and a price hovering around $447.1. This asset, often referred to as the "AI-powered blockchain," is playing an increasingly crucial role in the collaborative development of machine learning models.

This article will provide a comprehensive analysis of Bittensor's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. TAO Price History Review and Current Market Status

TAO Historical Price Evolution Trajectory

- 2023: TAO launched, price started at $100.93

- 2023: Reached all-time low of $21.428 on September 5

- 2024: Achieved all-time high of $795.6 on April 11

- 2025: Experienced significant volatility, price fluctuated between $300-$500

TAO Current Market Situation

As of October 15, 2025, TAO is trading at $447.1, with a 24-hour trading volume of $22,866,572.92. The token has seen a 5.67% increase in the last 24 hours and a substantial 35.65% gain over the past week. TAO's market capitalization stands at $4,291,038,226, ranking it 35th in the global cryptocurrency market.

The current price represents a -43.8% decline from its all-time high of $795.6 set on April 11, 2024, but remains significantly higher than its all-time low of $21.428 recorded on September 5, 2023. With a circulating supply of 9,597,491 TAO and a total supply cap of 21,000,000, the token has a circulating supply ratio of 45.70%.

TAO's performance over various timeframes shows mixed results: while it has seen strong gains in the short to medium term (1.42% in 1 hour, 28.19% in 30 days), it has experienced a -28.99% decline over the past year. This suggests that while the token is currently in an uptrend, it has yet to fully recover from previous market corrections.

The market sentiment for TAO appears cautiously optimistic, with the recent price increases potentially indicating renewed interest in the Bittensor project and its decentralized machine learning network.

Click to view the current TAO market price

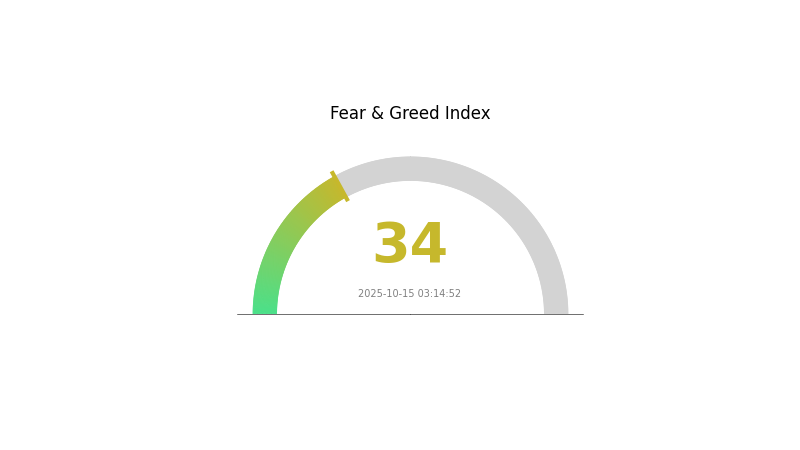

TAO Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index sits at 34, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. During such periods, it's crucial to conduct thorough research and consider dollar-cost averaging strategies. Remember, market fear often precedes significant price movements. Stay informed, manage your risk, and consider using Gate.com's advanced trading tools to navigate these uncertain waters.

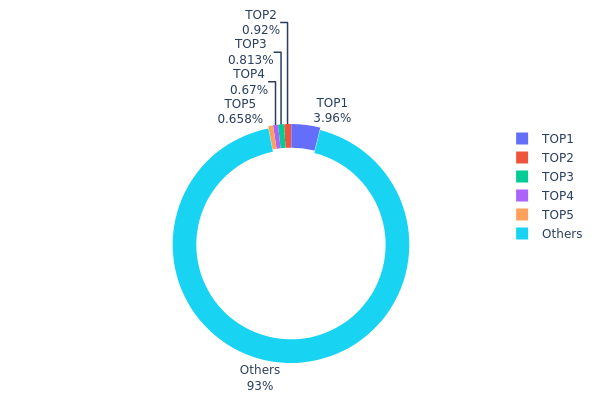

TAO Holdings Distribution

The address holdings distribution data for TAO reveals a relatively decentralized structure. The top holder possesses 3.96% of the total supply, while the subsequent four largest addresses each hold less than 1%. Collectively, the top 5 addresses control only 7% of TAO tokens, with the remaining 93% distributed among other addresses.

This distribution pattern suggests a healthy level of decentralization for TAO. The absence of significant concentration among a few addresses reduces the risk of market manipulation and enhances overall market stability. Such a spread can contribute to more organic price movements, as no single entity holds enough tokens to exert undue influence on the market.

The current address distribution reflects positively on TAO's market structure, indicating a robust on-chain stability and a high degree of decentralization. This characteristic may appeal to investors seeking projects with reduced centralization risks and potentially more democratic governance structures.

Click to view the current TAO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Hd2ze...86pg4N | 832.43K | 3.96% |

| 2 | 5DZku2...yas47M | 193.28K | 0.92% |

| 3 | 5FRqwe...hnhq7r | 170.80K | 0.81% |

| 4 | 5GhMqy...mRY4XZ | 140.65K | 0.66% |

| 5 | 5FqBL9...Lxoy2s | 138.10K | 0.65% |

| - | Others | 19524.74K | 93% |

II. Key Factors Affecting TAO's Future Price

Supply Mechanism

- Block Reward Halving: TAO's price is influenced by block reward halving events, which affect the rate of new token issuance.

