2025 SKYA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SKYA's Market Position and Investment Value

Sekuya (SKYA), as a community-driven video game company, has been revolutionizing the gaming landscape since its inception. As of 2025, SKYA's market capitalization has reached $1,097,545, with a circulating supply of approximately 403,212,732.75 tokens, and a price hovering around $0.002722. This asset, known for its "community-driven approach," is playing an increasingly crucial role in the anime epic fantasy gaming universe.

This article will comprehensively analyze SKYA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SKYA Price History Review and Current Market Status

SKYA Historical Price Evolution Trajectory

- 2024: Initial launch, price reached ATH of $0.085964 on December 16

- 2024: Market correction, price dropped to ATL of $0.00215 on September 19

- 2025: Consolidation phase, price fluctuating between support and resistance levels

SKYA Current Market Situation

As of October 29, 2025, SKYA is trading at $0.002722. The token has experienced a 3.5% decrease in the last 24 hours, with a trading volume of $36,355.07. SKYA's market cap stands at $1,097,545.06, ranking it at 2771 in the global cryptocurrency market.

The token's price has shown mixed performance across different timeframes. While it has seen a 2.68% increase over the past week, it has experienced significant declines of 28.51% and 11.17% over the past 30 days and year, respectively. The current price represents a substantial drop from its all-time high, indicating a challenging market environment for SKYA.

With a circulating supply of 403,212,732.75 SKYA out of a total supply of 1,000,000,000, the token has a circulation ratio of 40.32%. The fully diluted market cap is $2,722,000, suggesting potential for growth if market conditions improve.

Click to view the current SKYA market price

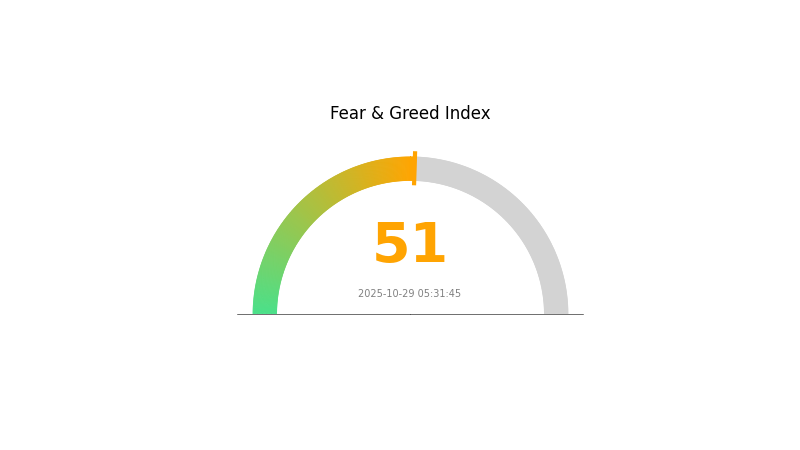

SKYA Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a neutral state, with the Fear and Greed Index at 51. This balanced sentiment suggests that investors are neither overly fearful nor excessively greedy. It's an ideal time for traders to reassess their strategies and portfolio allocations. While the market shows stability, it's crucial to remain vigilant and prepared for potential shifts in either direction. As always, conducting thorough research and exercising caution is advised before making any investment decisions in the volatile crypto space.

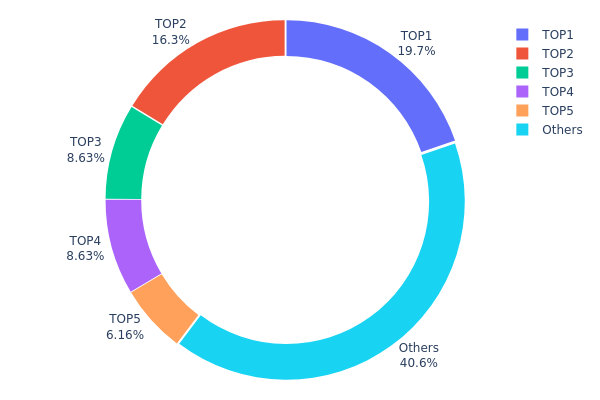

SKYA Holdings Distribution

The address holdings distribution for SKYA reveals a significant concentration among the top holders. The largest address holds 19.71% of the total supply, with the top five addresses collectively controlling 59.41% of SKYA tokens. This high concentration suggests a potentially centralized ownership structure, which could impact market dynamics.

Such a distribution pattern raises concerns about market manipulation and price volatility. With nearly 60% of tokens held by just five addresses, large movements from these wallets could significantly influence SKYA's market price. This concentration also implies that a small number of entities have substantial voting power in governance decisions, potentially affecting the project's decentralization efforts.

While 40.59% of tokens are distributed among other addresses, the current holdings structure indicates a relatively low level of decentralization. This concentration may pose risks to market stability and could deter some investors concerned about potential whale influence. However, it's important to note that the identity and intentions of these large holders are unknown, and their presence could also signify long-term commitment to the project.

