2025 CRTSPrice Prediction: Analyzing Market Trends and Future Valuation for CRTS Tokens in the Evolving Cryptocurrency Landscape

Introduction: CRTS Market Position and Investment Value

Cratos (CRTS), as a vote-to-earn (v2e) cryptocurrency designed for real-time live voting platforms, has been making strides since its inception in 2021. As of 2025, Cratos has a market capitalization of $11,238,403, with a circulating supply of approximately 63,529,696,688 tokens, and a price hovering around $0.0001769. This asset, known as the "democracy token," is playing an increasingly crucial role in promoting citizen participation in mobile voting applications.

This article will comprehensively analyze Cratos' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide professional price predictions and practical investment strategies for investors.

I. CRTS Price History Review and Current Market Status

CRTS Historical Price Evolution

- 2021: Initial launch, price reached all-time high of $0.00747511 on December 24

- 2022: Market downturn, price dropped to all-time low of $0.00013742 on December 3

- 2025: Gradual recovery, price fluctuating around $0.0001769

CRTS Current Market Situation

As of October 8, 2025, CRTS is trading at $0.0001769. The token has experienced a 3.86% decrease in the past 24 hours and a 7.48% decline over the last 30 days. However, it has shown a slight recovery of 0.33% in the past week. The current market capitalization stands at $11,238,403, ranking CRTS at 1359 in the global cryptocurrency market. With a circulating supply of 63,529,696,688 CRTS tokens, representing 63.53% of the total supply, the project has a fully diluted valuation of $17,690,000. The trading volume in the last 24 hours reached $23,837.61, indicating moderate market activity.

Click to view the current CRTS market price

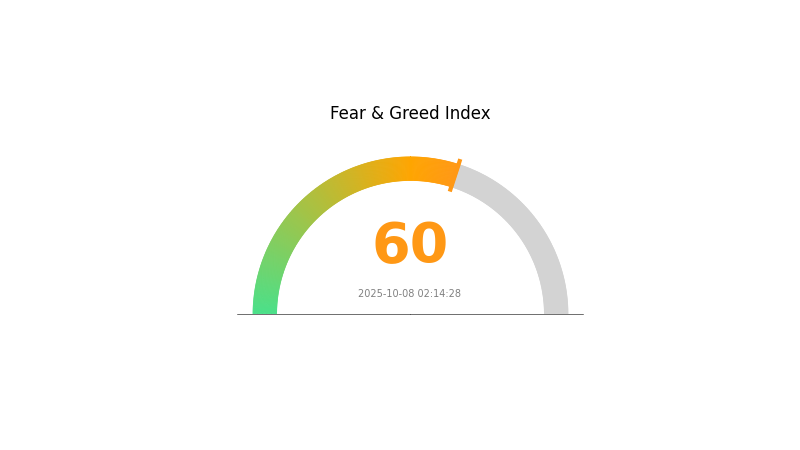

CRTS Market Sentiment Indicator

2025-10-08 Fear and Greed Index: 60 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 60. This suggests that investors are becoming increasingly optimistic about the market's potential. However, it's important to remember that excessive greed can lead to overvaluation and potential market corrections. Traders should exercise caution and consider diversifying their portfolios to mitigate risks. As always, thorough research and risk management are crucial when making investment decisions in the volatile crypto market.

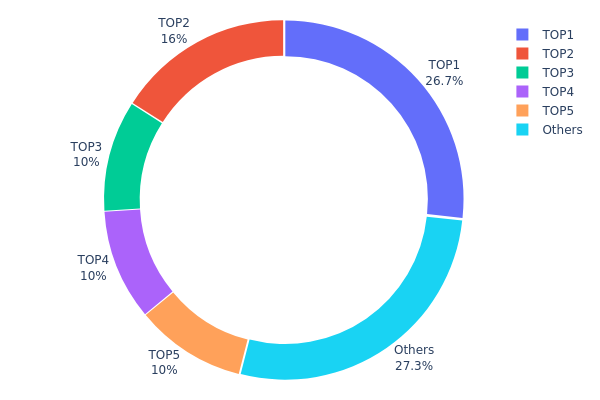

CRTS Holdings Distribution

The address holdings distribution data provides critical insights into the concentration of CRTS tokens among various wallet addresses. Analysis of this data reveals a highly concentrated distribution pattern, with the top 5 addresses controlling 72.71% of the total supply. The largest holder alone possesses 26.71% of all CRTS tokens, followed by four addresses each holding 10-16% of the supply.

This level of concentration raises concerns about market centralization and potential price manipulation. With such a significant portion of tokens held by a small number of addresses, there's an increased risk of large-scale sell-offs or coordinated actions that could dramatically impact CRTS's market price and liquidity. The high concentration also suggests a lower degree of decentralization, which may be at odds with the principles of many blockchain projects.

Despite these concerns, it's worth noting that 27.29% of tokens are distributed among other addresses, indicating some level of broader market participation. However, the overall structure points to a market that may be vulnerable to volatility and susceptible to the actions of a few major token holders.

