2025 RPL Price Prediction: Market Analysis and Future Outlook for Rocket Pool's Native Token

Introduction: RPL's Market Position and Investment Value

Rocket Pool (RPL), as a leading Ethereum PoS infrastructure service, has achieved significant milestones since its inception. As of 2025, Rocket Pool's market capitalization has reached $105,130,173, with a circulating supply of approximately 21,788,637 tokens, and a price hovering around $4.825. This asset, often referred to as the "decentralized staking solution," is playing an increasingly crucial role in the Ethereum staking ecosystem.

This article will provide a comprehensive analysis of Rocket Pool's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RPL Price History Review and Current Market Status

RPL Historical Price Evolution Trajectory

- 2023: Reached all-time high of $8,000 on January 10, marking a significant milestone

- 2025: Hit all-time low of $3.161 on April 7, indicating a major market correction

- 2025: Experienced a bearish trend, with price dropping from its peak to current levels

RPL Current Market Situation

As of September 26, 2025, RPL is trading at $4.825, representing a significant decline from its all-time high. The token has experienced negative price movements across various time frames:

- 1 hour: -1.23%

- 24 hours: -8.21%

- 7 days: -25.75%

- 30 days: -33.7%

- 1 year: -56.22%

The current market capitalization stands at $105,130,173, ranking RPL at 430th position in the global cryptocurrency market. The 24-hour trading volume is $541,783, indicating moderate market activity. The circulating supply matches the total supply at 21,788,636.94 RPL tokens, with no maximum supply limit set.

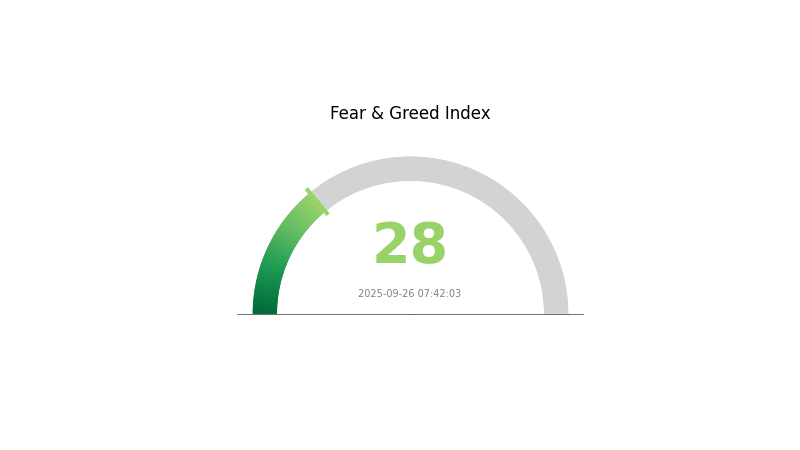

The market sentiment for RPL appears bearish, with consistent price declines observed across all timeframes. This downward trend aligns with the broader cryptocurrency market's current "Fear" sentiment, as indicated by a VIX score of 28.

Click to view the current RPL market price

RPL Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 28. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. While fear can present buying opportunities for some, it's essential to consider your risk tolerance and long-term investment strategy. Keep an eye on market trends and stay informed to navigate these challenging conditions effectively.

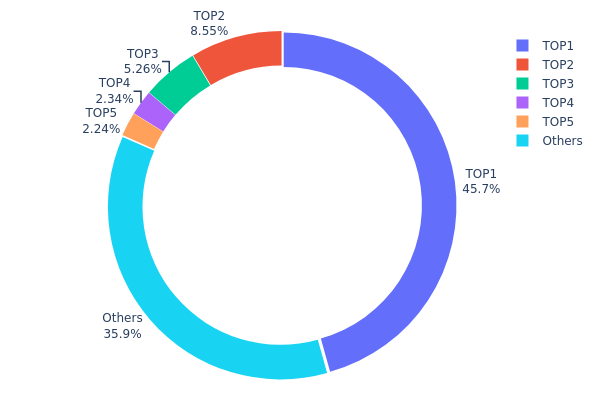

RPL Holdings Distribution

The address holdings distribution data for RPL reveals a significant concentration of tokens among a few top addresses. The top address holds a substantial 45.67% of the total supply, followed by the second largest holder with 8.54%. This high concentration in the top addresses indicates a relatively centralized distribution of RPL tokens.

Such a concentrated distribution can have notable implications for the market. The presence of large holders, particularly the top address controlling nearly half of the supply, could potentially impact price volatility and market dynamics. These major holders have the capacity to significantly influence the market through large-scale buying or selling actions. Furthermore, this concentration may raise concerns about the potential for market manipulation or sudden price movements triggered by the actions of a few key players.

Despite the concentration at the top, it's worth noting that 35.97% of the tokens are held by addresses outside the top 5, suggesting some level of distribution among smaller holders. However, the overall picture still points to a relatively centralized token distribution, which may affect the perceived decentralization and on-chain structural stability of the RPL ecosystem.

