Прогноз стоимости OP на 2025 год: анализ долгосрочного потенциала Optimism среди решений для масштабирования второго уровня

Введение: рыночная позиция и инвестиционный потенциал OP

Optimism (OP) — одна из самых быстрых и экономичных блокчейн-платформ второго уровня на базе Ethereum, демонстрирующая устойчивое развитие с момента запуска в 2021 году. К 2025 году рыночная капитализация Optimism достигла 1,39 млрд долларов США, в обращении находится порядка 1,78 млрд токенов, а стоимость одного токена составляет примерно 0,7825 доллара. Актив приобрел репутацию «решения для масштабирования Ethereum» и играет все более значимую роль в повышении масштабируемости и снижении издержек в сети Ethereum.

В этом материале представлен детальный анализ динамики цены Optimism в период 2025–2030 годов. В обзоре учитываются исторические движения рынка, баланс спроса и предложения, развитие экосистемы, а также ключевые макроэкономические факторы. Для инвесторов будут представлены профессиональные прогнозы цен и практические стратегии по работе с активом.

I. История цен OP и текущий рыночный статус

Динамика цены OP в ретроспективе

- 2022: год запуска, минимум цены — 0,402159 доллара (19 июня)

- 2024: ключевой рубеж — исторический максимум 4,84 доллара (6 марта)

