2025 DEGO Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Introduction: Market Position and Investment Value of DEGO

DEGO (DEGO) is a cross-chain NFT+DeFi protocol and infrastructure that has emerged as an open NFT ecosystem since its launch in 2020. As of 2025, DEGO's market capitalization has reached $9.26 million, with a circulating supply of 21 million tokens trading at approximately $0.4408. This innovative asset, recognized as a "cross-chain NFT infrastructure," is playing an increasingly important role in enabling blockchain projects to expand their user base, distribute tokens, and develop NFT-powered applications.

This article will provide a comprehensive analysis of DEGO's price trends through 2030, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this digital asset.

DEGO Finance (DEGO) Market Analysis Report

I. DEGO Price History Review and Current Market Status

DEGO Historical Price Evolution

- March 2021: Project reached its all-time high (ATH) of $33.41, reflecting peak market enthusiasm during the NFT and DeFi boom period.

- 2021-2025: Extended bear market cycle, with the token experiencing significant depreciation as market sentiment cooled following the initial NFT craze.

- October 2025: Token reached its all-time low (ATL) of $0.216349, marking the lowest price point in its trading history.

- December 2025: Token trading at $0.4408, showing partial recovery from the ATL but still trading at approximately 98.68% below its historical peak.

DEGO Current Market Situation

As of December 22, 2025, DEGO is trading at $0.4408 with a 24-hour trading volume of $20,502.92. The token has experienced recent downward pressure, declining 2.96% over the past 24 hours and 1.28% in the last hour. Over a longer timeframe, DEGO shows considerable weakness with a 27.81% decline over the past 30 days and an 85.11% drop over the past year.

The total market capitalization stands at $9,256,800.00, with a fully diluted valuation of $9,256,800.00. The circulating supply equals the total supply at 21,000,000 DEGO tokens, representing 100% circulation ratio. The token maintains a market dominance of 0.00028% and ranks 1,214th by market capitalization.

Current market sentiment reflects extreme fear (VIX: 25), indicating heightened market anxiety and risk aversion. DEGO is listed on 15 exchanges and currently maintains 1,139 token holders. The 24-hour high stands at $0.4615 while the low is $0.4393, demonstrating relatively tight price consolidation in the short term.

View the current DEGO market price

Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index dropping to 25. This indicates heightened investor anxiety and risk aversion across digital assets. Market participants are displaying pronounced caution, potentially creating both challenges and opportunities. During periods of extreme fear, experienced traders often identify undervalued assets, while conservative investors may prefer to wait for market stabilization. Monitor key support levels closely and consider your risk tolerance when making investment decisions on Gate.com.

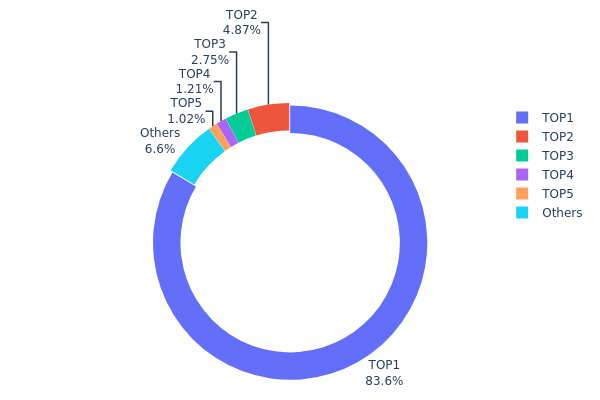

DEGO Holdings Distribution

The address holdings distribution chart illustrates the concentration of DEGO tokens across the top wallet addresses on the blockchain. This metric serves as a critical indicator of token ownership centralization, revealing how unevenly or evenly DEGO is distributed among market participants. By tracking the percentage of total supply held by individual addresses, particularly the top holders, this analysis helps assess the decentralization level and potential concentration risks within the DEGO ecosystem.

DEGO currently exhibits a highly concentrated token distribution pattern, with significant centralization concerns. The top holder controls 83.55% of the total supply (12.53 million tokens), representing an extreme concentration that substantially exceeds healthy decentralization benchmarks. The top five addresses collectively account for 93.37% of all DEGO tokens, leaving only 6.63% distributed among all other holders. This distribution structure indicates that a minimal number of entities wield disproportionate control over the token supply, creating potential vulnerabilities in the network's governance and market dynamics.

