2025 LWA Price Prediction: Expert Analysis and Market Forecast for Loom Network Token

Introduction: LWA's Market Position and Investment Value

LumiWave (LWA) is a Web3 IP platform powered by Sui that transforms traditional intellectual property into new content such as NFTs and blockchain games. Since its launch in May 2024, LWA has established itself as an innovative player in the IP ecosystem sector. As of December 2025, LWA has a market capitalization of approximately $4.51 million with a circulating supply of 770,075,466 tokens, currently trading around $0.005851. This asset is gaining increasing importance in the Web3 IP and digital content creation sectors.

This article will provide a comprehensive analysis of LWA's price trends from 2025 through 2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to offer investors professional price forecasts and practical investment strategies.

I. LWA Price Historical Review and Current Market Status

LWA Historical Price Evolution Trajectory

- May 2024: Project launch and initial trading phase, price reached all-time high of $1.00 on May 23, 2024

- Mid-2024 to Present: Significant correction phase, price declined from the historical high of $1.00 to current levels, representing a substantial depreciation of approximately 99.4%

- December 2024-Present: Price stabilized near historical lows, with the all-time low of $0.005 established on December 17, 2025

LWA Current Market Stance

As of December 24, 2025, LumiWave (LWA) is trading at $0.005851, reflecting a 24-hour decline of 6.62% and a 1-hour increase of 0.45%. The token demonstrates a 7-day upward momentum of 9.25%, though the 1-year performance shows a significant decline of 72.22% from the launch price of $0.065.

The token's market capitalization stands at approximately $4.51 million with a fully diluted valuation (FDV) of $4.51 million, indicating a market cap to FDV ratio of 100%, as all 770,075,466 tokens are currently in circulation. The 24-hour trading volume reached $16,928.24, demonstrating moderate liquidity levels. With a market dominance of 0.00014%, LWA maintains a relatively small position within the broader cryptocurrency market. The token is currently held by approximately 2,999 addresses, indicating a distributed holder base.

Market sentiment currently reflects "Extreme Fear" with a VIX reading of 24, suggesting challenging conditions across broader financial markets that may be influencing asset performance.

Click to view current LWA market price

LWA Market Sentiment Indicator

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index at 24. This indicates significant market pessimism and investor anxiety. During such periods, volatility typically increases as traders react defensively to negative sentiment. While extreme fear can present opportunities for long-term investors seeking entry points at lower valuations, it also signals heightened market risk. Investors should remain cautious, conduct thorough research, and consider their risk tolerance before making trading decisions. Monitor market developments closely on Gate.com for real-time data and analysis.

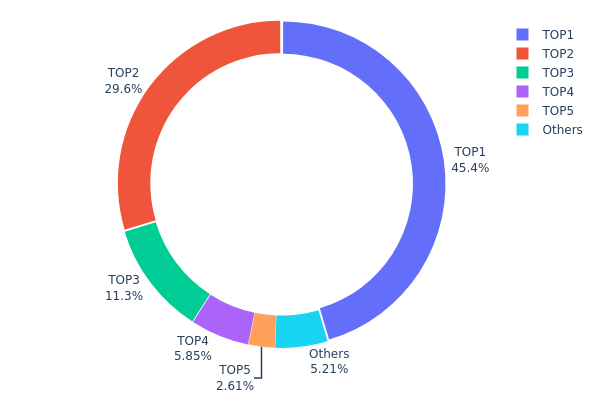

LWA Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top holders of LWA, revealing the degree of decentralization and potential risks associated with wealth concentration in the network. By analyzing the top five addresses and remaining holders, we can assess market structure stability and identify potential vulnerabilities to price manipulation or sudden liquidity events.

The LWA token exhibits pronounced concentration characteristics, with the top two addresses commanding 75.06% of total supply. The leading address (0x605f...d42700) alone holds 45.43%, while the second-largest holder (0x260e...bc8317) controls 29.63%, collectively representing more than three-quarters of all circulating tokens. This extreme concentration indicates significant centralization risk, as a coordinated action or unilateral decision by these two major stakeholders could substantially influence market dynamics. The third through fifth addresses contribute 19.71% cumulatively, while the remaining distributed holders account for only 5.23%, further emphasizing the oligopolistic structure of token ownership.

Such skewed distribution patterns suggest elevated vulnerability to price volatility and potential market manipulation. The concentration risk is particularly acute given that the top holder's position alone could exert considerable influence over trading activity, market sentiment, and token valuation. The limited participation of smaller holders indicates a less robust decentralization framework, which may constrain organic market development and increase dependency on the actions of major stakeholders. This distribution pattern reflects early-stage tokenomics typical of projects where institutional or founding stakeholders retain substantial control, warranting continued monitoring of holder behavior and potential unlock events that could introduce additional liquidity pressures.

