2025 MBL Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: MBL's Market Position and Investment Value

MovieBloc (MBL) is a blockchain-based film circulation platform that enables creators to obtain transparent revenue, audience data, and fair distribution opportunities. Since its launch in 2019, MovieBloc has established itself as a unique ecosystem connecting filmmakers, audiences, and content contributors. As of December 2025, MBL has a market capitalization of $33.9 million with a circulating supply of approximately 19.01 billion tokens, trading at around $0.00113 per token. This innovative asset is increasingly playing a critical role in decentralizing film distribution and democratizing creative monetization.

This article will provide a comprehensive analysis of MBL's price trends from 2025 to 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to the film and entertainment sector through blockchain technology.

MovieBloc (MBL) Market Analysis Report

I. MBL Price History Review and Current Market Status

MBL Historical Price Evolution

- April 2, 2021: All-time high (ATH) reached at $0.0450322, representing the peak of MBL's market performance during the bullish cycle of that period.

- October 25, 2019: All-time low (ATL) established at $0.00042973, marking the lowest valuation point in MBL's trading history.

- June 22, 2019: Token launch at an initial price of $0.0012.

MBL Current Market Situation

As of December 20, 2025, MBL is trading at $0.00113, representing a significant market recovery position relative to its all-time low. The token exhibits the following market characteristics:

Price Performance Metrics:

- 24-hour change: +1.8% (price increase of $0.000019980353634578)

- 1-hour change: -0.18%

- 7-day change: -8.5%

- 30-day change: -7.0%

- 1-year change: -62.51%

Market Capitalization and Supply:

- Current market cap: $21,481,172.55

- Fully diluted valuation (FDV): $33,900,000.00

- Circulating supply: 19,009,887,214 MBL (63.37% of total supply)

- Total supply: 30,000,000,000 MBL

- Market dominance: 0.0010%

Trading Activity:

- 24-hour trading volume: $11,969.93

- Current market ranking: #836

- Active holders: 1,289

- Listed on 11 exchanges, including Gate.com

Price Range:

- 24-hour high: $0.001147

- 24-hour low: $0.001108

Click to view current MBL market price

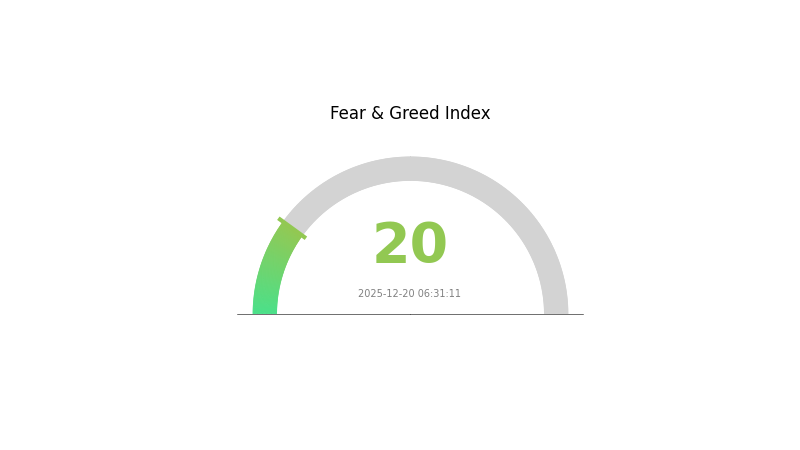

MBL 市场情绪指标

2025-12-20 恐惧与贪婪指数:20(Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with the Fear and Greed Index at 20, indicating severe market pessimism. This reading suggests investors are highly risk-averse, with significant selling pressure and declining market confidence. During periods of extreme fear, market volatility tends to be elevated, and asset prices may experience sharp corrections. However, such extreme sentiment levels historically present contrarian opportunities for long-term investors. Consider using Gate.com's market analysis tools to monitor real-time sentiment shifts and make informed trading decisions. Remember to implement proper risk management strategies when navigating highly fearful market conditions.

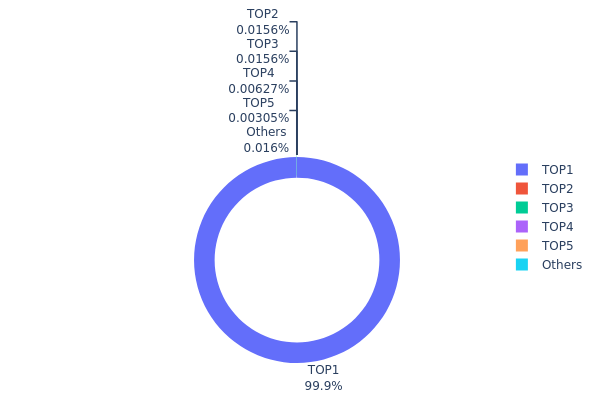

MBL Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a key indicator of market structure decentralization and potential systemic risks. By analyzing the top holders and their proportional stakes, researchers can assess vulnerability to price manipulation, assess market liquidity depth, and evaluate the overall health of token distribution within the ecosystem.