This pronounced concentration raises material considerations regarding market structure and price stability. With such dominant positions held by a limited number of addresses, the potential for significant price volatility increases substantially, as large-scale token movements or liquidations from these major holders could trigger considerable market swings. Furthermore, the highly centralized ownership structure reduces true decentralization and may limit the diversity of stakeholder perspectives in protocol governance. The existing distribution suggests that DEGO's current on-chain structure remains in a nascent phase of decentralization, with token concentration persisting at levels that warrant continued monitoring by market participants.

Click to view current DEGO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 12531.72K | 83.55% |

| 2 | 0x0d07...b492fe | 730.24K | 4.86% |

| 3 | 0xf16e...969b91 | 412.00K | 2.74% |

| 4 | 0x28c6...f21d60 | 180.80K | 1.20% |

| 5 | 0x75e8...1dcb88 | 153.71K | 1.02% |

| - | Others | 989.95K | 6.63% |

II. Core Factors Influencing DEGO's Future Price

Supply Mechanism

-

Block Reward Halving: DEGO's price trends are driven by supply and demand dynamics, influenced by block reward halvings and other supply-related factors. Historical patterns show that halvings can create significant market impacts as token supply growth slows.

-

Current Impact: Supply adjustments continue to play a critical role in price movements, with changes in token availability affecting market valuation and investor sentiment.

Institutional and Whale Dynamics

-

Regulatory Changes: Real-world events such as regulatory developments and cryptocurrency exchange security incidents significantly impact DEGO's price trajectory.

-

Business and Government Adoption: DEGO's future price is substantially influenced by adoption rates among businesses and governmental entities, as increased institutional participation typically strengthens token value and utility.

Macroeconomic Environment

- Market Trends and Economic Conditions: DEGO's price is materially affected by broader cryptocurrency market trends and overall macroeconomic conditions. Market sentiment and economic performance play key roles in determining price movements.

Three、2025-2030 DEGO Price Forecast

2025 Outlook

- Conservative Forecast: $0.4248 - $0.4425

- Neutral Forecast: $0.4425 - $0.5500

- Optimistic Forecast: $0.6549 (requires sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery phase with increasing volatility, characterized by consolidation and selective growth as market participants reassess asset fundamentals and ecosystem development.

- Price Range Forecast:

- 2026: $0.3621 - $0.5761

- 2027: $0.3037 - $0.7986

- 2028: $0.4900 - $0.7962

- Key Catalysts: Expansion of DeFi ecosystem partnerships, improvement in token utility within platform protocols, increased community engagement, and potential technological upgrades that enhance transaction efficiency and user experience.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.6276 - $1.0485 (assuming continued market maturation and moderate adoption of blockchain technology across mainstream applications)

- Optimistic Scenario: $1.0486 - $1.0095 (assuming accelerated institutional investment and successful integration into major DeFi platforms)

- Transformative Scenario: Up to $1.0495 (extreme favorable conditions including regulatory clarity, mass adoption of decentralized finance, and DEGO becoming a cornerstone asset within its ecosystem)

- 2025-12-22: DEGO trading range demonstrates baseline stabilization at current market valuation levels

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.6549 | 0.4425 | 0.4248 | 0 |

| 2026 | 0.57614 | 0.5487 | 0.36214 | 24 |

| 2027 | 0.79863 | 0.56242 | 0.30371 | 27 |

| 2028 | 0.79621 | 0.68053 | 0.48998 | 54 |

| 2029 | 1.04849 | 0.73837 | 0.62761 | 67 |

| 2030 | 1.00957 | 0.89343 | 0.56286 | 102 |

DEGO Finance Investment Strategy and Risk Management Report

I. Executive Overview

DEGO is a cross-chain NFT+DeFi protocol and infrastructure that operates as an open NFT ecosystem. As of December 22, 2025, DEGO is trading at $0.4408 with a market capitalization of $9.26 million and a circulating supply of 21 million tokens. The token has experienced significant volatility, declining 85.11% over the past year from its all-time high of $33.41 in March 2021.

II. DEGO Token Fundamentals and Use Cases

Token Economics

- Current Price: $0.4408 (as of December 22, 2025)

- Market Capitalization: $9,256,800

- Circulating Supply: 21,000,000 DEGO

- Maximum Supply: 21,000,000 DEGO

- 24-Hour Volume: $20,502.92

- Token Holders: 1,139 addresses

Core Utility Functions

1. Platform Governance DEGO token holders participate in voting on platform parameters and strategic decisions that guide the project's operational direction and development priorities.

