2025 DESO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: DESO's Market Position and Investment Value

Decentralized Social (DESO), as a native cryptocurrency supporting a decentralized social blockchain, has made significant strides since its inception in 2021. As of 2025, DESO's market capitalization has reached $75,821,695, with a circulating supply of approximately 10,532,253 tokens, and a price hovering around $7.199. This asset, often hailed as the "social media blockchain disruptor," is playing an increasingly crucial role in decentralized social media applications.

This article will comprehensively analyze DESO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. DESO Price History Review and Current Market Status

DESO Historical Price Evolution

- 2021: Initial launch, price reached all-time high of $198.68 on June 20

- 2024: Market downturn, price hit all-time low of $2.7 on November 5

- 2025: Gradual recovery, price stabilized around $7-8 range

DESO Current Market Situation

As of October 21, 2025, DESO is trading at $7.199, with a 24-hour trading volume of $17,235.81. The token has experienced a 3.97% decrease in the last 24 hours. DESO's market capitalization stands at $75,821,695.72, ranking it 482nd in the overall cryptocurrency market.

The current price represents a significant drop from its all-time high but shows recovery from its all-time low. In the past month, DESO has shown strong performance with a 17.04% increase, indicating growing interest and positive sentiment. However, short-term volatility is evident with a 1-hour decrease of 1.21%.

DESO's circulating supply is 10,532,253.8854 tokens, which is 97.44% of its total supply of 10,808,492.6854 tokens. This high circulation ratio suggests good liquidity for the token.

Click to view the current DESO market price

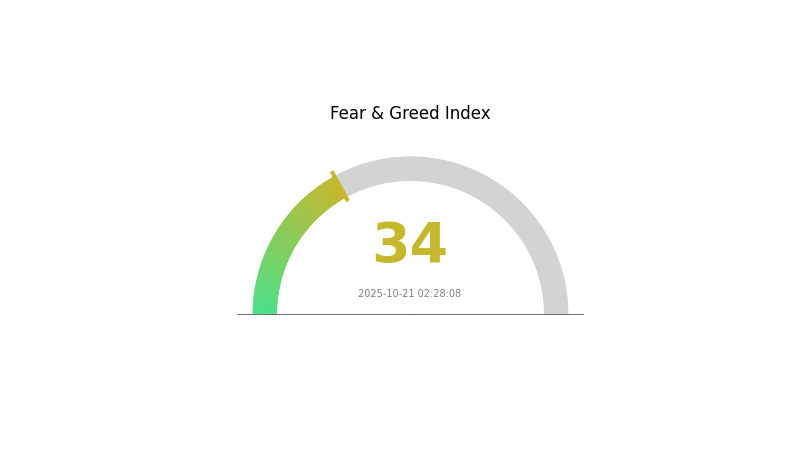

DESO Market Sentiment Indicator

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a state of fear, with the Fear and Greed Index at 34. This indicates a cautious sentiment among investors. During such periods, some traders view it as a potential buying opportunity, adhering to the contrarian principle of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Stay informed and trade responsibly on Gate.com.

DESO Holdings Distribution

The address holdings distribution chart for DESO reveals an unusual pattern, as the provided data table is empty. This could indicate several possibilities regarding the current state of DESO's on-chain structure.

The absence of top holder data may suggest a highly decentralized distribution, where no single address holds a significant portion of the total supply. Alternatively, it could point to limitations in data availability or transparency issues in tracking DESO holdings. This lack of clear concentration data makes it challenging to assess the potential for market manipulation or price volatility based on large holder behavior.

Without concrete distribution data, it's difficult to draw definitive conclusions about DESO's market characteristics. However, this situation underscores the importance of ongoing monitoring and the need for improved blockchain analytics to provide a clearer picture of DESO's on-chain dynamics and overall market health.

Click to view the current DESO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting DESO's Future Price

Supply Mechanism

- Market Dynamics: The core driver of DESO's price is the supply and demand dynamics. When supply exceeds demand, the price tends to decrease, and vice versa.

Institutional and Large Holder Movements

- Corporate Adoption: The adoption of DESO by well-known companies could significantly impact its price and market perception.

Macroeconomic Environment

-

Monetary Policy Impact: The policies of major central banks, particularly regarding interest rates, can influence DESO's price. Lower interest rates may drive investors towards riskier assets like cryptocurrencies.