- Historical Patterns: Past supply changes have shown to impact TAO's price significantly.

- Current Impact: The next halving event is expected to potentially drive up TAO's price due to reduced supply inflation.

Institutional and Whale Dynamics

- Enterprise Adoption: The adoption of TAO by prominent companies in the AI industry could significantly influence its price.

- Government Policies: Regulatory decisions and government adoption of AI technologies may impact TAO's value.

Macroeconomic Environment

- Inflation Hedging Properties: TAO's performance in inflationary environments may affect its appeal as a potential hedge.

- Geopolitical Factors: International situations and conflicts could influence the demand for decentralized AI solutions, impacting TAO's price.

Technical Development and Ecosystem Building

- AI Service Enhancements: Improvements in the Bittensor network's AI services directly affect TAO's value proposition.

- Ecosystem Applications: The development of new DApps and AI solutions within the Bittensor ecosystem could drive demand for TAO.

III. TAO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $348.43 - $400

- Neutral forecast: $400 - $446.7

- Optimistic forecast: $446.7 - $491.37 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range predictions:

- 2027: $436.53 - $649.47

- 2028: $449.09 - $815.46

- Key catalysts: Wider blockchain integration, increased institutional interest

2029-2030 Long-term Outlook

- Base scenario: $703.19 - $815.7 (assuming steady market growth and adoption)

- Optimistic scenario: $815.7 - $1000 (assuming strong market performance and technological advancements)

- Transformative scenario: $1000 - $1215.39 (assuming breakthrough applications and mainstream adoption)

- 2030-12-31: TAO $815.7 (potential average price based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 491.37 | 446.7 | 348.43 | 0 |

| 2026 | 595.67 | 469.04 | 281.42 | 4 |

| 2027 | 649.47 | 532.35 | 436.53 | 18 |

| 2028 | 815.46 | 590.91 | 449.09 | 31 |

| 2029 | 928.21 | 703.19 | 485.2 | 56 |

| 2030 | 1215.39 | 815.7 | 570.99 | 81 |

IV. TAO Professional Investment Strategies and Risk Management

TAO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term believers in AI and decentralized technology

- Operation suggestions:

- Accumulate TAO tokens during market dips

- Set up regular purchasing plans to average out entry prices

- Store tokens in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to AI and blockchain

- Set clear entry and exit points based on technical indicators

TAO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for TAO

TAO Market Risks

- High volatility: Cryptocurrency markets are known for extreme price swings

- Market sentiment: AI hype cycles may affect TAO's valuation

- Competition: Other AI-focused blockchain projects may emerge

TAO Regulatory Risks

- Uncertain regulatory landscape: Governments may impose stricter regulations on AI and cryptocurrencies

- Potential classification as a security: May impact TAO's trading and distribution

TAO Technical Risks

- Smart contract vulnerabilities: Potential for exploitation if flaws are discovered

- Scalability challenges: Network may face issues as it grows

- Centralization concerns: Potential concentration of TAO tokens among large holders

VI. Conclusion and Action Recommendations

TAO Investment Value Assessment

TAO presents a unique opportunity in the intersection of AI and blockchain technology. Long-term potential is significant, but short-term volatility and regulatory uncertainties pose considerable risks.

TAO Investment Recommendations

✅ Beginners: Start with small, regular investments to learn about the project and market dynamics ✅ Experienced investors: Consider a moderate allocation, balancing TAO with other crypto assets ✅ Institutional investors: Conduct thorough due diligence and consider TAO as part of a diversified crypto portfolio

TAO Participation Methods

- Spot trading: Purchase TAO tokens on Gate.com

- Staking: Participate in network validation for potential rewards

- Contribution: Engage with the Bittensor community and development efforts

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can Tao crypto go?

Based on aggregated forecasts, Tao could potentially reach $1,108.53 in 2025 and $954.31 by 2030. However, actual prices may vary.

Is Tao a good buy?

Yes, Tao looks promising. At $490, it shows potential for growth in the current market. Consider its strong performance and positive market sentiment.

What is the price prediction for Tron in 2025?

Tron's price is expected to rise significantly in 2025, benefiting from the second leg of the crypto bull market. Increased transaction volume and revenue growth suggest it could be among the top-performing altcoins.

Can Bittensor's price reach $1,000?

Yes, Bittensor could reach $1,000 by July 2026, requiring a 113% increase from current levels. The market's growth trajectory supports this potential milestone.

2025 BNKR Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Space

2025 ASPPrice Prediction: Market Trends and Strategic Forecast for Industry Leaders

2025 ORAI Price Prediction: Market Analysis and Future Growth Potential for Oraichain Token

2025 TAPrice Prediction: Analyzing Market Trends and Forecasting Future Values for Technical Assets

2025 TAPrice Prediction: Analyzing Market Trends and Future Valuation of Token Assets

2025 DNX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Golem (GLM) a good investment?: A Comprehensive Analysis of the Distributed Computing Platform's Potential and Risks

Is RUNE (RUNE) a good investment?: A Comprehensive Analysis of THORChain's Native Token for 2024 and Beyond

Is eCash (XEC) a good investment?: A comprehensive analysis of risks, opportunities, and market potential in 2024

Is Monad (MON) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Market Potential

ZBCN vs XTZ: A Comprehensive Comparison of Features, Performance, and Investment Potential