2025 RUNE Price Prediction: Bullish Trends and Key Factors Shaping THORChain's Future Value

Introduction: RUNE's Market Position and Investment Value

RUNE (RUNE), as a key player in the multi-chain ecosystem, has made significant strides since its inception in 2019. As of 2025, RUNE's market capitalization has reached $296,669,805, with a circulating supply of approximately 351,254,802 tokens, and a price hovering around $0.8446. This asset, often referred to as the "Liquidity Backbone," is playing an increasingly crucial role in cross-chain asset exchanges and decentralized finance (DeFi).

This article will provide a comprehensive analysis of RUNE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RUNE Price History Review and Current Market Status

RUNE Historical Price Evolution

- 2019: Initial launch, price started at $0.00851264

- 2021: Bull market peak, price reached all-time high of $20.87

- 2025: Market correction, price dropped to $0.8446

RUNE Current Market Situation

As of October 18, 2025, RUNE is trading at $0.8446. The token has experienced a significant decline over the past year, with a -82.41% price change. In the last 24 hours, RUNE has seen a slight decrease of -1.56%. The token's market cap currently stands at $296,669,805, ranking it 218th in the overall cryptocurrency market.

RUNE's 24-hour trading volume is $945,351, indicating moderate market activity. The circulating supply is 351,254,802 RUNE, which represents 70.25% of the total supply of 425,308,068 RUNE. The fully diluted market cap is $422,300,000.

Despite the recent downtrend, RUNE has shown some short-term resilience with a 0.6% increase in the last hour. However, the token remains in a bearish trend across longer timeframes, with -5.27% and -36.77% changes over the past 7 and 30 days, respectively.

Click to view the current RUNE market price

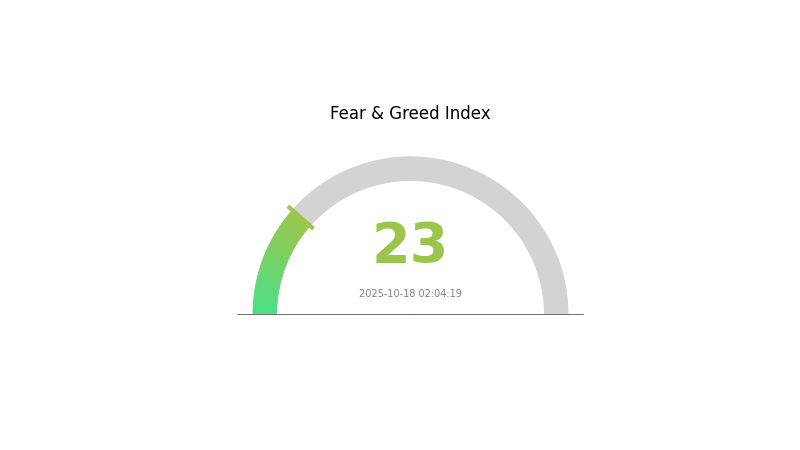

RUNE Market Sentiment Indicator

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the index at a low 23. This level of sentiment often indicates a potential buying opportunity for long-term investors. However, it's crucial to remember that market bottoms can persist. While some may see this as a chance to accumulate, others might prefer to wait for signs of recovery. As always, thorough research and risk management are essential in navigating these volatile market conditions.

RUNE Holdings Distribution

The address holdings distribution data for RUNE is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of information prevents us from assessing the degree of centralization or decentralization in RUNE's ownership structure.

Without specific data on top holders and their respective percentages, it's challenging to evaluate the potential impact on market dynamics, price volatility, or susceptibility to manipulation. The absence of this crucial information also hinders our assessment of RUNE's on-chain structural stability and overall market characteristics.

In such scenarios, it's advisable for investors and analysts to seek additional sources of information or wait for updated data to become available before drawing conclusions about RUNE's market structure and potential risks or opportunities.

Click to view the current RUNE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting RUNE's Future Price

Supply Mechanism

- Emission Schedule: RUNE has a predetermined emission schedule that gradually reduces new supply over time.

- Historical Pattern: Past supply reductions have generally led to upward price pressure due to decreased sell-side liquidity.

- Current Impact: The ongoing emission reduction is expected to continue supporting RUNE's price, assuming demand remains stable or increases.