-

Inflation Hedging Properties: DESO's performance in inflationary environments could affect its appeal as a potential hedge against inflation.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects on the DESO network could drive adoption and potentially influence the price.

III. DESO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $5.18 - $6.19

- Neutral forecast: $6.20 - $7.20

- Optimistic forecast: $7.21 - $8.78 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $4.61 - $10.73

- 2028: $6.66 - $12.05

- Key catalysts: Technological advancements, wider ecosystem integration, and potential regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $10.93 - $13.17 (assuming steady market growth and adoption)

- Optimistic scenario: $13.18 - $15.41 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $15.42 - $18.96 (with breakthrough use cases and mainstream integration)

- 2030-12-31: DESO $18.96 (potential peak under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 8.78034 | 7.197 | 5.18184 | 0 |

| 2026 | 9.74618 | 7.98867 | 5.4323 | 10 |

| 2027 | 10.72958 | 8.86742 | 4.61106 | 23 |

| 2028 | 12.05216 | 9.7985 | 6.66298 | 36 |

| 2029 | 15.40472 | 10.92533 | 8.08474 | 51 |

| 2030 | 18.95763 | 13.16502 | 9.08387 | 82 |

IV. DESO Professional Investment Strategies and Risk Management

DESO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high-risk tolerance and belief in decentralized social media

- Operation suggestions:

- Accumulate DESO tokens during market dips

- Monitor project developments and community growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Pay attention to project announcements and market sentiment

DESO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, backup private keys securely

V. Potential Risks and Challenges for DESO

DESO Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited adoption: Challenges in attracting users from established social platforms

- Competition: Other blockchain-based social media projects may emerge

DESO Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of decentralized platforms

- Data privacy concerns: Regulatory challenges related to user data protection

- Token classification: Risk of DESO being classified as a security

DESO Technical Risks

- Scalability issues: Potential limitations in handling large-scale user adoption

- Smart contract vulnerabilities: Risk of exploits in the underlying blockchain code

- Network security: Potential for 51% attacks or other blockchain-specific vulnerabilities

VI. Conclusion and Action Recommendations

DESO Investment Value Assessment

DESO presents a unique value proposition in the decentralized social media space, with potential for long-term growth. However, it faces significant short-term risks due to market volatility and adoption challenges.

DESO Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the project ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified crypto portfolio

DESO Participation Methods

- Direct token purchase: Buy DESO on Gate.com

- Participate in the ecosystem: Use DeSo-based applications to gain firsthand experience

- Staking: Explore staking options if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can sandbox reach $10?

Yes, The Sandbox's SAND token could potentially reach $10 if metaverse adoption grows and the platform expands. Market trends and partnerships will be crucial factors.

What is the all time high for Deso coin?

The all-time high for Deso coin was $110.65, reached on July 14, 2020.

Can Sol reach $1000 USD?

While unlikely in the near term, Solana could potentially reach $1000 in the long run if it continues to grow and gain adoption. However, such predictions are highly speculative.

What will Doge be worth in 2025?

Based on expert predictions, Dogecoin (DOGE) is expected to reach an average price of $0.1 by the end of 2025, with potential highs between $0.5710 and $0.6898.

2025 SCARCITY Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Ecosystem

Is P00LS (P00LS) a good investment?: Analyzing the potential and risks of this social token platform

P00LS vs XLM: Comparing Two Innovative Blockchain Solutions for Content Creators

Is SCARCITY (SCARCITY) a good investment?: Analyzing the potential of this deflationary token in the crypto market

2025 MOOO Price Prediction: Bullish Trends and Key Factors Driving the Future of this Crypto Asset

2025 LAUNCHCOIN Price Prediction: Analyzing Market Trends and Future Growth Potential for this Emerging Digital Asset

How Do On-Chain Data Analysis Reveal WLFI's True Circulating Supply and Whale Movement Trends?

Mastering the Wyckoff Accumulation Phase in Cryptocurrency Trading

What is TST (Test) Token Price, Market Cap, and 24-Hour Trading Volume Overview?

Exploring UnityMeta (UMT): A Beginner's Guide to Cryptocurrency

Ethereum Upgrade Release and Initial Value Exploration