- 2025: рыночный цикл — коррекция стоимости с максимума к текущим значениям

Текущее положение на рынке OP

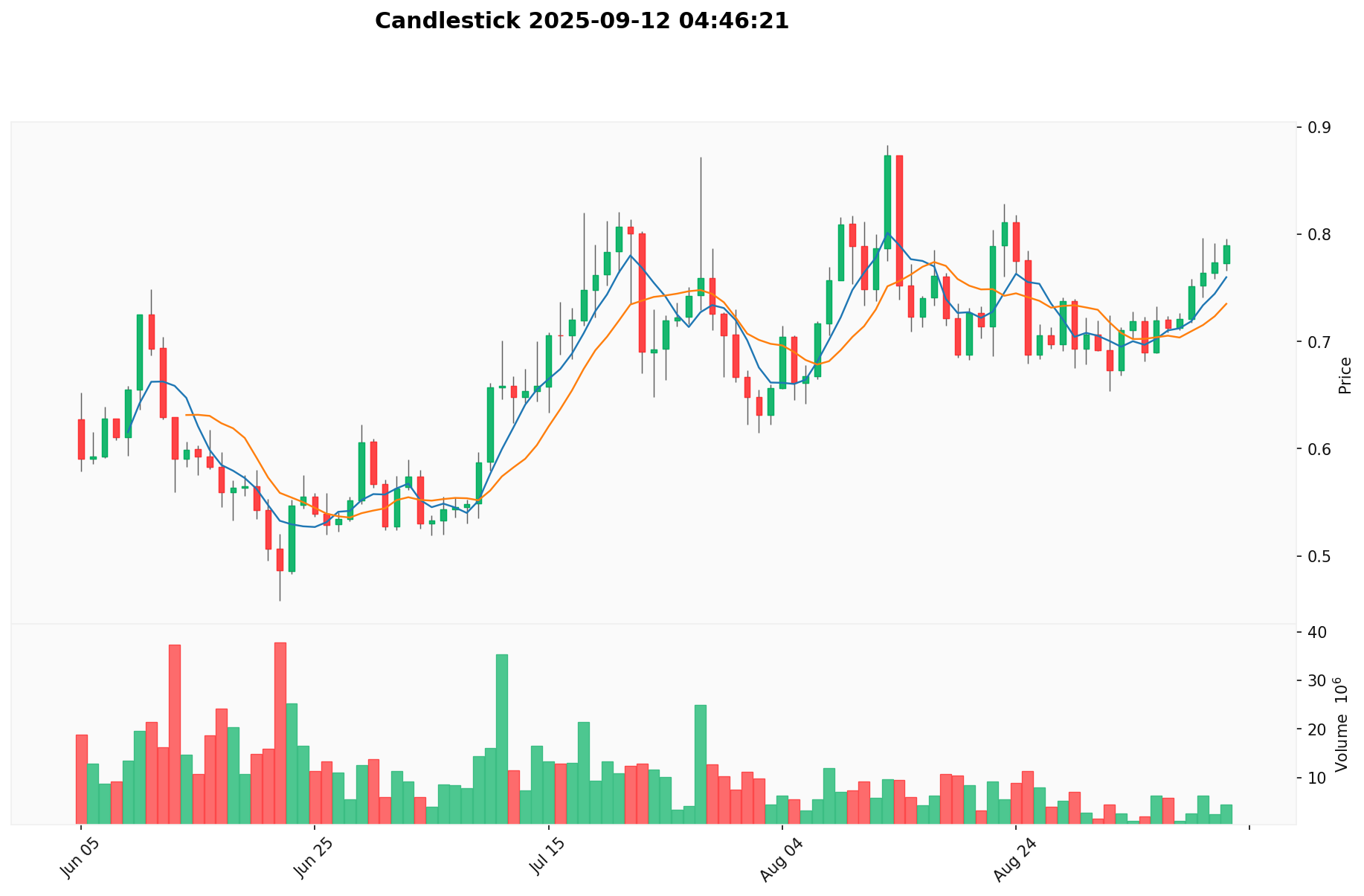

На 12 сентября 2025 г. OP торгуется на уровне 0,7825 доллара, что ниже на 1,32% за последние сутки. Рыночная капитализация составляет 1 391 781 410 долларов, что обеспечивает 91-е место OP среди всех криптоактивов. Суточный объем торгов достигает 2 695 259 долларов, характерен для умеренно активного рынка. Текущая стоимость на 49,35% ниже прошлогодней, однако за неделю был зафиксирован рост на 12%, что может свидетельствовать о положительном импульсе. Токен находится на 83,83% ниже абсолютного максимума и на 94,58% выше исторического минимума. Это отражает высокий уровень волатильности и потенциал для восстановления.

Посмотреть актуальную рыночную цену OP

Индикатор рыночных настроений по OP

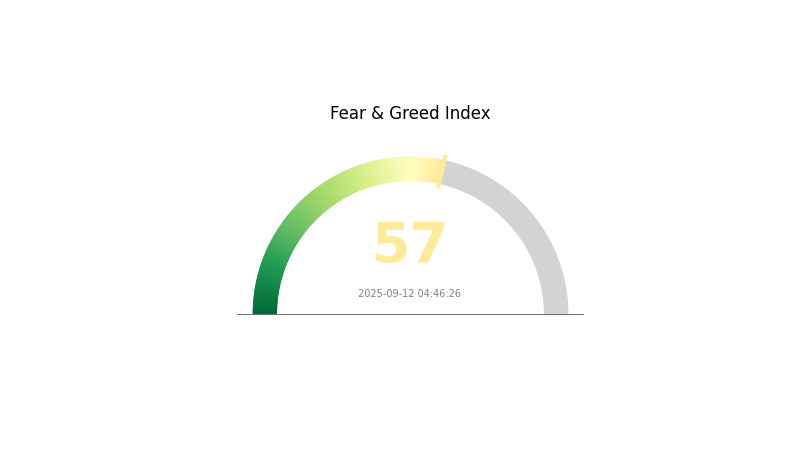

12 сентября 2025 г. — Индекс страха и жадности: 57 («Жадность»)

Посмотреть текущий индекс страха и жадности

Крипторынок демонстрирует преобладание оптимистичного настроя: индекс страха и жадности — 57 (уровень «Жадность»). Это свидетельствует о росте уверенности участников и преобладании бычьих ожиданий. Несмотря на позитив, важно не поддаваться чрезмерному энтузиазму и сохранять рациональность. Даже на растущем рынке необходимо тщательное управление рисками и глубокий анализ перед инвестиционными решениями. На Gate.com доступны актуальные инструменты и аналитика для эффективной работы в условиях высокой динамичности рынка.

Структура распределения OP

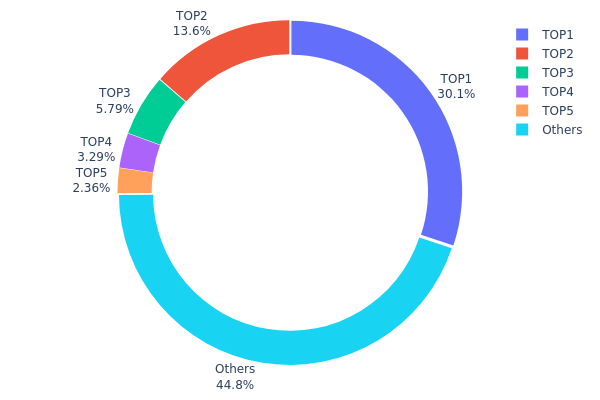

Анализ распределения токенов OP по адресам выявляет высокую концентрацию актива у ограниченного числа держателей. Крупнейший адрес владеет 30,12% общего объема, топ-5 адресов — совокупно 55,18%. Подобная концентрация создает риски манипулирования рынком и подрывает принципы децентрализации.

