2025 PIPPIN Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: Market Position and Investment Value of PIPPIN

PIPPIN (PIPPIN), a meme token operating on the Solana blockchain, has emerged as a notable digital asset in the cryptocurrency landscape. As of December 2025, PIPPIN has achieved a market capitalization of approximately $436.07 million with a circulating supply of approximately 999.94 million tokens, maintaining a price point around $0.4361. This asset, characterized by its community-driven nature and rapid growth trajectory, is gaining increasing traction within the decentralized digital asset ecosystem.

This article will provide a comprehensive analysis of PIPPIN's price movements and market trends through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and broader macroeconomic factors. Our analysis aims to deliver professional price forecasts and practical investment strategies for market participants seeking to understand PIPPIN's investment potential and risk landscape on platforms such as Gate.com.

PIPPIN Market Analysis Report

I. PIPPIN Price History Review and Market Status

PIPPIN Historical Price Evolution Trajectory

PIPPIN reached its all-time high of $0.45644 on December 16, 2025, demonstrating significant appreciation since its launch. The token started from a publish price of $0.144, marking an initial gain of approximately 217% to reach its current peak. The all-time low was recorded at $0.00165 on October 10, 2025, representing the token's lowest valuation point in its trading history.

PIPPIN Current Market Performance

As of December 16, 2025, PIPPIN is trading at $0.4361, reflecting a 24-hour increase of 22.56% ($0.0803 gain). The token has demonstrated exceptional growth metrics across multiple timeframes:

- 1-Hour Performance: -0.02% (-$0.000087)

- 24-Hour Performance: +22.56% (+$0.0803)

- 7-Day Performance: +141.29% (+$0.2554)

- 30-Day Performance: +1,375.28% (+$0.4065)

- 1-Year Performance: +1,722.93% (+$0.4122)

Market Capitalization Metrics:

- Total Market Cap: $436,072,981.28

- Fully Diluted Valuation: $436,072,981.28

- Market Dominance: 0.014%

- Trading Volume (24H): $15,886,805.08

- Circulating Supply: 999,938,044.66 PIPPIN (99.99% of max supply)

- Total Supply: 1,000,000,000 PIPPIN

The token currently ranks 135th by market capitalization and maintains an active holder base of 31,578 addresses. PIPPIN's market cap to fully diluted valuation ratio stands at 99.99%, indicating near-complete token circulation.

Click to view current PIPPIN market price

PIPPIN Market Sentiment Index

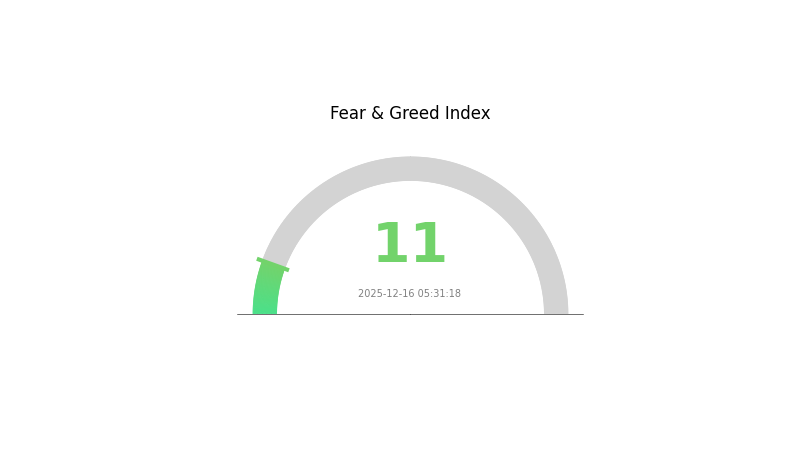

2025-12-16 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

Market Analysis:

The crypto market is experiencing extreme fear with an index reading of 11. This indicates severe pessimism among investors, suggesting potential capitulation selling. During such extreme fear periods, opportunities may emerge for contrarian investors, as panic-driven price declines often create attractive entry points for long-term holders. However, exercise caution and conduct thorough research before making investment decisions. Monitor key support levels and market fundamentals closely during this volatility phase.

PIPPIN Holdings Distribution

The address holdings distribution map provides a granular view of how PIPPIN tokens are allocated across the blockchain network. By tracking the top token holders and their respective concentrations, this metric reveals critical insights into the token's decentralization status, market structure stability, and vulnerability to potential price manipulation or coordinated selling pressures.

