2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: LUCIC's Market Position and Investment Value

LUCIC (Lucidum Coin) is a next-generation meme coin on Binance Smart Chain (BEP-20) that unites transparency, innovation, and ethical wealth creation. Since its launch, LUCIC has established itself as a deflationary token with a unique value proposition combining community-driven governance and dividend-yielding NFTs designed by French artist Michel Saja. As of December 19, 2025, LUCIC boasts a market capitalization of approximately $29.8 million with a circulating supply of 164.1 million tokens, trading at $0.1816 per token. This innovative asset, recognized for its commitment to ethical wealth creation and DAO principles, is increasingly gaining traction in the Web3 ecosystem.

This article will provide a comprehensive analysis of LUCIC's price trajectory from 2025 through 2030, integrating historical price patterns, market dynamics, tokenomics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

LUCIC (Lucidum Coin) Market Analysis Report

I. LUCIC Price History Review and Current Market Status

LUCIC Historical Price Evolution

-

November 9, 2025: LUCIC reached its all-time high (ATH) of $0.735, marking the peak of its initial market rally following project launch in September 2025.

-

December 3, 2025: LUCIC declined to its all-time low (ATL) of $0.1697, representing a significant correction of approximately 76.9% from its peak within less than a month.

-

December 19, 2025: LUCIC is currently trading at $0.1816, showing stabilization near its ATL levels after the sharp market correction.

LUCIC Current Market Status

Price Metrics:

- Current Price: $0.1816 USD

- 24-Hour Change: -0.76%

- 7-Day Change: -27.16%

- 30-Day Change: -57.62%

- 1-Year Change: +357.43%

Market Capitalization Data:

- Market Cap: $29,801,539.73 USD

- Fully Diluted Valuation (FDV): $38,136,000.00 USD

- Market Cap to FDV Ratio: 78.15%

- Market Dominance: 0.0011%

- 24-Hour Trading Volume: $52,182.62 USD

Supply Information:

- Circulating Supply: 164,105,395 LUCIC

- Total Supply: 210,000,000 LUCIC

- Max Supply: 210,000,000 LUCIC

- Circulation Ratio: 78.15%

Community Metrics:

- Total Holders: 12,693

- Market Ranking: 696

Trading Range (24-Hour):

- High: $0.1931

- Low: $0.179

The token is currently in a bearish phase following its November peak, with significant downward pressure over the past month. However, recent price stabilization around support levels and the proximity to ATL suggests potential consolidation phases in the near term.

Click to view the current LUCIC market price

LUCIC Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as the Fear and Greed Index plummets to 16. This historically low reading signals significant market pessimism and investor anxiety. During such extreme fear periods, experienced traders often view it as a potential buying opportunity, as markets tend to overreact to negative sentiment. However, caution is warranted—confirm the underlying fundamentals before making investment decisions. Monitor key support levels closely and consider dollar-cost averaging to mitigate volatility risks. Stay informed through Gate.com's market data tools for real-time insights.

LUCIC Holding Distribution

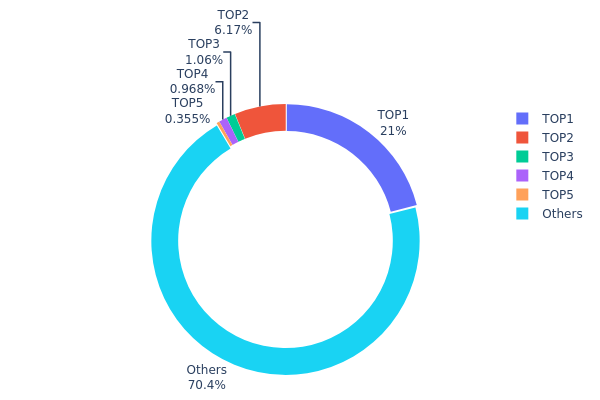

The address holding distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing market decentralization and potential systemic risks. By analyzing the top token holders and their respective percentages of total supply, investors and analysts can evaluate the degree of wealth concentration and its implications for market stability and governance structures.

LUCIC's current holding distribution reveals a moderately concentrated ownership structure. The top address controls 21.00% of the total supply with 44.1 million tokens, while the second-largest holder maintains 6.17% of circulating tokens. Combined, the top five addresses account for approximately 29.54% of the token supply, with the remaining 70.46% distributed among other addresses. This distribution pattern suggests that while significant concentration exists at the top tier, the majority of tokens are dispersed across a broader holder base, indicating a degree of decentralization that mitigates extreme concentration risks typically observed in newly launched projects.

The presence of a dead address holding 0.96% of tokens reflects typical token burn mechanisms or supply reduction strategies. The concentration level observed does not present an acute centralization concern that would materially elevate single-actor price manipulation risks or consensus vulnerability. However, the 21.00% stake held by the leading address warrants continued monitoring, as large stakeholders retain considerable influence over market dynamics. The distribution structure demonstrates reasonable health relative to peer projects, with sufficient token decentralization to support organic market development while maintaining recognizable key stakeholders that can potentially drive ecosystem adoption and strategic initiatives.

