2025 GMT Price Prediction: Analyzing Market Trends and Potential Growth Factors for STEPN's Native Token

Introduction: GMT's Market Position and Investment Value

STEPN (GMT), as a leading move-to-earn sports application in the cryptocurrency market, has achieved significant milestones since its inception in 2022. As of 2025, STEPN's market capitalization has reached $86,528,038, with a circulating supply of approximately 3,111,400,155 tokens, and a price hovering around $0.02781. This asset, often referred to as the "Web3 Fitness Pioneer," is playing an increasingly crucial role in the intersection of fitness, blockchain technology, and digital asset management.

This article will comprehensively analyze STEPN's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GMT Price History Review and Current Market Status

GMT Historical Price Evolution Trajectory

- 2022: Launch of STEPN, price reached all-time high of $4.11 on April 28

- 2023: Market downturn, price declined significantly

- 2024: Gradual market recovery, price showed signs of stabilization

- 2025: Continued market volatility, price dropped to all-time low of $0.01532444 on October 11

GMT Current Market Situation

As of October 21, 2025, GMT is trading at $0.02781, with a 24-hour trading volume of $74,156.15. The price has seen a 2.72% increase in the last 24 hours, but a 10.16% decrease over the past week. GMT's market cap currently stands at $86,528,038.31, ranking it 446th in the cryptocurrency market. The circulating supply is 3,111,400,155.10 GMT, with a total supply of 5,073,850,155.10 GMT and a maximum supply of 6,000,000,000 GMT.

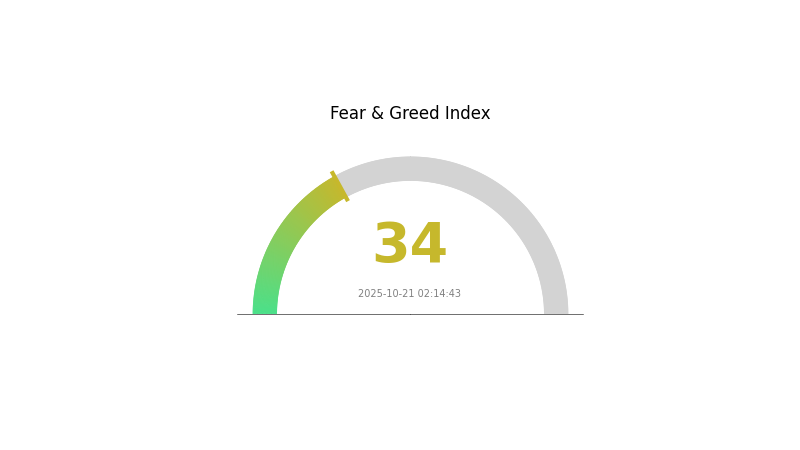

The current price represents a significant drop from its all-time high, indicating a challenging market environment for GMT. However, the recent 24-hour price increase suggests some short-term positive momentum. The market sentiment, as indicated by the Fear and Greed Index, is currently in the "Fear" zone with a value of 34, reflecting overall caution among investors.

Click to view the current GMT market price

GMT Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index at 34. This suggests investors are becoming cautious, possibly due to recent market uncertainties or negative news. During such periods, some traders see it as a potential buying opportunity, following the contrarian approach of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and use tools like Gate.com to stay informed.

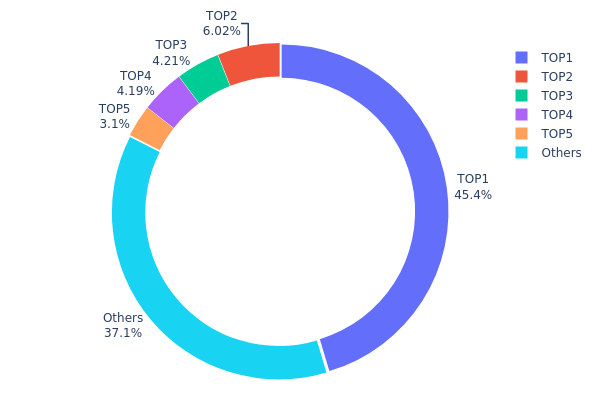

GMT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GMT tokens among various wallet addresses. Analysis of this data reveals a significant concentration of GMT tokens, with the top address holding 45.38% of the total supply, equivalent to 90,564.03K tokens. The subsequent four largest holders collectively account for an additional 17.49% of the supply, bringing the total concentration among the top 5 addresses to 62.87%.

This high level of concentration raises concerns about potential market manipulation and price volatility. With a single address controlling nearly half of the supply, there's a risk of large-scale sell-offs or accumulations that could significantly impact GMT's market price. Furthermore, the top 5 addresses holding over 60% of the supply suggests a relatively low level of decentralization, which may affect the token's long-term stability and governance structure.

The current distribution pattern indicates a market structure that is vulnerable to whale movements and potentially less resistant to external shocks. While the remaining 37.13% held by other addresses provides some balance, the overall on-chain structure appears to be tilted towards centralization, which could be a point of concern for investors and market participants.

Click to view the current GMT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5cd7...4e1db2 | 90564.03K | 45.38% |

| 2 | 0xf89d...5eaa40 | 12003.77K | 6.01% |

| 3 | 0x53b9...e4cf5c | 8400.00K | 4.20% |

| 4 | 0x4368...26f042 | 8369.92K | 4.19% |

| 5 | 0xffff...ffdead | 6183.73K | 3.09% |

| - | Others | 74030.45K | 37.13% |

II. Key Factors Influencing GMT's Future Price

Supply Mechanism

- Burning Plan: GMT implements a token burning mechanism to reduce supply and potentially increase value.