Значительный объем в руках нескольких крупных игроков усиливает волатильность: такие держатели способны существенно влиять на цену своими действиями. Кроме того, это может негативно сказаться на устойчивости сети и прозрачности управления проектом.

44,82% токенов распределены между прочими категориями, что свидетельствует о частичной диверсификации. Для повышения устойчивости рынка необходимо расширять децентрализацию, так как OP сохраняет чувствительность к действиям крупных держателей («китов»).

Посмотреть актуальное распределение OP по адресам

| Топ | Адрес | Количество | Доля (%) |

|---|---|---|---|

| 1 | 0x2a82...663a26 | 1 294 044,37K | 30,12% |

| 2 | 0x2501...a8b3f0 | 585 251,18K | 13,62% |

| 3 | 0xf977...41acec | 248 814,11K | 5,79% |

| 4 | 0x641f...35ec6e | 141 320,03K | 3,29% |

| 5 | 0x6ba2...ff7c9f | 101 494,92K | 2,36% |

| - | Прочие | 1 924 038,68K | 44,82% |

II. Главные факторы, определяющие будущую стоимость OP

Механизм предложения

- Разблокировки токенов. Ранее проведение разблокировок практически не влияло на стоимость OP за счет сбалансированного рыночного спроса.

- Актуальное влияние. Недавняя разблокировка токенов на 40 млн долларов может спровоцировать умеренное давление на цену со стороны продавцов.

Роль институциональных и крупных участников

- Использование в корпоративном секторе. Решение второго уровня от Optimism является значимым вкладом в масштабирование сети Ethereum и привлекает интерес со стороны корпоративных клиентов.

Макроэкономические условия

- Защита от инфляции. Способность OP выступать инструментом хеджирования инфляционных рисков пока не подтверждена из-за молодости актива.

Техническое развитие и рост экосистемы

- Экосистемные проекты. Optimism активно формирует собственную экосистему децентрализованных приложений, что в будущем может повысить спрос на токен OP.

III. Прогноз развития стоимости OP на 2025–2030 годы

Перспектива 2025 года

- Консервативный сценарий: 0,6557 – 0,7806 доллара

- Нейтральный сценарий: 0,7806 – 0,84305 доллара

- Оптимистичный сценарий: 0,84305 – 0,89301 доллара (при благоприятных условиях рынка)

Ожидания на 2027–2028 годы

- Прогноз рыночной фазы: рост

- Ожидаемые ценовые диапазоны:

- 2027: 0,63079 – 1,17633 доллара

- 2028: 0,69992 – 1,32883 доллара

- Ключевые драйверы: массовое внедрение решений второго уровня, восстановление крипторынка

Долгосрочная перспектива на 2029–2030 годы

- Базовый прогноз: 1,1716 – 1,33563 доллара (при условии стабильного роста рынка)

- Оптимистичный прогноз: 1,49965 – 1,72296 доллара (при динамичном расширении экосистемы)

- Трансформационный прогноз: 1,72296+ доллара (в случае исключительно благоприятных условий для крипты и решений второго уровня)

- 31 декабря 2030 г.: OP — 1,72296 доллара (возможный пик по оптимистичному сценарию)

| Год | Прогноз: максимум | Прогноз: среднее | Прогноз: минимум | Изменение (%) |

|---|---|---|---|---|

| 2025 | 0,84305 | 0,7806 | 0,6557 | 0 |

| 2026 | 0,89301 | 0,81182 | 0,69005 | 3 |

| 2027 | 1,17633 | 0,85242 | 0,63079 | 8 |

| 2028 | 1,32883 | 1,01437 | 0,69992 | 29 |

| 2029 | 1,49965 | 1,1716 | 1,08959 | 49 |

| 2030 | 1,72296 | 1,33563 | 1,24213 | 70 |

IV. Профессиональные стратегии и управление рисками при инвестициях в OP

Методология инвестирования в OP

(1) Долгосрочные стратегии

- Рекомендуется инвесторам, ориентированным на долгосрок и верящим в потенциал масштабирования Ethereum.