Current analysis of PIPPIN's holdings distribution demonstrates a relatively healthy decentralization profile. The top five addresses collectively hold approximately 18.51% of the total token supply, with the largest holder (FGmqWE...PjnBo8) maintaining a 4.22% stake. This concentration level suggests moderate risk exposure, as no single entity commands an overwhelming majority position. The remaining 81.49% of tokens are distributed across numerous addresses categorized as "Others," indicating a broad-based ownership structure that limits the influence of any individual large holder.

The current distribution pattern reflects positively on PIPPIN's market resilience. With no address exceeding 5% of total holdings, the token demonstrates reduced susceptibility to flash crash scenarios or large-scale liquidation events that could result from coordinated whale actions. The substantial "Others" allocation suggests genuine community participation and organic adoption, which typically correlates with enhanced price stability and market efficiency. This decentralized architecture mitigates systemic risks inherent in highly concentrated tokens and indicates a market structure capable of absorbing significant trading volumes without experiencing extreme volatility.

Click to view the current PIPPIN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | FGmqWE...PjnBo8 | 42222.63K | 4.22% |

| 2 | 68N4Yc...MpQAyc | 37999.99K | 3.80% |

| 3 | u6PJ8D...ynXq2w | 36435.09K | 3.64% |

| 4 | 4QyhPZ...RMhdiP | 35998.54K | 3.60% |

| 5 | J8nRfP...mwRTEj | 32570.70K | 3.25% |

| - | Others | 814711.10K | 81.49% |

II. Core Factors Affecting PIPPIN's Future Price

Technology Development and Ecosystem Building

-

Open-Source Architecture: PIPPIN's core operating logic is fully open and accessible on GitHub, enhancing transparency and trust among investors and users. This accessibility allows the community to verify mechanisms and contribute to development.

-

Enhanced Visualization Features: Future development roadmap includes the integration of richer visualization capabilities to better present the token's daily operational logic and workflow efficiency.

-

Ecosystem Collaboration: PIPPIN's price trajectory is significantly influenced by market demand, technological advancement, and ecosystem partnerships. The protocol's design facilitates collaboration opportunities that could drive adoption and utility expansion.

Market Sentiment and Trading Dynamics

-

High Short Interest: PIPPIN token surged to an all-time high of $0.36 USD, while short positions represented over 72% of trader positions, indicating intense bearish sentiment and elevated volatility and liquidation risks in the market.

-

Market Capitalization Growth: The AI Agent token PIPPIN reached a market capitalization breakthrough of $450 million, reflecting significant investor interest despite elevated short positioning.

Three. 2025-2030 PIPPIN Price Forecast

2025 Outlook

- Conservative Prediction: $0.3192-$0.4373

- Base Case Prediction: $0.4373

- Optimistic Prediction: $0.6122 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with increasing institutional interest and protocol upgrades driving adoption.

- Price Range Forecast:

- 2026: $0.4303-$0.6140 (19% upside potential)

- 2027: $0.4840-$0.8142 (30% upside potential)

- Key Catalysts: Ecosystem expansion, strategic partnerships, technological improvements, and increased utility adoption across decentralized applications.

2028-2030 Long-term Outlook

- Base Case: $0.6448-$1.2455 (101% cumulative appreciation by 2030, assuming steady adoption and market maturation)

- Optimistic Scenario: $0.8716-$0.9849 (78-101% gains driven by mainstream adoption and significant network growth)

- Transformation Scenario: $1.2455+ (extreme favorable conditions including widespread institutional adoption, major exchange listings on platforms like Gate.com, regulatory clarity, and breakthrough technological innovations)

- December 16, 2025: PIPPIN $0.4373 (mid-range consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.61221 | 0.43729 | 0.31922 | 0 |

| 2026 | 0.61396 | 0.52475 | 0.43029 | 19 |

| 2027 | 0.81417 | 0.56935 | 0.48395 | 30 |

| 2028 | 0.87162 | 0.69176 | 0.38047 | 58 |

| 2029 | 0.98493 | 0.78169 | 0.49247 | 78 |

| 2030 | 1.24547 | 0.88331 | 0.64482 | 101 |

PIPPIN Investment Strategy and Risk Management Report

IV. PIPPIN Professional Investment Strategy and Risk Management

PIPPIN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Retail investors with medium to long-term investment horizons and high risk tolerance

- Operation recommendations:

- Accumulate positions during market volatility phases, particularly when price corrections occur

- Maintain a diversified portfolio allocation to manage concentration risk

- Store tokens securely in Gate Web3 Wallet for enhanced security and accessibility

(2) Active Trading Strategy

- Technical analysis tools:

- Price action analysis: Monitor 24-hour and 7-day price movements to identify trend reversals and support/resistance levels