Technical Development and Ecosystem Building

- Thorchain Upgrades: Continuous improvements to the Thorchain protocol enhance security, efficiency, and scalability, potentially increasing RUNE's utility and value.

- Cross-chain Functionality: Thorchain's focus on enabling seamless cross-chain swaps could expand its user base and increase demand for RUNE.

- Ecosystem Applications: Development of DeFi applications leveraging Thorchain's infrastructure may drive adoption and usage of RUNE.

III. RUNE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.67 - $0.80

- Neutral prediction: $0.80 - $0.90

- Optimistic prediction: $0.90 - $0.95 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.76 - $1.24

- 2028: $1.08 - $1.50

- Key catalysts: Ecosystem expansion, technological improvements, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $1.30 - $1.40 (assuming steady growth and adoption)

- Optimistic scenario: $1.40 - $1.60 (assuming strong market performance and project success)

- Transformative scenario: $1.60 - $1.70 (with exceptional market conditions and breakthrough innovations)

- 2030-12-31: RUNE $1.62 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.91379 | 0.8461 | 0.67688 | 0 |

| 2026 | 1.19672 | 0.87994 | 0.50157 | 4 |

| 2027 | 1.23562 | 1.03833 | 0.76837 | 22 |

| 2028 | 1.50081 | 1.13698 | 1.08013 | 34 |

| 2029 | 1.47716 | 1.31889 | 0.80452 | 56 |

| 2030 | 1.62171 | 1.39803 | 0.96464 | 65 |

IV. Professional Investment Strategies and Risk Management for RUNE

RUNE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate RUNE during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined targets

RUNE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Never share private keys, use 2FA, regularly update software

V. Potential Risks and Challenges for RUNE

RUNE Market Risks

- High volatility: RUNE price can experience significant fluctuations

- Competition: Other cross-chain protocols may gain market share

- Liquidity risk: Potential difficulties in selling large amounts quickly

RUNE Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on DeFi projects

- Cross-border compliance: Challenges in adhering to various jurisdictions' rules

- Tax implications: Evolving tax laws may impact RUNE transactions

RUNE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Risks associated with cross-chain transactions

VI. Conclusion and Action Recommendations

RUNE Investment Value Assessment

RUNE offers potential long-term value as a cross-chain liquidity protocol but faces short-term risks due to market volatility and regulatory uncertainties.

RUNE Investment Recommendations

✅ Beginners: Start with small investments, focus on education

✅ Experienced investors: Consider allocating a portion of portfolio, use risk management tools

✅ Institutional investors: Conduct thorough due diligence, consider OTC options for large trades

RUNE Trading Participation Methods

- Spot trading: Buy and sell RUNE on Gate.com

- Staking: Participate in liquidity pools to earn rewards

- DeFi interactions: Use RUNE in various DeFi applications within the THORChain ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is rune a good investment?

Yes, RUNE shows strong potential. Its innovative cross-chain technology and growing ecosystem make it a promising long-term investment in the DeFi space.

Will Rune bounce back?

Yes, Rune is likely to bounce back. As the crypto market recovers and THORChain's technology matures, Rune's price could see significant growth by 2025.

What is the future of Rune coin?

Rune coin's future looks promising, with potential for significant growth. As DeFi and cross-chain solutions gain traction, Rune's role in the THORChain ecosystem could drive increased adoption and value appreciation by 2025.

How much will THORChain cost in 2030?

Based on market trends and potential growth, THORChain (RUNE) could reach $50 to $100 by 2030. However, cryptocurrency prices are highly volatile and unpredictable.

What Is SRP Price: Analyzing Token Value and Market Trends in 2025

2025 DBRPrice Prediction: Analyzing Market Trends and Future Value Potential for Digital Bond Reserves

What Is Dexscreener How to Track Tokens on Decentralized Exchanges

2025 AERO Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Does On-Chain Data Analysis Reveal AUCTION's Market Manipulation Risk in 2025?

How Does Cryptocurrency Fund Flow Impact Market Dynamics?

What is VTHO: Understanding VeThor Token and Its Role in the VeChainThor Blockchain Ecosystem

What is SC: A Comprehensive Guide to Supply Chain Management in Modern Business

What is VANA: A Comprehensive Guide to the Revolutionary Decentralized AI Data Network

2025 SUSHI Price Prediction: Expert Analysis and Market Forecast for the Leading DeFi Token

2025 ALEO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year