2025 MERL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: MERL's Market Position and Investment Value

Merlin Chain (MERL), as a native Bitcoin Layer 2 solution, has locked over $3.5 billion TVL within 30 days of its mainnet launch since its inception. As of 2025, MERL's market capitalization has reached $351,876,935, with a circulating supply of approximately 978,958,758 tokens, and a price hovering around $0.35944. This asset, hailed as "Bitcoin's Fun Layer 2," is playing an increasingly crucial role in empowering Bitcoin's native assets, protocols, and products.

This article will comprehensively analyze MERL's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. MERL Price History Review and Current Market Status

MERL Historical Price Evolution

- 2024: Mainnet launch, price surged to all-time high of $1.888 on April 19

- 2025: Market correction, price dropped to all-time low of $0.0623 on February 3

- 2025: Recovery phase, price rebounded to current level of $0.35944

MERL Current Market Situation

As of October 17, 2025, MERL is trading at $0.35944, with a market capitalization of $351,876,935. The token has shown strong performance in the past 24 hours, with a 21.38% increase. The 7-day trend is also positive, showing a 5.58% gain. More impressively, MERL has experienced a significant 91.44% surge over the past 30 days, indicating growing market interest and adoption.

The current price is considerably higher than its all-time low of $0.0623, recorded on February 3, 2025, but still well below its all-time high of $1.888, reached on April 19, 2024. This suggests potential room for growth if market conditions remain favorable.

MERL's trading volume in the last 24 hours stands at $12,380,897, reflecting active market participation. The token's circulating supply is 978,958,758 MERL, which represents 46.62% of its total supply of 2,100,000,000 MERL.

Click to view the current MERL market price

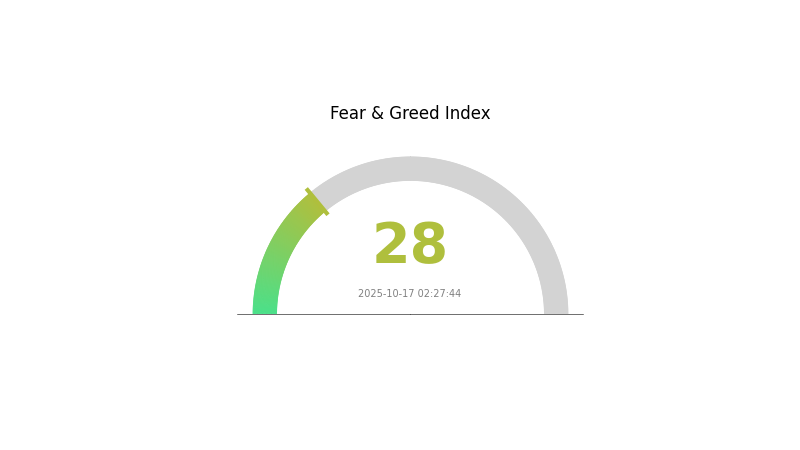

MERL Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a fearful sentiment, with the Fear and Greed Index standing at 28. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a long-term perspective. However, it's crucial to remember that market sentiment can shift rapidly. Traders should exercise caution, conduct thorough research, and consider diversifying their portfolios to mitigate risks in this uncertain environment. As always, it's advisable to stay informed about market trends and global events that may impact cryptocurrency valuations.

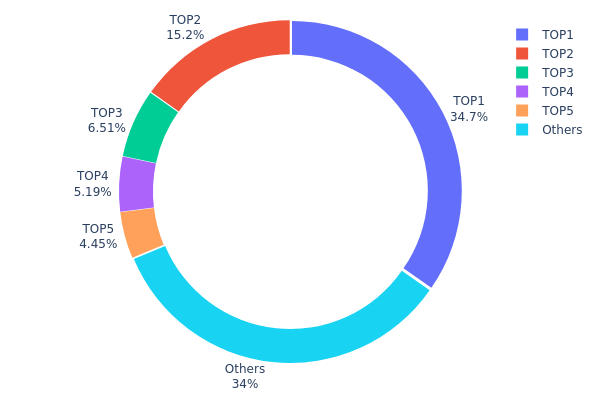

MERL Holdings Distribution

The address holdings distribution data for MERL reveals a highly concentrated ownership structure. The top address holds a substantial 34.68% of the total supply, with the top five addresses collectively controlling 66.02% of MERL tokens. This concentration level raises concerns about the token's decentralization and potential market manipulation risks.

Such a concentrated distribution may lead to increased price volatility and susceptibility to large sell-offs if major holders decide to liquidate their positions. The dominance of a few addresses also suggests that MERL's governance and decision-making processes could be heavily influenced by a small number of large token holders, potentially compromising the project's decentralization ethos.

While the presence of a 33.98% distribution among "Others" indicates some level of wider adoption, the overall token distribution structure of MERL appears to be skewed towards a small group of dominant holders. This raises questions about the token's long-term stability and its ability to maintain a balanced market structure.

Click to view the current MERL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa2ff...ad8443 | 693103.78K | 34.68% |

| 2 | 0x6353...326813 | 303643.79K | 15.19% |

| 3 | 0x6414...f10d59 | 130148.10K | 6.51% |

| 4 | 0xdc94...a44536 | 103782.44K | 5.19% |

| 5 | 0xbd37...4f45ab | 88851.83K | 4.45% |

| - | Others | 678937.92K | 33.98% |

II. Key Factors Affecting MERL's Future Price

Supply Mechanism

- Maximum Supply: The maximum supply of MERL is capped at 2,100,000,000 tokens.