The MBL token exhibits severe concentration risk, with the leading address (0xe373...7cfb3e) commanding 99.94% of all circulating supply. This extraordinarily high concentration level indicates that market dynamics are substantially controlled by a single entity, whether a founding team, major stakeholder, or protocol treasury. The remaining top four addresses collectively hold only 0.02% of tokens, demonstrating a dramatic power disparity. Such extreme centralization creates significant structural vulnerabilities, as the dominant holder possesses unilateral authority over token supply dynamics and could theoretically execute large-scale liquidations or strategic releases that would fundamentally reshape market conditions.

The current distribution model poses considerable risks to market maturity and price discovery mechanisms. With over 99% of supply locked in a single address, secondary market liquidity is inherently constrained, limiting genuine price formation through open market trading. This concentration pattern typically reflects either an early-stage protocol during active distribution phases, a governance model concentrating authority in core development entities, or token holdings within protocol treasuries awaiting programmatic deployment. Until substantial decentralization occurs through systematic token distribution to active participants and community stakeholders, MBL remains structurally dependent on the primary holder's management decisions rather than distributed consensus, constraining its evolution toward genuine market-driven price discovery.

Click to view current MBL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe373...7cfb3e | 29983029.01K | 99.94% |

| 2 | 0xa94e...a2acf9 | 4687.50K | 0.01% |

| 3 | 0xe9df...6fb814 | 4687.50K | 0.01% |

| 4 | 0x462a...708704 | 1881.17K | 0.00% |

| 5 | 0xf170...8b06fd | 914.47K | 0.00% |

| - | Others | 4800.35K | 0.039999999999992% |

II. Core Factors Influencing MBL's Future Price

Supply Mechanism

- Token Supply Model: MBL's price movements are influenced by market supply and demand dynamics within the blockchain ecosystem.

- Historical Patterns: Supply adjustments have historically affected MBL price performance as the project evolves its tokenomic structure.

- Current Impact: Ongoing supply mechanisms continue to shape price trajectory in the dynamic cryptocurrency market.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policy expectations, particularly interest rate decisions, will directly influence MBL price movements. Major central banks' policy shifts create significant ripple effects across cryptocurrency markets.

- Inflation Hedge Properties: MBL demonstrates characteristics relevant to inflationary cycles, as cryptocurrency markets often respond to macroeconomic pressures and inflation concerns.

Technology Development and Ecosystem Building

- Blockchain Innovation: Continuous technological advancement within the MBL ecosystem supports long-term value proposition and market adoption.

- Ecosystem Growth: Development of the platform's technical infrastructure and ecosystem expansion contribute to future price dynamics through increased utility and network effects.

III. MBL Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00096 - $0.00113

- Neutral Forecast: $0.00113

- Bullish Forecast: $0.00142 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Predictions:

- 2026: $0.00105 - $0.00149

- 2027: $0.00093 - $0.00195

- Key Catalysts: Increased adoption rates, ecosystem expansion, improved liquidity on platforms like Gate.com, and positive regulatory developments

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00144 - $0.00237 by 2028 (assumes continued development and moderate market expansion)

- Bullish Scenario: $0.00192 - $0.00301 by 2029 (assumes accelerated adoption, strategic partnerships, and favorable market conditions)

- Transformative Scenario: $0.00262 - $0.00301+ by 2030 (requires breakthrough technological advancement, mainstream institutional adoption, and sustained bull market conditions)

Key Observation: Projected growth from 2025 through 2030 indicates cumulative appreciation of approximately 122%, reflecting anticipated long-term value accretion driven by ecosystem maturation and market expansion.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00142 | 0.00113 | 0.00096 | 0 |

| 2026 | 0.00149 | 0.00128 | 0.00105 | 13 |

| 2027 | 0.00195 | 0.00139 | 0.00093 | 22 |

| 2028 | 0.00237 | 0.00167 | 0.00144 | 47 |

| 2029 | 0.00301 | 0.00202 | 0.00192 | 78 |

| 2030 | 0.00262 | 0.00251 | 0.00128 | 122 |

MovieBloc (MBL) Professional Investment Strategy and Risk Management Report

IV. MBL Professional Investment Strategy and Risk Management

MBL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in blockchain-based content distribution platforms and decentralized creator ecosystems

- Operational Recommendations:

- Accumulate MBL during market downturns when prices fall significantly below historical averages

- Hold tokens for extended periods (12+ months) to benefit from potential ecosystem growth and increased adoption

- Participate in platform activities to earn additional MBL through content curation, translation services, and community engagement

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: MBL shows historical resistance at $0.0450 (all-time high from April 2021) and support around $0.0011 (current price level)

- Moving Averages: Monitor 50-day and 200-day moving averages to identify trend reversals and momentum shifts

- Wave Trading Key Points:

- Monitor 24-hour volatility (currently showing +1.8% movement) for short-term entry and exit opportunities