2. NFT Ecosystem Incentives DEGO tokens are allocated to reward user participation in bounty programs, referral campaigns, and other ecosystem engagement initiatives.

3. NFT Operations DEGO tokens are utilized for NFT minting, collateralization, auction participation, and marketplace transactions within the DEGO ecosystem.

4. Value Capture Mechanism Trading fees on DEGO tokens contribute to a revenue pool, creating a value capture mechanism for token holders.

Platform Infrastructure Features

NFT Foundry Enables users to create NFTs with unique attributes and rarity levels. Users can lock ERC-20 or BEP-20 tokens within NFTs, providing intrinsic value to DEGO NFT assets.

NFT Mining Allows users to stake NFTs and earn mining rewards as incentives for participation.

Auction System DEGO NFTs are auctioned using a FOMO3D-style mechanism designed to maximize user engagement and distribute rewards equitably to participants.

NFT Marketplace (Treasureland) Provides a dedicated trading platform where users can buy, sell, and exchange DEGO NFTs.

ScanDrop dApp Enables users to participate in NFT airdrops through QR code scanning mechanisms.

III. Market Performance Analysis

Price Trends and Volatility

- 1-Hour Change: -1.28%

- 24-Hour Change: -2.96%

- 7-Day Change: -5.33%

- 30-Day Change: -27.81%

- 1-Year Change: -85.11%

Historical Price Levels

- All-Time High: $33.41 (March 14, 2021)

- All-Time Low: $0.216349 (October 11, 2025)

- 24-Hour High: $0.4615

- 24-Hour Low: $0.4393

Market Position

DEGO ranks #1,214 by market capitalization among cryptocurrencies, with a market dominance of 0.00028%. The token is listed on 15 exchanges globally.

IV. DEGO Professional Investment Strategy and Risk Management

DEGO Investment Methodology

(1) Long-Term Holding Strategy

-

Suitable Investors: NFT and DeFi ecosystem believers, project developers, community members committed to cross-chain infrastructure development

-

Operational Recommendations:

- Accumulate DEGO tokens during periods of high volatility when prices approach support levels

- Participate in governance voting to influence platform development direction and secure voting rewards

- Engage with NFT minting and mining activities to generate additional yield alongside token holdings

-

Storage Approach: Utilize Gate.com's Web3 wallet for secure token storage with direct access to staking and governance participation features

(2) Active Trading Strategy

Given DEGO's high volatility and low daily trading volume ($20,502.92), active trading strategies should be approached cautiously:

-

Technical Analysis Considerations:

- Support/Resistance Levels: Monitor key price points at $0.35-$0.45 range for potential reversal patterns

- Volume Analysis: Track trading volume spikes as indicators of institutional or significant trader interest

-

Wave Trading Key Points:

- Execute trades during 2-4 hour windows when volatile price movements are most pronounced

- Set strict stop-loss orders at 10-15% below entry prices to manage downside risk

- Limit position sizing to 2-5% of total portfolio due to low liquidity conditions

DEGO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-2% of total crypto portfolio in DEGO due to high volatility and speculative nature

- Active Investors: 2-5% of total crypto portfolio, with hedging mechanisms in place

- Professional Investors: 5-10% of specialized NFT/DeFi-focused portfolios, with sophisticated risk management protocols

(2) Risk Hedging Approaches

- Portfolio Diversification: Combine DEGO holdings with stablecoins and established large-cap cryptocurrencies to reduce overall portfolio volatility

- Position Sizing: Maintain positions small enough that maximum drawdown scenarios do not exceed individual risk tolerance thresholds

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com's Web3 wallet provides convenient access for frequent trading and governance participation while maintaining reasonable security standards

- Cold Storage Protocol: Transfer large DEGO holdings to hardware wallets during extended holding periods to minimize exposure to exchange-based risks

- Security Considerations:

- Enable two-factor authentication on all exchange accounts

- Never share private keys or seed phrases

- Verify smart contract addresses before any token transactions

- Use hardware wallets for holdings exceeding personal risk thresholds

V. DEGO Potential Risks and Challenges

Market Risks

- Extreme Volatility: DEGO has experienced an 85.11% decline over one year and a 27.81% decline over 30 days, indicating significant price instability that can result in substantial losses

- Liquidity Constraints: Daily trading volume of approximately $20,500 is insufficient to support large position entries or exits without substantial price impact

- Market Concentration: With only 1,139 token holders, the distribution is highly concentrated, creating vulnerability to large holders manipulating prices