Visit LUCIC Holding Distribution on Gate.com for real-time data updates.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4079...ee1bbe | 44100.00K | 21.00% |

| 2 | 0x8562...9a73aa | 12957.03K | 6.17% |

| 3 | 0xe9e0...179f13 | 2226.57K | 1.06% |

| 4 | 0x0000...00dead | 2032.94K | 0.96% |

| 5 | 0x34ce...86af65 | 745.90K | 0.35% |

| - | Others | 147937.57K | 70.46% |

II. Core Factors Affecting LUCIC's Future Price

Supply Mechanism

-

Airdrop Distribution Impact: The scale of airdrop allocations significantly influences price movements at launch. Large early sell-offs by airdrop recipients can trigger sharp price declines immediately after trading begins.

-

Project Team Support: Whether the project team actively supports price stability through repurchasing, market-making activities, or simply allows the token to trade freely substantially impacts post-launch price performance.

Market Demand and Competition

-

Market Positioning: LUCIC's future price is primarily driven by market demand, technological innovation, and competitive dynamics within its sector.

-

Supply Chain Stability: The stability and efficiency of supply chain operations play a critical role in maintaining investor confidence and price stability.

-

Brand Recognition: Market marketing strategies and brand awareness significantly influence LUCIC's market positioning and valuation.

Note: This analysis is based on available information as of December 19, 2025. The cryptocurrency market remains highly volatile, and investors should conduct thorough due diligence before making investment decisions. Consider using Gate.com for trading and price monitoring purposes.

Three、2025-2030 LUCIC Price Forecast

2025 Outlook

- Conservative Forecast: $0.11992 - $0.1817

- Neutral Forecast: $0.1817

- Optimistic Forecast: $0.20532 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with moderate growth trajectory

- Price Range Forecast:

- 2026: $0.14126 - $0.24769

- 2027: $0.18972 - $0.32428

- 2028: $0.24247 - $0.29696

- Key Catalysts: Ecosystem expansion, increased adoption rate, strategic partnerships, and market sentiment recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.2847 - $0.32741 (assuming steady market conditions and consistent development progress)

- Optimistic Scenario: $0.30606 - $0.4346 (assuming accelerated adoption and positive macroeconomic environment)

- Transformational Scenario: $0.4346+ (contingent on breakthrough technological advances and mainstream institutional adoption)

- Growth Trajectory: LUCIC demonstrates cumulative appreciation of 56-68% from 2029 to 2030, indicating strengthening long-term value proposition

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20532 | 0.1817 | 0.11992 | 0 |

| 2026 | 0.24769 | 0.19351 | 0.14126 | 6 |

| 2027 | 0.32428 | 0.2206 | 0.18972 | 21 |

| 2028 | 0.29696 | 0.27244 | 0.24247 | 50 |

| 2029 | 0.32741 | 0.2847 | 0.14805 | 56 |

| 2030 | 0.4346 | 0.30606 | 0.19588 | 68 |

LUCIC (Lucidum Coin) Professional Investment Strategy and Risk Management Report

IV. LUCIC Professional Investment Strategy and Risk Management

LUCIC Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-focused participants, ethical finance advocates, and long-term Web3 believers

- Operation Recommendations:

- Accumulate during market corrections and hold through multiple market cycles to benefit from deflationary tokenomics

- Participate in DAO governance to understand project direction and community decisions

- Monitor dividend-yielding NFT opportunities designed by French artist Michel Saja for enhanced returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify price floors at $0.1697 (ATL on December 3, 2025) and ceilings at $0.735 (ATH on November 9, 2025) to execute entry and exit points

- Moving Averages: Use 7-day and 30-day moving averages to confirm trend direction given the 27.16% decline over 7 days and 57.62% decline over 30 days

- Wave Trading Key Points:

- Monitor the 24-hour trading volume of approximately $52,182.62 to identify liquidity windows for optimal trade execution

- Watch for reversal signals after extended downtrends; the token showed +357.43% annual return, indicating recovery potential

LUCIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio

- Active Investors: 3-7% of total portfolio

- Professional Investors: 5-15% of total portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Balance LUCIC holdings with stablecoins or other established assets given its position as rank 696 with 0.0011% market dominance

- Position Sizing: Use strict stop-loss orders at 15-20% below entry points to manage downside risk during high volatility periods

(3) Secure Storage Solution

- Recommended Wallet: Gate.com Web3 Wallet for integrated exchange and custody management

- Self-Custody Option: Store LUCIC tokens at contract address 0xe054017a2f0ecfa294b08a74af319bce0b985a39 on BSC blockchain using secure hardware methods

- Security Precautions: Never share private keys, use two-factor authentication on all accounts, verify contract addresses through official channels at https://lucidum.cc/, and maintain offline backup copies of recovery phrases