- Watch volume patterns on Gate.com to confirm price movements and identify potential breakouts

- Be cautious of the significant 1-year decline (-62.51%) indicating sustained downtrend pressure

MBL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Active Investors: 2-5% of total crypto portfolio

- Professional Investors: 5-10% of total crypto portfolio (with strict stop-loss discipline)

(2) Risk Hedging Solutions

- Diversification Strategy: Balance MBL holdings with established cryptocurrencies to reduce concentration risk

- Position Sizing: Never allocate more than your risk tolerance allows; use dollar-cost averaging to reduce entry price volatility

(3) Secure Storage Solutions

- Hot Wallet Method: Use Gate.com's built-in wallet for active trading and frequent transactions

- Security Precautions: Enable two-factor authentication, use strong passwords, and never share private keys or seed phrases with anyone

V. MBL Potential Risks and Challenges

MBL Market Risks

- Low Trading Volume: With only $11,969.93 in 24-hour volume, MBL exhibits significant liquidity constraints that could lead to large price swings during larger trades

- Extreme Price Volatility: Historical price range from $0.0450 to $0.00043 demonstrates extreme volatility, creating substantial downside risk for investors

- Market Capitalization Decline: Current market cap of $33.9 million represents a significant contraction from historical peaks, indicating reduced market confidence

MBL Regulatory Risks

- Evolving Content Regulation: As a blockchain-based platform handling diverse content, MBL faces potential regulatory challenges regarding content moderation and intellectual property enforcement

- Geographic Restrictions: Different jurisdictions may impose varying compliance requirements on the platform's operations, limiting user access in certain regions

- Cryptocurrency Compliance Pressure: Increased global regulatory scrutiny on cryptocurrencies could impact MBL's ability to operate and maintain exchange listings

MBL Technology Risks

- Ecosystem Adoption Uncertainty: The success of the platform depends on achieving critical mass of creators and viewers, which has not yet materialized at scale

- Blockchain Network Dependency: MBL operates on the Ontology blockchain; any technical issues or network congestion could impact platform performance

- Smart Contract Vulnerabilities: Any flaws in the platform's smart contracts could lead to security breaches or loss of user funds

VI. Conclusion and Action Recommendations

MBL Investment Value Assessment

MovieBloc presents a niche opportunity in the blockchain-based content distribution space with a compelling long-term vision. However, the project faces significant headwinds including dramatic price depreciation (-62.51% over one year), low trading liquidity, and uncertain ecosystem adoption. The current market valuation of $33.9 million suggests the market has significantly discounted the project's near-term growth prospects. Potential investors should recognize that this is a high-risk, speculative investment suitable only for those with high risk tolerance and a long investment horizon.

MBL Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) only if you understand and believe in the content distribution use case; use Gate.com for secure purchasing and storage ✅ Experienced Investors: Consider 2-5% allocation with strict risk management protocols; monitor ecosystem development metrics and community engagement indicators closely ✅ Institutional Investors: Evaluate MBL only as part of diversified blockchain infrastructure or content platform portfolio with thorough due diligence on adoption metrics

MBL Trading Participation Methods

- Exchange Trading: Purchase MBL directly on Gate.com using fiat currency or other cryptocurrencies

- Platform Participation: Earn MBL through MovieBloc platform activities including content curation, translation services, and community contributions

- DeFi Integration: Monitor any future DeFi integration opportunities that may provide yield or liquidity mining options

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and financial situation. Always consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

What is MBL crypto?

MBL is the native cryptocurrency of MovieBloc, a decentralized film and content distribution platform. Built on blockchain technology, MBL enables creators and users to participate in a peer-to-peer content ecosystem, with roots in the Korean streaming platform Pandora.tv.

What is the price prediction for MBL in 2025?

Based on technical analysis, the predicted price for MBL in 2025 is approximately $0.005942. This forecast is derived from current market trends and historical data patterns.

What are the risks and benefits of investing in MBL?

MBL offers high leverage potential for substantial returns in crypto trading. Benefits include diverse trading instruments and accessibility. Risks include market volatility, regulatory uncertainty, and capital loss possibilities. Investors should assess their risk tolerance carefully.

How does MBL compare to other cryptocurrencies?

MBL demonstrates above-average trading volume compared to cryptocurrencies launched in the same year, with an average market cap among similar coins. It maintains a stable trading presence in the market.

What factors influence MBL price movements?

MBL price is influenced by market demand, trading volume, project developments, investor sentiment, and broader cryptocurrency market trends. Technological upgrades and community adoption also significantly impact price dynamics.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Title: Regulatory Hurdles Stall Cryptocurrency Custody Launch Plans

Exploring Promising Altcoin Projects for Beginners

Beginner's Guide to Understanding Dogecoin in the Blockchain World

Introduction to Bitcoin Ordinals for Beginners

Exploring DeFi Lending: A Comprehensive Guide to Securing Loans in Decentralized Finance