Regulatory Risks

- NFT Market Uncertainty: Regulatory frameworks governing NFT creation, trading, and taxation remain undefined in many jurisdictions

- Cross-Chain Compliance: Operating across multiple blockchain networks (Ethereum, Binance Smart Chain) introduces jurisdictional complexity and regulatory exposure

- Token Classification Risk: Regulatory authorities may reclassify DEGO as a security, triggering compliance requirements and potential trading restrictions

Technical Risks

- Parallel Chain Development: The project's reliance on Substrate-based parallel chain development for cross-chain NFT transfers introduces execution risk

- Smart Contract Vulnerability: NFT minting, staking, and auction mechanisms depend on smart contract security; any vulnerabilities could result in asset loss

- Ecosystem Adoption: Platform viability depends on sustained user growth and developer participation; declining interest could render the protocol economically unviable

VI. Conclusion and Action Recommendations

DEGO Investment Value Assessment

DEGO represents a specialized play on cross-chain NFT infrastructure with governance and yield-generation opportunities. However, the project faces significant headwinds including extreme price depreciation (down 85% annually), concentrated token distribution, limited daily liquidity, and uncertain regulatory treatment of NFT-based assets. The 100% circulating supply-to-maximum supply ratio indicates no future dilution mechanics.

The protocol's technical innovation in cross-chain NFT transfers and embedded value mechanisms through ERC-20/BEP-20 token locking presents long-term potential. However, this potential is offset by current market realities of low adoption, minimal trading activity, and substantial near-term downward price momentum.

DEGO Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% of crypto portfolio) only after thoroughly understanding NFT mechanics and DeFi protocols. Use this as a learning opportunity rather than capital appreciation strategy. Begin with gate.com's Web3 wallet to explore governance participation without excessive capital commitment.

✅ Experienced Investors: Consider 2-5% portfolio allocation if maintaining a dedicated NFT/DeFi sector focus. Employ strict position sizing and stop-loss discipline given volatility metrics. Actively engage with governance and mining mechanisms to generate yield offsetting holding risks.

✅ Institutional Investors: Reserve allocation for specialized NFT infrastructure funds only. Conduct comprehensive smart contract audits and regulatory analysis before position establishment. Implement sophisticated risk management including derivatives hedging and multi-signature custody arrangements.

DEGO Trading Participation Methods

- Gate.com Trading: Access DEGO trading pairs with competitive fees and professional trading interfaces designed for cryptocurrency market participants

- Governance Participation: Lock DEGO tokens to vote on platform upgrades and parameter adjustments, potentially earning governance rewards

- NFT Ecosystem Engagement: Participate in NFT minting, staking, and trading activities on the DEGO platform to generate additional yields beyond token appreciation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consult professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Why is Dego Finance falling?

Dego Finance is experiencing price decline due to market volatility and broader cryptocurrency market trends. The decline reflects typical crypto market dynamics influenced by overall sentiment and trading activity fluctuations.

What is the price of Dego today?

The price of Dego today is $0.4462 with a 24-hour trading volume of $1,439,638. The price has declined by 2.82% in the last day.

What is DEGO Finance and what is its use case?

DEGO Finance is a governance token enabling holders to participate in platform decision-making through voting. Its primary use case involves governing platform changes, allowing token holders to influence the protocol's development and operational directions.

What factors influence DEGO token price movements?

DEGO token price is primarily driven by supply and demand dynamics, market sentiment, trading volume, protocol updates, and network developments such as block reward halvings and hard forks.

What is the price prediction for DEGO in 2025?

Based on technical analysis, DEGO's predicted price for 2025 is approximately $5.04. This projection reflects market trends and historical data patterns through the end of the year.

2025 DEGO Price Prediction: Analyzing Potential Growth and Market Trends for the DeFi Governance Token

Will Crypto Recover in 2025?

2025 DYDX Price Prediction: Evaluating Growth Potential and Market Factors for the Leading Derivatives Exchange Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 1INCH Price Prediction: Will This DeFi Protocol Token Reach New Heights in the Decentralized Exchange Market?

2025 CETUS Price Prediction: Analyzing Growth Potential and Market Factors in the Evolving DeFi Landscape

Understanding QNT Token: Its Current Value and Real-World Applications

How to Acquire Vesper (VSP) Tokens: A Comprehensive Guide

PAPARAZZI vs OP: The Ultimate Showdown Between Celebrity Photography and Original Content Creation

Simple Guide to Buying I-COIN (ICN) in Italy Securely

Exploring the World of Web3 and Blockchain Technology