2025 COMP Price Prediction: Navigating the Future of DeFi and Compound's Potential Growth

Introduction: COMP's Market Position and Investment Value

Compound (COMP), as a decentralized money market protocol built on the Ethereum blockchain, has achieved significant milestones since its inception in 2020. As of 2025, Compound's market capitalization has reached $313,216,450, with a circulating supply of approximately 9,640,395 tokens, and a price hovering around $32.49. This asset, often referred to as a "DeFi pioneer," is playing an increasingly crucial role in the decentralized finance (DeFi) sector.

This article will comprehensively analyze Compound's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. COMP Price History Review and Current Market Status

COMP Historical Price Evolution

- 2020: COMP launched in June, initial price around $244.5

- 2021: Reached all-time high of $910.54 on May 12

- 2025: Hit all-time low of $22.89 on October 11

COMP Current Market Situation

As of November 15, 2025, COMP is trading at $32.49. The 24-hour trading volume stands at $111,635.201. COMP has experienced a 1.12% decrease in the past 24 hours. The current market cap is $313,216,450, ranking COMP at 196th position in the overall cryptocurrency market.

COMP's price is down 4.73% in the past week and 8.05% over the last month. The year-to-date performance shows a significant decline of 29.53%. Despite the recent downturn, COMP is still trading 41.94% above its all-time low but remains 96.43% below its all-time high.

The circulating supply of COMP is 9,640,395.52 tokens, which represents 96.4% of the total supply of 10,000,000 COMP. The fully diluted market cap stands at $324,900,000.

Click to view the current COMP market price

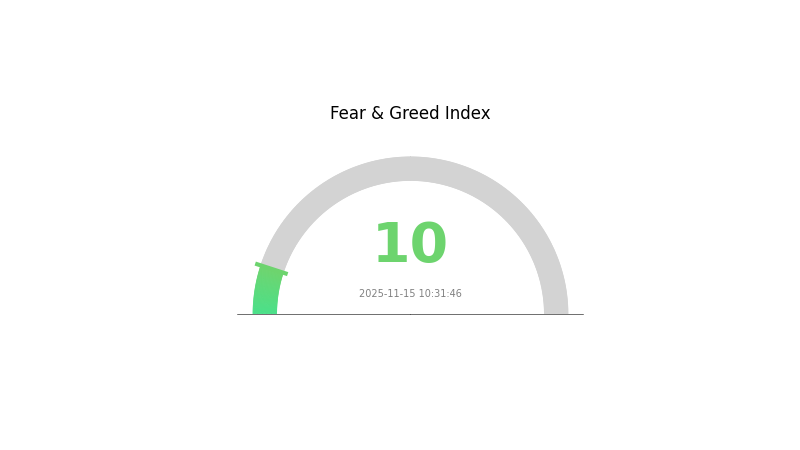

COMP Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the sentiment index plummeting to 10. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks. Gate.com offers a range of tools and resources to help you navigate these turbulent market conditions.

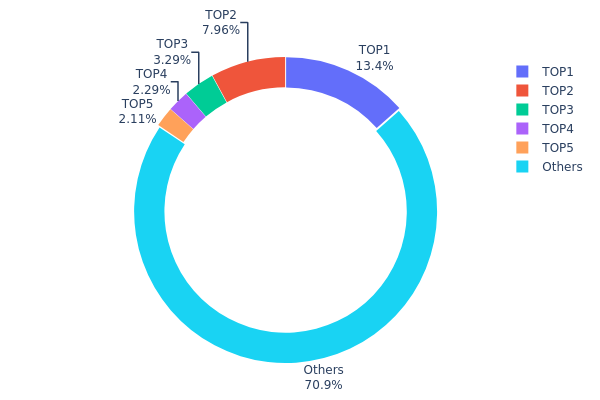

COMP Holdings Distribution

The address holdings distribution data for COMP reveals significant concentration among top holders. The largest address controls 13.43% of the total supply, with the top 5 addresses collectively holding 29.05% of COMP tokens. This level of concentration indicates a relatively centralized distribution, potentially impacting market dynamics.

Such concentration could lead to increased volatility and susceptibility to large-scale market movements. The top holders possess substantial influence over price action, potentially enabling market manipulation. However, with 70.95% of tokens distributed among other addresses, there's still a considerable degree of decentralization, mitigating some risks associated with excessive concentration.

This distribution pattern suggests a market structure where major players have significant sway, but widespread adoption exists. It reflects a balance between institutional involvement and retail participation, potentially contributing to COMP's market stability while maintaining liquidity and trading activity.

Click to view the current COMP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73af...54d935 | 1343.77K | 13.43% |

| 2 | 0xf977...41acec | 796.12K | 7.96% |

| 3 | 0x3d98...c9cd3b | 328.89K | 3.28% |

| 4 | 0x3bbd...3a1a8d | 228.70K | 2.28% |

| 5 | 0x0f50...c63c4e | 210.97K | 2.10% |

| - | Others | 7091.55K | 70.95% |

II. Key Factors Influencing COMP's Future Price

Supply Mechanism

- Fixed Supply: COMP has a fixed maximum supply of 10 million tokens.