- Volume analysis: Observe trading volume patterns to confirm price movements and market participation levels

- Wave trading key points:

- Capitalize on the token's demonstrated 22.56% 24-hour volatility and 141.29% 7-day gains

- Set clear entry and exit points based on resistance levels (all-time high at $0.45644) and support levels

PIPPIN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% portfolio allocation

- Aggressive investors: 3-5% portfolio allocation

- Professional investors: 5-10% portfolio allocation with active hedging strategies

(2) Risk Hedging Solutions

- Position sizing: Limit individual position to no more than 5% of total portfolio to mitigate concentration risk

- Stop-loss implementation: Establish stop-loss orders at 20-30% below entry price to protect against sudden downturns

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for frequent trading and accessibility

- Cold storage approach: Transfer long-term holdings to offline storage solutions for maximum security

- Security precautions: Enable two-factor authentication, use strong passwords, never share private keys, and verify contract addresses before transactions

V. PIPPIN Potential Risks and Challenges

PIPPIN Market Risk

- Extreme volatility exposure: PIPPIN demonstrates significant price fluctuation patterns with 1,722.93% annual gains, indicating high volatility and potential rapid value erosion

- Liquidity concentration: As a meme token on Solana's PumpFun platform, the token may experience sudden liquidity drainage during market downturns

- Market sentiment dependency: Price movements heavily influenced by social media trends and community sentiment rather than fundamental utility

PIPPIN Regulatory Risk

- Evolving regulatory framework: Meme tokens face increasing scrutiny from global regulators regarding classification and compliance requirements

- Jurisdiction-specific restrictions: Certain countries may implement restrictions on meme token trading or participation

- Securities classification uncertainty: Regulatory bodies may reassess whether meme tokens meet securities definitions, potentially triggering enforcement actions

PIPPIN Technical Risk

- Smart contract vulnerabilities: Potential undiscovered bugs or exploits in the token's smart contract code could result in loss of funds

- Blockchain network risk: Solana network congestion or technical issues could impair transaction execution and liquidity availability

- Platform dependency: Direct reliance on PumpFun infrastructure means platform outages or shutdowns would severely impact trading capabilities

VI. Conclusion and Action Recommendations

PIPPIN Investment Value Assessment

PIPPIN is a community-driven meme token created by prominent AI/VC innovator Yohei Nakajima, gaining significant traction with a current market capitalization of approximately $436 million and ranking 135 globally. The token has demonstrated substantial appreciation since its launch at $0.144, with current trading at $0.4361 as of December 16, 2025. However, investors must recognize that PIPPIN's value proposition relies primarily on community sentiment and brand association rather than underlying technical utility or revenue generation. The token's extreme volatility—exhibiting 1,722.93% annual returns—reflects both opportunity and substantial downside risk. Market participation should be viewed as speculative positioning rather than value investing.

PIPPIN Investment Recommendations

✅ Beginners: Start with minimal allocations (1-2% of portfolio) to gain market exposure while maintaining strict risk discipline. Utilize dollar-cost averaging to reduce timing risk and avoid emotional decision-making during volatility spikes.

✅ Experienced investors: Consider tactical trading strategies exploiting identified support/resistance levels. Implement sophisticated risk management including stop-loss orders and position sizing protocols. Monitor social sentiment indicators and community developments for trading signals.

✅ Institutional investors: Evaluate PIPPIN only as a limited allocation alternative asset for portfolio diversification purposes, subject to comprehensive compliance and regulatory review. Establish formal risk governance frameworks and conduct thorough due diligence on underlying creator reputation and project sustainability.

PIPPIN Trading Participation Methods

- Gate.com spot trading: Purchase and hold PIPPIN directly through Gate.com's trading interface with full custody control

- Gate.com margin trading: Implement leveraged trading strategies for experienced traders seeking enhanced returns (note: margin trading amplifies both gains and losses)

- Token swaps and bridges: Acquire PIPPIN through Solana ecosystem transactions using standard blockchain bridges and DEX integration points

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Always consult professional financial advisors before significant investment decisions. Never invest capital you cannot afford to lose completely.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Guide to Using Kukai Wallet on the Tezos Blockchain

What is KNC: A Comprehensive Guide to Kyber Network Crystal Token and Its Role in DeFi Ecosystem

What is SXP: A Comprehensive Guide to the Swipe Token and Its Role in the Decentralized Finance Ecosystem

What is CORN: A Comprehensive Guide to Understanding Corn's Uses, Cultivation, and Global Impact

What is FB: A Comprehensive Guide to Facebook's Evolution, Features, and Impact on Modern Communication