Click to view current LWA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x605f...d42700 | 349876.29K | 45.43% |

| 2 | 0x260e...bc8317 | 228248.62K | 29.63% |

| 3 | 0x6605...af081e | 86681.84K | 11.25% |

| 4 | 0x1cb5...d9f4c5 | 45067.81K | 5.85% |

| 5 | 0x11fb...414178 | 20099.56K | 2.61% |

| - | Others | 40101.34K | 5.23% |

II. Core Factors Influencing LWA's Future Price

Supply Mechanism

-

Token Distribution Structure: LWA exhibits a highly concentrated holding distribution, with the top five addresses controlling approximately 88.28% of total supply (45.86%, 29.63%, 7.32%, 5.47%, and 4.74% respectively), while other addresses account for only 6.98%.

-

Market Impact of Concentration: The concentrated holding structure may profoundly influence market dynamics. Top addresses possess the capacity to dominate LWA's price fluctuations and liquidity. Any large-scale transactions could trigger significant price volatility. Additionally, this structure may introduce centralization risks that affect market stability and investor confidence.

Institutional and Whale Dynamics

- Whale Holdings: The top five wallet addresses maintain dominant positions in LWA distribution, creating potential risks related to market manipulation and sudden liquidity shifts. The significant concentration means that coordinated movements by these major holders could substantially impact price action and market sentiment.

III. LWA Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00433 - $0.00586

- Neutral Forecast: $0.00585

- Bullish Forecast: $0.0086 (requiring sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with incremental price appreciation driven by ecosystem development and increased market participation.

- Price Range Forecast:

- 2026: $0.0047 - $0.00766 (23% upside potential)

- 2027: $0.00588 - $0.01027 (27% upside potential)

- 2028: $0.00726 - $0.01125 (51% upside potential)

- Key Catalysts: Technology upgrades, strategic partnerships, improved market sentiment, and growing institutional interest in emerging digital assets.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00513 - $0.01146 (71% growth by 2029), progressing toward $0.01011 - $0.01108 by 2030 (83% cumulative growth from 2025 levels).

- Bullish Scenario: $0.01146 (assuming strong adoption acceleration and favorable macroeconomic conditions).

- Transformative Scenario: $0.01108+ (contingent on breakthrough utility developments, major platform integrations, or significant changes in regulatory environment supporting crypto assets).

The multi-year forecast suggests LWA maintaining a relatively stable foundation while establishing higher price floors over time. Investors should monitor developments on Gate.com and track ecosystem milestones as key performance indicators for validating these projections.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0086 | 0.00585 | 0.00433 | 0 |

| 2026 | 0.00766 | 0.00723 | 0.0047 | 23 |

| 2027 | 0.01027 | 0.00744 | 0.00588 | 27 |

| 2028 | 0.01125 | 0.00886 | 0.00726 | 51 |

| 2029 | 0.01146 | 0.01005 | 0.00513 | 71 |

| 2030 | 0.01108 | 0.01076 | 0.01011 | 83 |

LumiWave (LWA) Professional Investment Strategy and Risk Management Report

IV. LWA Professional Investment Strategy and Risk Management

LWA Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Web3 IP ecosystem believers, blockchain gaming enthusiasts, and risk-tolerant investors with a 2+ year investment horizon

- Operational recommendations:

- Accumulate during market downturns when LWA trades near support levels, leveraging the current 72.22% year-over-year decline

- Maintain a dollar-cost averaging approach through quarterly purchases to mitigate volatility risk

- Store tokens in secure custody solutions with multi-signature protection for enhanced security

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Monitor oversold conditions (RSI < 30) as potential entry points given recent market weakness

- Moving Average Convergence Divergence (MACD): Track momentum shifts to identify trend reversals in LWA's price action

- Range trading key points:

- Resistance level at $0.006796 (24-hour high) presents profit-taking opportunities

- Support level at $0.00582 (24-hour low) provides calculated entry signals

LWA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total crypto portfolio allocation

- Active investors: 2-5% of total crypto portfolio allocation

- Professional investors: 5-10% of total crypto portfolio allocation with hedging instruments

(2) Risk Hedging Solutions

- Portfolio diversification: Balance LWA holdings with established layer-1 blockchain assets and stablecoins to reduce concentration risk

- Volatility management: Utilize stop-loss orders at 10-15% below entry prices to limit downside exposure during adverse market conditions

(3) Secure Storage Solutions

- Self-custody approach: Gate Web3 wallet offers user-controlled key management with multi-chain support for seamless LWA management

- Cold storage option: For significant holdings, consider air-gapped offline storage solutions with hardware-based key generation

- Security best practices: Enable two-factor authentication, maintain backup recovery phrases in secure locations, and regularly audit wallet access patterns

V. LWA Potential Risks and Challenges

LWA Market Risk

- Extreme price volatility: LWA has declined 72.22% year-over-year, reflecting significant market uncertainty and liquidity constraints typical of mid-cap digital assets