V. LUCIC Potential Risks and Challenges

LUCIC Market Risks

- High Volatility: The token experienced a 57.62% decline over 30 days and 27.16% over 7 days, indicating extreme price swings unsuitable for risk-averse investors

- Low Market Liquidity: With only $52,182.62 in 24-hour trading volume and 12,693 holders, concentrated selling could trigger significant price pressure

- Meme Coin Characteristics: As a next-generation meme coin, LUCIC depends heavily on community sentiment and social media trends, which are unpredictable and subject to rapid reversal

LUCIC Regulatory Risks

- Evolving Global Regulation: Meme coins face increased scrutiny from regulatory bodies worldwide, with potential restrictions on trading or use cases

- Security Token Classification: If dividend-yielding NFTs or governance mechanisms trigger securities classification, LUCIC could face compliance challenges

- Regional Trading Restrictions: Certain jurisdictions may restrict access to BSC-based tokens, limiting the addressable market

LUCIC Technical Risks

- Smart Contract Vulnerabilities: While BEP-20 is established, any bugs in LUCIC's deflationary tokenomics mechanism could impact token value

- Blockchain Network Risks: Binance Smart Chain outages or congestion could prevent timely transactions or access to holdings

- Contract Address Dependency: The entire ecosystem depends on a single contract address (0xe054017a2f0ecfa294b08a74af319bce0b985a39); migration issues could create technical complications

VI. Conclusion and Action Recommendations

LUCIC Investment Value Assessment

LUCIC presents a unique value proposition by combining meme coin accessibility with ethical wealth creation principles and DAO governance. The 357.43% annual return demonstrates recovery potential, though recent 30-day and 7-day declines of 57.62% and 27.16% respectively signal caution. With a market cap of approximately $38.1 million and 78.15% circulating supply ratio, LUCIC operates as a moderate-cap project with growth potential tempered by inherent volatility. The dividend-yielding NFT mechanism and community-driven approach differentiate it from speculative meme coins, but market dominance of only 0.0011% reflects limited mainstream adoption.

LUCIC Investment Recommendations

✅ Beginners: Start with micro positions (1-3% of portfolio) using dollar-cost averaging over 2-3 months to reduce timing risk. Focus on understanding the whitepaper and DAO governance before trading actively.

✅ Experienced Investors: Implement technical analysis strategies using identified support ($0.1697) and resistance ($0.735) levels. Allocate 3-7% of portfolio while maintaining strict stop-loss discipline given recent volatility.

✅ Institutional Investors: Evaluate LUCIC as part of emerging market or innovation-focused crypto strategies, conducting due diligence on DAO governance mechanisms and long-term sustainability of deflationary tokenomics.

LUCIC Trading Participation Methods

- Gate.com Platform: Trade LUCIC directly on Gate.com with integrated Web3 wallet functionality for seamless custody and withdrawal to personal wallets

- Direct Blockchain Interaction: Purchase through decentralized methods on Binance Smart Chain using the official contract address, then transfer to secure storage

- Community Participation: Engage in DAO governance at https://lucidum.cc/ and evaluate dividend-yielding NFT opportunities for enhanced yield potential

Cryptocurrency investment carries extreme risk and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is Lukso a buy or sell?

Lukso demonstrates solid potential with its innovative Web3 infrastructure. Current market conditions suggest buying opportunities for long-term holders seeking exposure to fashion and digital lifestyle ecosystems.

What is the price prediction for Lukso (LUCIC) in 2025?

Based on market indicators, Lukso (LUKSO) is projected to trade within the range of $3.0041 to $3.1918 by the end of 2025, reflecting moderate growth potential in the coming period.

What factors influence Lukso (LUCIC) price movements?

Lukso (LUCIC) price movements are driven by market trends, technology advancements, regulatory changes, and trading volume. Technical analysis and market sentiment also significantly impact price fluctuations.

How does Lukso (LUCIC) compare to other layer 2 blockchain projects?

Lukso stands out with its unique identity management system and smart contract capabilities, offering scalable solutions with high throughput and low fees compared to traditional layer 2 projects.

Gate Fun: Revolutionizing Web3 with Community-Driven Token Launch Platform

2025 PENGU Price Prediction: Navigating the Crypto Waters with the Penguin-Themed Token

What is SKOP: A Comprehensive Guide to the Innovative Blockchain Technology

What is MFER: The Rising Trend in NFT Collectibles Explained

2025 XCAD Price Prediction: Bullish Outlook as Adoption and Partnerships Drive Growth

What is SKOP: The Innovative AI-Powered Platform Revolutionizing Supply Chain Management

Understanding Centralized Digital Currency Platforms

Understanding NFT Minting: A Step-by-Step Guide

Discover Zero Knowledge Airdrop Opportunities

Comprehensive Guide to Acquiring and Understanding the Functionality of the Hive Token

Understanding Cryptography in Blockchain Technology