- Current Impact: The circulating supply of 978,958,758 MERL tokens influences the current market dynamics and price.

Institutional and Whale Dynamics

- Institutional Holdings: Institutional investors are showing increasing interest in MERL, with predictions of significant inflows by 2025.

Macroeconomic Environment

- Monetary Policy Impact: Potential Federal Reserve interest rate cuts could significantly influence MERL's price, with some analysts predicting a rise to $3 if cuts occur in September.

- Geopolitical Factors: The upcoming election cycle and its potential impact on market sentiment may affect MERL's price trajectory.

Technological Development and Ecosystem Building

- Layer 2 Solution: MERL is positioned as a Layer 2 solution for Bitcoin, aiming to enhance scalability, efficiency, and functionality of the Bitcoin network.

- ZK-Rollup Integration: The integration of ZK-Rollup network technology aims to improve transaction processing and overall network performance.

- Decentralized Oracle Network: Implementation of a decentralized oracle network to enhance the capabilities of the Merlin Chain ecosystem.

- Ecosystem Applications: MERL is utilized for staking, validator delegation, transaction fees, and as native liquidity and collateral within the Merlin ecosystem.

III. MERL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.3465 - $0.35722

- Neutral prediction: $0.35722 - $0.38937

- Optimistic prediction: $0.38937 - $0.42152 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.3115 - $0.47114

- 2027: $0.3442 - $0.58514

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.51706 - $0.71814 (assuming steady market growth)

- Optimistic scenario: $0.71814 - $0.85243 (assuming strong market performance)

- Transformative scenario: $0.85243 - $1.03412 (assuming exceptional market conditions)

- 2030-12-31: MERL $1.03412 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.42152 | 0.35722 | 0.3465 | 0 |

| 2026 | 0.47114 | 0.38937 | 0.3115 | 8 |

| 2027 | 0.58514 | 0.43025 | 0.3442 | 19 |

| 2028 | 0.66001 | 0.5077 | 0.36047 | 41 |

| 2029 | 0.85243 | 0.58385 | 0.54882 | 62 |

| 2030 | 1.03412 | 0.71814 | 0.51706 | 99 |

IV. MERL Professional Investment Strategies and Risk Management

MERL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in Bitcoin's long-term potential

- Operation suggestions:

- Accumulate MERL during market dips

- Set up regular purchases to average out entry prices

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Track Bitcoin price movements as they may influence MERL

- Monitor TVL and user activity on Merlin Chain for sentiment shifts

MERL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 2 projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Software wallet option: Official Merlin Chain wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for MERL

MERL Market Risks

- High volatility: Price swings can be extreme in the crypto market

- Correlation with Bitcoin: MERL may be affected by Bitcoin price movements

- Competition: Other Layer 2 solutions may impact Merlin Chain's market share

MERL Regulatory Risks

- Uncertain regulatory landscape: Potential for new regulations affecting Layer 2 solutions

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

- Tax implications: Evolving tax laws may impact MERL holders

MERL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Merlin Chain ecosystem

- Scalability challenges: Unforeseen issues in handling increased network load

- Oracle reliability: Risks associated with the decentralized oracle network

VI. Conclusion and Action Recommendations

MERL Investment Value Assessment

MERL shows promise as a Bitcoin Layer 2 solution with strong initial traction. However, investors should be aware of the high volatility and potential risks associated with emerging blockchain technologies.

MERL Investment Recommendations

✅ Beginners: Start with small positions and focus on education about Layer 2 technologies ✅ Experienced investors: Consider a moderate allocation based on risk tolerance and Bitcoin market outlook ✅ Institutional investors: Evaluate MERL as part of a diversified crypto portfolio, focusing on its potential to enhance Bitcoin's ecosystem

MERL Trading Participation Methods

- Spot trading: Purchase MERL tokens on Gate.com

- DeFi participation: Engage with Merlin Chain's ecosystem projects (if available)

- Staking: Look for staking opportunities to earn passive income (if offered by the project)

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What's the future of Merlin Crypto?

Merlin Crypto aims to integrate with Sui in August 2025, expanding cross-chain DeFi opportunities. Its success depends on execution and market competition. Ongoing token unlocks may impact price dynamics.

What is merl crypto?

MERL is the native cryptocurrency of Merlin Chain, enhancing Bitcoin's Layer 2 with scalability and DeFi features. It aims to improve transaction speeds and reduce fees.

What crypto has the highest price prediction?

Bitcoin is predicted to have the highest price in 2026, potentially reaching several trillion dollars in market cap due to mass adoption and current trends.

What type of token is merl?

MERL is a governance token for the Merlin Chain ecosystem, allowing holders to participate in decision-making and network development.

2025 B2Price Prediction: Market Trends and Investment Opportunities for the Digital Currency

2025 B2 Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is BSquared Network (B2) a good investment?: Evaluating the potential and risks of this emerging blockchain platform

What is the Core Value and Risk Analysis of B2 Project in 2025?

2025 MERL Price Prediction: Will This Emerging Crypto Asset Reach New Heights?

Is Stacks (STX) a good investment?: Analyzing the potential of this Bitcoin layer-2 solution

Understanding the Key Differences Between BEP2 and BEP20 Token Standards

Top Secure Solutions for Managing Polygon Tokens in Web3

Guide to Buying Bitcoin in the UK: Simple Steps to Get Started

Top NFT Wallets for Beginners: Secure Your Digital Collectibles

Nepal's Crypto Challenges: Trading Ban Sparks Increase in Fraud