Click to view the current RPL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3bdc...b469d6 | 9951.24K | 45.67% |

| 2 | 0xd335...21a51f | 1862.01K | 8.54% |

| 3 | 0x5775...647806 | 1145.78K | 5.25% |

| 4 | 0xfce7...b24a96 | 509.54K | 2.33% |

| 5 | 0xf977...41acec | 488.87K | 2.24% |

| - | Others | 7831.19K | 35.97% |

II. Key Factors Affecting RPL's Future Price

Institutional and Whale Dynamics

- Government Policies: The SEC's regulatory stance towards certain projects in the Ethereum ecosystem is a crucial factor influencing RPL's price.

Macroeconomic Environment

- Geopolitical Factors: The potential approval and launch of Ethereum spot ETFs could significantly impact RPL's price, given its close correlation with Ethereum's market performance.

Technological Development and Ecosystem Building

-

Ecosystem Applications: As an important infrastructure within the Ethereum ecosystem, RPL's price movement is highly correlated with Ethereum's market performance.

-

Regulatory Compliance: Projects like Plume are building secure, scalable RWA platforms that comply with current regulations (such as MiCA and SEC guidelines), potentially paving the way for the future global RWA market, estimated at $19 trillion.

III. RPL Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $2.56 - $4.00

- Neutral forecast: $4.00 - $5.00

- Optimistic forecast: $5.00 - $5.90 (requires positive market sentiment and adoption growth)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range predictions:

- 2027: $4.03 - $8.36

- 2028: $6.47 - $9.66

- Key catalysts: Increased adoption of Rocket Pool, Ethereum ecosystem growth, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $7.96 - $9.56 (assuming steady growth in DeFi and Ethereum staking)

- Optimistic scenario: $9.56 - $10.70 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $10.70+ (with major breakthroughs in Ethereum scalability and widespread institutional adoption)

- 2030-12-31: RPL $9.56 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5.89626 | 4.833 | 2.56149 | 0 |

| 2026 | 6.33026 | 5.36463 | 2.84325 | 10 |

| 2027 | 8.36185 | 5.84745 | 4.03474 | 20 |

| 2028 | 9.66232 | 7.10465 | 6.46523 | 46 |

| 2029 | 10.73086 | 8.38348 | 7.96431 | 72 |

| 2030 | 10.70403 | 9.55717 | 6.88116 | 96 |

IV. RPL Professional Investment Strategies and Risk Management

RPL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in Ethereum staking

- Operation suggestions:

- Accumulate RPL during market dips

- Stake RPL in the Rocket Pool protocol

- Store RPL in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Ethereum network upgrades and their impact on staking

- Track overall market sentiment in the crypto space

RPL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for RPL

RPL Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Emergence of alternative staking solutions

- Ethereum upgrades: Potential impact on Rocket Pool's relevance

RPL Regulatory Risks

- Staking regulations: Potential classification as securities

- Tax implications: Evolving treatment of staking rewards

- Jurisdictional restrictions: Varying legal status across different countries

RPL Technical Risks

- Smart contract vulnerabilities: Potential exploits in the Rocket Pool protocol

- Ethereum network issues: Reliance on Ethereum's stability and performance

- Validator slashing: Risk of penalties for node operators

VI. Conclusion and Action Recommendations

RPL Investment Value Assessment

RPL offers long-term potential as an integral part of Ethereum's staking ecosystem. However, short-term volatility and regulatory uncertainties pose significant risks.

RPL Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about Ethereum staking ✅ Experienced investors: Consider allocating a portion of your crypto portfolio to RPL ✅ Institutional investors: Evaluate RPL as part of a diversified crypto staking strategy

RPL Participation Methods

- Direct purchase: Buy RPL on Gate.com

- Staking: Participate in Rocket Pool's staking protocol

- Node operation: Run a Rocket Pool node for advanced users

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is RPL crypto a good buy?

RPL shows promise as Ethereum's staking ecosystem grows. Its unique node-operating model and increasing adoption make it an interesting investment option for 2025 and beyond.

Is RPL a good investment?

RPL is a good investment due to its innovative Ethereum staking model. Its decentralized approach offers strong potential for growth. Current market trends favor its adoption.

Is XRP will reach $100?

XRP reaching $100 is unlikely in the near future. Predictions suggest it could hit this price around 2038-2039, based on current market trends and growth projections.

How high could a rocket pool go?

Rocket Pool (RPL) could potentially reach $6 by 2026, based on current projections and market trends.

Ethereum to AUD: What Australian Traders Need to Know in 2025

2025 LRC Price Prediction: Analyzing Market Trends, Tokenomics and Growth Potential in the Layer 2 Ecosystem

2025 UNI Price Prediction: Analyzing the Potential Growth and Challenges for Uniswap's Native Token

2025 ZCXPrice Prediction: Market Analysis and Potential Growth Factors for the ZCX Token

GLQ vs OP: Exploring the Impact of Different Optimization Algorithms on Machine Learning Performance

How Does APEX's Fundamentals Analysis Reveal Its Long-Term Value Potential?

What is ZKC: A Comprehensive Guide to Zero-Knowledge Cryptography and Its Real-World Applications

What is REZ: A Comprehensive Guide to Understanding Real Estate Investment Zones and Their Impact on Property Markets

What is MAV: Understanding Micro Aerial Vehicles and Their Applications in Modern Technology

Convert Satoshis to Bitcoin: Understanding the Calculation

Exploring Cryptocurrency Loans: Top Platforms for Borrowers