- Current Impact: The recent burning of 600 million tokens has attracted widespread attention, with the market anticipating positive effects on GMT's price.

Macroeconomic Environment

- Monetary Policy Impact: Changes in interest rates and broader economic policies can affect GMT's price as part of the overall cryptocurrency market.

- Inflation Hedging Properties: GMT's performance in inflationary environments may influence its attractiveness as a potential hedge against inflation.

Technological Development and Ecosystem Building

- AI Integration: If StepN can swiftly adapt to technological trends such as incorporating AI elements, it could open up new value points for GMT.

- Social Elements: The introduction of social features into the StepN ecosystem could expand GMT's utility and user base.

- Ecosystem Applications: The continuous expansion of GMT's ecosystem and the development of new DApps or projects within it are expected to drive future demand and price.

III. GMT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02444 - $0.02777

- Neutral prediction: $0.02777 - $0.03082

- Optimistic prediction: $0.03082 - $0.03500 (requires significant market adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.02073 - $0.04718

- 2028: $0.02778 - $0.04271

- Key catalysts: Increased utility and broader market adoption

2029-2030 Long-term Outlook

- Base scenario: $0.04208 - $0.04293 (assuming steady market growth)

- Optimistic scenario: $0.04377 - $0.04636 (with favorable market conditions)

- Transformative scenario: $0.05000 - $0.06000 (with exponential ecosystem expansion)

- 2030-12-31: GMT $0.04636 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03082 | 0.02777 | 0.02444 | 0 |

| 2026 | 0.04219 | 0.0293 | 0.02695 | 5 |

| 2027 | 0.04718 | 0.03574 | 0.02073 | 28 |

| 2028 | 0.04271 | 0.04146 | 0.02778 | 49 |

| 2029 | 0.04377 | 0.04208 | 0.02693 | 51 |

| 2030 | 0.04636 | 0.04293 | 0.02318 | 54 |

IV. GMT Professional Investment Strategies and Risk Management

GMT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Growth-oriented investors with high risk tolerance

- Operation suggestions:

- Accumulate GMT during market dips

- Hold for at least 1-2 years to capture potential upside

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined price targets

GMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Options strategies: Use put options to protect downside

- Portfolio diversification: Combine GMT with other crypto assets

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for large holdings

- Security precautions: Enable 2FA, use strong passwords, backup recovery phrases

V. Potential Risks and Challenges for GMT

GMT Market Risks

- High volatility: Price swings can be extreme

- Competition: Other move-to-earn projects may capture market share

- User adoption: Sustained growth depends on attracting new users

GMT Regulatory Risks

- Unclear regulations: Cryptocurrency rules are still evolving globally

- Potential bans: Some countries may restrict crypto-related activities

- Tax implications: Changing tax laws could impact GMT holders

GMT Technical Risks

- Smart contract vulnerabilities: Potential for hacks or exploits

- Scalability issues: Network congestion could affect user experience

- Technological obsolescence: Newer technologies may emerge

VI. Conclusion and Action Recommendations

GMT Investment Value Assessment

GMT offers long-term potential in the move-to-earn space but faces short-term volatility and adoption challenges. The project's success depends on user growth and ecosystem development.

GMT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the technology

✅ Experienced investors: Consider dollar-cost averaging and set clear exit strategies

✅ Institutional investors: Conduct thorough due diligence and consider GMT as part of a diversified crypto portfolio

GMT Trading Participation Methods

- Spot trading: Buy and sell GMT on Gate.com

- Staking: Participate in GMT staking programs for passive income

- NFT integration: Explore STEPN's NFT ecosystem for additional exposure

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GMT going to go up?

GMT's price is closely tied to Bitcoin. If Bitcoin rises, GMT is likely to follow. However, market conditions are unpredictable, so future price movements remain uncertain.

Why is GMT coin pumping?

GMT coin is pumping due to a daily midnight surge pattern, possibly linked to a trading strategy. The exact cause remains unclear.

Which crypto will be 1000x in 2030?

While speculative, meme coins like BONK, SHIB, and PEPE show potential for massive gains. However, no guarantee exists for 1000x returns by 2030.

What happened to GMT crypto?

Binance Labs ended its involvement, transferring remaining GMT tokens to Binance. This created uncertainty for the project's future and caused price fluctuations.

Is GameFi (GAFI) a Good Investment?: Analyzing the Potential and Risks of Blockchain Gaming Tokens in 2023

2025 HMSTR Price Prediction: Analysis of Growth Factors and Market Potential for Hamster Token

2025 CATI Price Prediction: Analyzing Market Trends and Future Growth Potential in the Decentralized Asset Ecosystem

2025 BIGTIME Price Prediction: Analysis of Growth Potential and Market Factors Influencing the Gaming Token's Future Value

2025 GAME2Price Prediction: Analyzing Market Trends and Future Valuation Potential for the Gaming Token

2025 MAVIA Price Prediction: Future Growth Analysis and Potential ROI for Investors

What is BAND: A Comprehensive Guide to Understanding the Blockchain-Based Decentralized Oracle Network

What is HUMA: A Comprehensive Guide to Humanoid Understanding and Machine Adaptation

What is INC: A Comprehensive Guide to Understanding Incorporated Business Entities and Their Legal Implications

What is ILV: A Comprehensive Guide to Illuvium's Governance Token and Gaming Ecosystem

What is MASK: A Comprehensive Guide to Understanding Machine Learning Masking Techniques and Their Applications in Modern AI Systems