Click to view the current SKYA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x277b...e5186c | 160000.00K | 19.71% |

| 2 | 0x7c90...288a40 | 132285.50K | 16.30% |

| 3 | 0x3dc9...0fa240 | 70000.00K | 8.62% |

| 4 | 0x6486...6fd8d8 | 70000.00K | 8.62% |

| 5 | 0x5063...77512e | 50000.00K | 6.16% |

| - | Others | 329139.56K | 40.59% |

II. Key Factors Affecting SKYA's Future Price

Technical Development and Ecosystem Building

- Decentralized Cloud Storage: SKYA is positioning itself as a decentralized cloud storage solution, which could significantly impact its future price as the demand for such services grows.

- Ecosystem Applications: As a decentralized finance protocol, SKYA's ecosystem includes stablecoins like Dai and USDS, which are widely used. The adoption and performance of these ecosystem components could influence SKYA's price.

Macroeconomic Environment

- Market Sentiment: The broader cryptocurrency market conditions and psychological factors, such as fear and greed, can have a substantial impact on SKYA's price trends.

- Geopolitical Factors: Uncertainties in government policies and risk-averse sentiment in the market can affect cryptocurrency prices, including SKYA.

III. SKYA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00185 - $0.00273

- Neutral prediction: $0.00273 - $0.00302

- Optimistic prediction: $0.00302 - $0.00332 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00214 - $0.00439

- 2028: $0.00277 - $0.00448

- Key catalysts: Technological advancements, expanding use cases, and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00419 - $0.00465 (assuming steady market growth and project development)

- Optimistic scenario: $0.00511 - $0.00618 (with significant ecosystem expansion and market adoption)

- Transformative scenario: $0.00618 - $0.00700 (with groundbreaking innovations and mainstream integration)

- 2030-12-31: SKYA $0.00618 (potential peak, subject to market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00332 | 0.00273 | 0.00185 | 0 |

| 2026 | 0.00378 | 0.00302 | 0.00221 | 11 |

| 2027 | 0.00439 | 0.0034 | 0.00214 | 25 |

| 2028 | 0.00448 | 0.0039 | 0.00277 | 43 |

| 2029 | 0.00511 | 0.00419 | 0.0039 | 53 |

| 2030 | 0.00618 | 0.00465 | 0.00279 | 70 |

IV. SKYA Professional Investment Strategies and Risk Management

SKYA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operation suggestions:

- Accumulate SKYA tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend direction and potential reversal points

- RSI (Relative Strength Index): Helps identify overbought or oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage risk

SKYA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords, and never share private keys

V. Potential Risks and Challenges for SKYA

SKYA Market Risks

- High volatility: SKYA's price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to slippage and difficulty in executing large trades

- Market sentiment: Changes in overall crypto market sentiment can impact SKYA's price

SKYA Regulatory Risks

- Uncertain regulatory environment: Potential changes in cryptocurrency regulations could affect SKYA's operations

- Compliance challenges: Ensuring compliance with evolving global regulations may be difficult

- Legal status: The legal status of SKYA in different jurisdictions may vary

SKYA Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the underlying smart contract

- Network congestion: High transaction fees and slow processing times during peak periods

- Technological obsolescence: Emerging technologies may render SKYA's platform less competitive

VI. Conclusion and Action Recommendations

SKYA Investment Value Assessment

SKYA presents a high-risk, high-potential investment opportunity in the gaming and cryptocurrency sector. While it offers innovative features and community-driven development, investors should be aware of the significant volatility and regulatory uncertainties in the market.

SKYA Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, if any, and focus on education ✅ Experienced investors: Consider a small position as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider SKYA as a speculative, high-risk investment

SKYA Trading Participation Methods

- Spot trading: Buy and sell SKYA tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options for SKYA tokens as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can Siacoin reach 1 dollar?

While possible, it's unlikely Siacoin will reach $1 soon. Its current price and market trends don't support such a significant increase in the near future.

Will SLP coin reach $1?

SLP could reach $1 if 90% of tokens are destroyed. This would require a 628.93x increase from current prices. Predictions suggest this may happen by 2030.

Will Solana reach $1000 in 2025?

Based on current market trends and Solana's growth potential, reaching $1000 by 2025 is possible but not guaranteed. Factors like adoption and technological advancements will play crucial roles.

What is Skya Crypto?

SKYA is the native token of the Sekuya ecosystem, enabling transactions, rewards, and governance across the network.

Is League of Traders (LOT) a good investment?: Analyzing the potential and risks of this crypto gaming platform

VICE vs ENJ: Comparing Two Digital Content Platforms Shaping the Future of Media

Is GameBuild (GAME2) a good investment?: Analyzing the potential and risks of this gaming cryptocurrency

Is Versus-X (VSX) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 MNRY Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Immortal Rising 2 (IMT) a good investment?: Analyzing the Potential and Risks of this Emerging Crypto Asset

Understanding the 90% Rule in Trading Circles

Understanding Digital Ledgers: The Backbone of Blockchain Technology

Effortless Ethereum Bridging to Arbitrum: A Web3 User's Handbook

Exploring Kamino Finance: A Solana-Based Liquidity Management Solution

What is LAVA: A Comprehensive Guide to Large-scale Autonomous Vehicle Architecture