Click to view the current CRTS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa82b...be993b | 26711766.31K | 26.71% |

| 2 | 0xe891...eb5bbb | 16000000.00K | 16.00% |

| 3 | 0x61ad...ae0a46 | 10000000.00K | 10.00% |

| 4 | 0xdfa3...9fc360 | 10000000.00K | 10.00% |

| 5 | 0x7454...5c275f | 10000000.00K | 10.00% |

| - | Others | 27288233.69K | 27.29% |

II. Key Factors Influencing the Future Price of CRTS

Supply Mechanism

- Market Supply and Demand: The basic principle of supply and demand plays a crucial role in determining CRTS price.

- Historical Pattern: Limited supply coupled with increased demand tends to drive prices up, while an excess of sellers over buyers can lead to sharp price declines.

- Current Impact: The interaction between supply and demand is influenced by factors such as total supply, mining or creation rate of new coins, and market events triggering sudden buying or selling surges.

Institutional and Whale Dynamics

- Corporate Adoption: Adoption of CRTS by well-known enterprises could significantly impact its price.

- National Policies: Government-level policies related to cryptocurrencies can have a substantial effect on CRTS price.

Macroeconomic Environment

- Monetary Policy Impact: Policies of major central banks are expected to influence CRTS price.

- Inflation Hedging Properties: CRTS performance in inflationary environments could affect its price.

- Geopolitical Factors: International situations may impact CRTS price.

Technological Development and Ecosystem Building

- Blockchain Protocol Upgrades: Upgrades to existing blockchain protocols can improve efficiency and potentially drive CRTS price.

- Ecosystem Applications: Development of major DApps and ecosystem projects could influence CRTS price.

III. CRTS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00015 - $0.00018

- Neutral forecast: $0.00018 - $0.00022

- Optimistic forecast: $0.00022 - $0.00026 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2026: $0.00013 - $0.00032

- 2027: $0.00020 - $0.00032

- Key catalysts: Project milestones, market recovery, and increased utility of CRTS

2028-2030 Long-term Outlook

- Base scenario: $0.00029 - $0.00037 (assuming steady market growth and project development)

- Optimistic scenario: $0.00037 - $0.00042 (with strong market performance and widespread adoption)

- Transformative scenario: $0.00042 - $0.00049 (with groundbreaking developments and mainstream acceptance)

- 2030-12-31: CRTS $0.00049 (potential peak price for the period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00026 | 0.00018 | 0.00015 | 0 |

| 2026 | 0.00032 | 0.00022 | 0.00013 | 23 |

| 2027 | 0.00032 | 0.00027 | 0.0002 | 50 |

| 2028 | 0.00042 | 0.00029 | 0.00025 | 65 |

| 2029 | 0.00039 | 0.00036 | 0.00026 | 102 |

| 2030 | 0.00049 | 0.00037 | 0.00031 | 110 |

IV. CRTS Professional Investment Strategies and Risk Management

CRTS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operation suggestions:

- Accumulate CRTS tokens during market dips

- Set price targets and review periodically

- Store tokens in secure wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor voting activity on the Cratos platform

- Track overall market sentiment in the cryptocurrency sector

CRTS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Plans

- Portfolio diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Cratos wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for CRTS

CRTS Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Liquidity: Limited trading volume may impact price stability

- Competition: Other voting-based tokens may emerge

CRTS Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations vary by country

- Compliance issues: Potential challenges with vote-to-earn models

- Tax implications: Evolving tax laws for cryptocurrency earnings

CRTS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability: Ability to handle increased user activity

- Network congestion: Ethereum network limitations may affect transactions

VI. Conclusion and Action Recommendations

CRTS Investment Value Assessment

Cratos (CRTS) offers a unique value proposition in the vote-to-earn space, but faces significant short-term volatility and regulatory uncertainties. Long-term potential depends on user adoption and platform development.

CRTS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the platform ✅ Experienced investors: Consider dollar-cost averaging, monitor voting trends ✅ Institutional investors: Conduct thorough due diligence, assess regulatory landscape

CRTS Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Staking: Participate in staking programs if offered by the Cratos platform

- Governance: Engage in voting activities to earn CRTS tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for TRX in 2025?

TRX is predicted to reach $0.40-$0.42 by October 2025, assuming a successful breakout above $0.37.

How much is the CRTS token?

As of October 2025, the CRTS token is priced at $0.0001756. It has traded between $0.000167 and $0.000188 in the last 24 hours.

What is the price prediction for Trac in 2030?

Based on current market analysis, the predicted price for Trac in 2030 is $0.623463, assuming a 27.63% growth rate.

What crypto has the highest price prediction?

Bitcoin (BTC) is predicted to have the highest price in 2025. It remains a top choice for investors, supported by its consistent trend.

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

2025 HTPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Huobi Token

2025 MTLPrice Prediction: Analyzing Future Growth Trends and Market Potential for Metal Token

2025 CHEQ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Cheqd Network Token

2025 VICEPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Media Giant

2025 TOMI Price Prediction: Market Analysis and Future Outlook for the Emerging Digital Asset

Magma Finance: Best DeFi DEX Platform for Low-Cost Decentralized Trading in 2024

Cross-Chain Interoperability Solutions: Circle and Axelar Lead Web3 Bridge Technology

What are the main security risks and smart contract vulnerabilities in AXL and Axelar Network?

MicroStrategy Bitcoin Investment Strategy: How MSTR Stock Became a Leading Bitcoin Concept Stock

Trump's American Bitcoin Treasury Strategy and US Crypto Policy Impact on Markets