- Low trading volume: With 24-hour volume of approximately $16,928, the token exhibits limited liquidity that could amplify price movements during large trades

- Market cap concentration: At $4.5 million market capitalization with only 2,999 token holders, LWA remains highly susceptible to whale manipulation and sudden capital outflows

LWA Regulatory Risk

- Blockchain gaming regulation uncertainty: As NFT and gaming functionalities expand, evolving regulatory frameworks across multiple jurisdictions may impact LWA's utility and adoption rates

- Intellectual property classification: Regulatory authorities may introduce new guidelines affecting how IP-linked tokens are treated under securities laws

- Compliance requirements: Changing global crypto regulations could necessitate operational adjustments affecting LWA's ecosystem and user accessibility

LWA Technology Risk

- Smart contract vulnerabilities: Any exploits or vulnerabilities in LWA's SUI-based smart contracts could lead to significant token losses or operational disruptions

- Platform dependency: LWA's reliance on the Sui blockchain means that network-level technical issues could directly impact token functionality and market availability

- Adoption challenges: Competition from established IP platforms and blockchain gaming ecosystems may limit LWA's growth trajectory and network effects

VI. Conclusion and Action Recommendations

LWA Investment Value Assessment

LumiWave presents a specialized investment opportunity within the Web3 intellectual property and blockchain gaming sector. The platform's positioning on the Sui network provides access to efficient smart contract infrastructure and a growing developer ecosystem. However, the token's significant year-over-year decline of 72.22%, combined with limited liquidity and a concentrated holder base, indicates substantial risk exposure. LWA's long-term value proposition depends critically on successful IP transformation initiatives, meaningful adoption by content creators, and sustained blockchain gaming demand. Investors should carefully evaluate whether the speculative upside potential justifies the considerable technical and market risks involved.

LWA Investment Recommendations

✅ Beginners: Start with micro allocations (0.5-1% of crypto portfolio) through Gate.com's spot trading, prioritizing education about Web3 IP mechanics before expanding positions

✅ Experienced investors: Consider 2-5% portfolio allocation with layered entry strategies during technical support levels, utilizing stop-loss discipline at -12% to manage downside risk

✅ Institutional investors: Conduct comprehensive due diligence on LumiWave's IP partnership pipeline and blockchain gaming adoption metrics before considering larger strategic positions

LWA Trading Participation Methods

- Spot trading: Purchase LWA directly on Gate.com's exchange using stable assets, with immediate settlement for active portfolio management

- Staking opportunities: If LWA implements yield-generating mechanisms through the Sui ecosystem, participate in network governance while generating additional token rewards

- DCA (Dollar-cost averaging): Execute scheduled periodic purchases at predetermined price intervals to systematize entry timing and reduce timing risk

Cryptocurrency investments carry extreme risk and are highly volatile. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. It is strongly recommended to consult with qualified financial advisors before making significant investment commitments. Never invest capital that you cannot afford to lose completely.

FAQ

What is LWA (Loom Network) and what is its current use case?

LWA is Loom Network's blockchain platform designed for building scalable decentralized applications. It enables developers to create and deploy dApps with high throughput and low transaction fees, focusing on mainstream adoption through improved performance and user experience.

What are expert price predictions for LWA token in 2025?

According to expert analysis, LWA token is predicted to reach $0.006282 by the end of 2025. Long-term forecasts suggest prices could reach $0.01284 by 2030, based on market trends and technical analysis indicators.

What factors could influence LWA price movement in the future?

LWA price is influenced by supply and demand dynamics, market sentiment, trading volume, regulatory developments, and macroeconomic conditions. Technology upgrades, adoption rates, and competitive landscape also play significant roles in price movements.

What are the risks and potential rewards of investing in LWA?

LWA offers potential high returns through price appreciation and ecosystem growth, but carries market volatility risks. Rewards include significant gains during bull markets, though prices can fluctuate significantly. Conduct thorough research before investing.

2025 ISLAND Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset

What is Moni

2025 WAXPPrice Prediction: Market Trends and Future Outlook for the WAX Ecosystem

ALU vs FLOW: Evaluating Different Computational Architectures for Modern Machine Learning Applications

Is Adventure Gold (AGLD) a Good Investment?: Analyzing the Long-Term Potential of this Gaming Token in the NFT Ecosystem

2025 ALUPrice Prediction: Market Analysis and Future Outlook for Aluminum Commodity Trends

Top Secure Platforms for Buying Cryptocurrencies in 2025

Exploring Decentraland $MANA: A Top Metaverse Coin for Future Investment

The remarkable surge of an AI-powered cryptocurrency: Is this the beginning of a new era?

What is UOS: A Comprehensive Guide to the Unified Operating System

What is POR: A Comprehensive Guide to Plan of Record in Project Management