- Historical Pattern: Limited supply has historically contributed to price stability and potential appreciation.

- Current Impact: The fixed supply continues to create scarcity, potentially supporting long-term price growth.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms and DeFi-focused funds hold significant COMP positions.

- Enterprise Adoption: Various DeFi protocols and lending platforms have integrated Compound's technology.

Macroeconomic Environment

- Inflation Hedging Properties: COMP, as part of the broader crypto market, may be seen as a potential hedge against inflation.

Technological Development and Ecosystem Building

- Compound Chain: Development of a standalone blockchain for cross-chain interest rate markets.

- Ecosystem Applications: Numerous DeFi applications built on top of Compound, including lending and borrowing platforms.

III. COMP Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $25.90 - $32.38

- Neutral forecast: $32.38 - $37.40

- Optimistic forecast: $37.40 - $42.42 (requires favorable market conditions and increased DeFi adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $34.08 - $56.80

- 2028: $33.74 - $73.10

- Key catalysts: DeFi sector expansion, technological improvements, and wider institutional adoption

2029-2030 Long-term Outlook

- Base scenario: $62.11 - $75.15 (assuming steady growth in the DeFi ecosystem)

- Optimistic scenario: $75.15 - $88.20 (with accelerated adoption and favorable regulatory environment)

- Transformative scenario: $88.20 - $108.97 (with breakthrough innovations and mainstream DeFi integration)

- 2030-12-31: COMP $108.97 (potential peak based on most optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 42.4178 | 32.38 | 25.904 | 0 |

| 2026 | 53.48043 | 37.3989 | 20.94338 | 15 |

| 2027 | 56.79958 | 45.43966 | 34.07975 | 40 |

| 2028 | 73.10106 | 51.11962 | 33.73895 | 57 |

| 2029 | 88.19668 | 62.11034 | 40.37172 | 91 |

| 2030 | 108.97 | 75.15351 | 49.60132 | 131 |

IV. COMP Professional Investment Strategies and Risk Management

COMP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate COMP during market dips

- Set price targets for partial profit-taking

- Store in secure wallets with regular security audits

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor COMP's correlation with broader crypto market trends

- Use stop-loss orders to manage downside risk

COMP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for COMP

COMP Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity risk: Potential difficulty in executing large trades without significant price impact

- Competitor risk: Emerging DeFi protocols may challenge Compound's market share

COMP Regulatory Risks

- Regulatory uncertainty: Changing global regulations may impact DeFi protocols

- Compliance challenges: Potential difficulties in adhering to evolving financial regulations

- Legal risks: Possibility of legal actions against DeFi protocols

COMP Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol's code

- Scalability issues: Challenges in handling increased transaction volume

- Oracle failures: Risks associated with price feed inaccuracies

VI. Conclusion and Action Recommendations

COMP Investment Value Assessment

COMP represents a significant player in the DeFi space with long-term potential, but faces short-term volatility and regulatory uncertainties.

COMP Investment Recommendations

✅ Beginners: Start with small positions, focus on learning DeFi mechanics ✅ Experienced investors: Consider COMP as part of a diversified DeFi portfolio ✅ Institutional investors: Explore COMP for DeFi exposure, implement robust risk management

COMP Participation Methods

- Direct purchase: Buy COMP tokens on Gate.com

- Yield farming: Participate in Compound's liquidity pools

- Governance: Engage in protocol governance with COMP tokens

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Will comp reach 1000?

While COMP has potential for growth, reaching $1000 is ambitious. It may hit this target in the long term if DeFi adoption surges and COMP's utility expands significantly.

How high can comp go?

COMP could potentially reach $500-$600 by 2026, driven by DeFi growth and increased adoption of the Compound protocol.

Will comp ever recover?

Yes, COMP is likely to recover. As the DeFi sector grows, COMP's role in lending and borrowing should drive its value up in the long term.

What crypto will skyrocket in 2025?

Ethereum (ETH) is likely to skyrocket in 2025 due to its upcoming upgrades, increased adoption, and growing DeFi ecosystem.

2025 UNI Price Prediction: Will Uniswap's Token Reach New Heights in the DeFi Boom?

Is IDEX (IDEX) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is Divergence Protocol (DIVER) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Outlook for 2024

Is TrustSwap (SWAP) a good investment?: A Comprehensive Analysis of Risk, Performance, and Market Potential for 2024

What Does “Liquidated” Actually Mean?

Will Crypto Recover in 2025?

Exploring Decentraland $MANA: A Top Metaverse Coin for Future Investment

What is UOS: A Comprehensive Guide to the Unified Operating System

What is POR: A Comprehensive Guide to Plan of Record in Project Management

What is KYVE: A Decentralized Data Validation and Archiving Protocol for Web3

Centralized Exchange Shutdown: Safe Choices for Investors