- Практические рекомендации:

- Постепенно накапливать OP на ценовых спадах

- Размещать OP в стейкинге для участия в управлении и получения вознаграждений

- Хранить активы на защищенных некостодиальных кошельках

(2) Активные торговые стратегии

- Инструменты технического анализа:

- Скользящие средние (moving average, MA): анализировать краткосрочные (50-дневные) и долгосрочные (200-дневные) скользящие средние для выявления трендов

- Индекс относительной силы (RSI): отслеживать перекупленность и перепроданность рынка

- Ключевые акценты для краткосрочной торговли:

- Регулярно мониторить обновления Ethereum и их влияние на решения второго уровня

- Анализировать темпы роста экосистемы и ключевые метрики внедрения Optimism

Структура управления рисками для OP

(1) Принципы аллокации активов

- Консервативные инвесторы: 1–3% криптопортфеля

- Агрессивные инвесторы: 5–10% портфеля

- Профессиональные инвесторы: до 15% портфеля

(2) Инструменты хеджирования

- Диверсификация — распределение инвестиций между несколькими проектами второго уровня

- Опционные стратегии — покупка опционов на продажу (put-опционов) для минимизации риска просадки

(3) Безопасное хранение

- Горячий кошелек: Gate Web3-кошелек

- Холодное хранение: аппаратные криптокошельки для долгосрочных инвестиций

- Безопасность: использовать уникальные пароли и включить двухфакторную аутентификацию

V. Основные риски и вызовы для OP

Рыночные риски OP

- Высокая волатильность: OP может демонстрировать резкие ценовые колебания на коротких временных промежутках

- Повышенная конкуренция: появление альтернативных платформ второго уровня

- Изменения в Ethereum: обновления протокола могут повлиять на роль Optimism

Регуляторные барьеры OP

- Нерешенные вопросы регулирования решений второго уровня

- Возможность классификации OP как ценной бумаги

- Ограничения доступа к OP в отдельных юрисдикциях

Технические риски OP

- Уязвимости смарт-контрактов и баги в исходном коде

- Потенциальные сложности масштабирования в условиях роста нагрузки

- Зависимость от изменений в основной сети Ethereum

VI. Итоги и рекомендации

Оценка инвестиционного потенциала OP

Optimism (OP) обладает высоким долгосрочным потенциалом как ведущая платформа второго уровня для масштабирования Ethereum. При этом волатильность и конкуренция на рынке решений второго уровня формируют дополнительные риски для инвесторов.

Рекомендации по работе с OP

Новичкам рекомендуется формировать позицию через регулярные небольшие покупки.

Опытным трейдерам — комбинировать долгосрочные инвестиции и активную торговлю.

Институциональным инвесторам — включать OP в диверсифицированный портфель решений второго уровня.

Варианты участия в экосистеме OP

- Спотовая торговля на Gate.com

- Стейкинг: получение дохода и участие в управлении

- Интеграция с DeFi-приложениями в экосистеме Optimism

Инвестиции в криптовалюту связаны с крайне высокими рисками; данный материал носит информационный характер и не является инвестиционной рекомендацией. Прежде чем принимать решения, тщательно оценивайте собственную толерантность к риску и консультируйтесь с профессиональными финансовыми экспертами. Никогда не инвестируйте больше, чем готовы потерять.

FAQ

Есть ли перспективы у OP?

Да, у OP высокий потенциал развития. Итоговое будущее будет зависеть от тенденций рынка и степени внедрения, однако эксперты оценивают долгосрочные перспективы актива как положительные.

Стоит ли инвестировать в OP?

Да, OP — это перспективная инвестиция. Технологические преимущества и рост экосистемы Web3 делают токен привлекательным для долгосрочных стратегий.

Какова исторически максимальная цена OP?

Исторический максимум OP — 4,84 доллара, что заметно выше текущих рыночных котировок.

Для чего используется токен Optimism?

Токен Optimism (OP) служит средством управления и финансирования сети Optimism второго уровня для Ethereum. Владельцы OP участвуют в голосованиях по развитию протокола и поддерживают масштабируемость сети.

Прогноз цены POL на 2025 год: анализ основных факторов роста и сценариев развития рынка для нативного токена Polygon

Прогноз цены LINEA на 2025 год: анализ рыночных тенденций, технологического прогресса и факторов масштабирования внедрения Layer 2 решения

Является ли LightLink (LL) перспективной инвестицией?: Анализ потенциала этой развивающейся блокчейн-платформы на рынке DeFi

CORE против ETH: сравнение решений масштабируемости для экосистем DeFi

YFII против OP: Противостояние протоколов доходного фермерства в экосистеме DeFi

Является ли Arbitrum (ARB) привлекательной инвестицией?: Анализ потенциала данной Layer 2-системы масштабирования в условиях динамичного развития криптовалютного рынка

Visa начала проводить расчеты с использованием стейблкоина USDC на блокчейне Solana для американских банков

Последняя покупка BitMine 48 000 ETH: значение для Web3

Ответ на ежедневный тест Marina Protocol 18 декабря 2025 года

Что такое ONT: полный гид по оптическим сетевым терминалам и блокчейну Ontology

Что такое USDP: что представляет собой стейблкоин USD Coin и какую роль он играет в децентрализованных финансах