2025 BFC Price Prediction: Expert Analysis and Market Outlook for Bitcoin Future Coin

Introduction: Market Position and Investment Value of BFC

Bifrost (BFC) is a blockchain middleware that supports multi-chain technology, always making full use of the advantages of each protocol. Since its launch in 2020, it has established itself as a key infrastructure solution in the blockchain ecosystem. As of December 2025, BFC boasts a market capitalization of approximately $48.6 million, with a circulating supply of around 1.39 billion tokens, currently trading at $0.02052. This innovative asset is increasingly playing a critical role in enabling seamless cross-chain interoperability and multi-protocol integration.

This article will provide a comprehensive analysis of BFC's price trends from 2025 through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this emerging blockchain middleware solution.

I. BFC Price History Review and Current Market Status

BFC Historical Price Evolution

-

2021: Project launched on January 3, 2021, at an initial price of $0.01634183, marking the all-time low (ATL). The token subsequently experienced significant appreciation throughout the year, reaching its all-time high (ATH) of $0.778815 on August 19, 2021, representing an extraordinary gain of approximately 3,665% from launch.

-

2021-2025: Following the peak in August 2021, BFC entered a prolonged consolidation and decline phase. The token has experienced substantial downward pressure over the multi-year period, with the price depreciating significantly from its historical highs.

BFC Current Market Status

As of December 20, 2025, BFC is trading at $0.02052, reflecting a market capitalization of $28.55 million with a fully diluted valuation (FDV) of $48.60 million. The token maintains a circulating supply of approximately 1.39 billion BFC out of a total supply of 2.37 billion tokens, representing a circulation ratio of 58.74%.

The token exhibits modest negative momentum across multiple timeframes: declining 0.24% over the past hour, 0.53% over 24 hours, 0.77% over the past week, 10.10% over the past month, and 56.92% over the past year. The 24-hour trading volume stands at $11,526.10, with the token trading within a narrow range between $0.02047 and $0.02064.

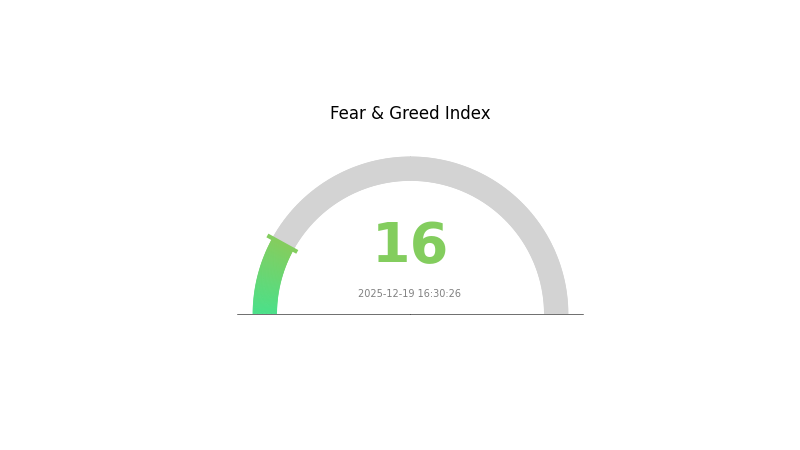

BFC maintains a market dominance of 0.0015%, ranking 719th by market capitalization. The project maintains an active ecosystem with 3,721 token holders and is listed on 4 exchanges. Market sentiment remains pessimistic, with the Crypto Fear & Greed Index reflecting "Extreme Fear" at a reading of 16.

Click to view current BFC market price

BFC Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index plummeting to 16. This indicates significant market pessimism and heightened anxiety among investors. During such periods, panic selling often dominates, and asset valuations may reach compelling levels for contrarian investors. However, extreme fear also signals elevated volatility and risk. Investors should exercise caution, conduct thorough research, and avoid emotional decision-making. Consider dollar-cost averaging strategies to mitigate timing risks. Professional traders often monitor such sentiment extremes as potential reversal signals.

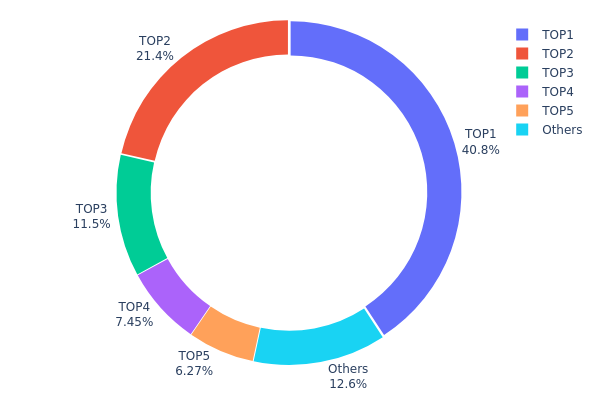

BFC Token Holdings Distribution

The address holdings distribution map illustrates the concentration of BFC tokens across the blockchain network by tracking the quantity and percentage of tokens held by individual wallet addresses. This metric serves as a critical indicator for assessing the decentralization level, market structure, and potential vulnerability of the token to price manipulation or coordinated selling pressures.

The current BFC holdings data reveals a notably concentrated distribution pattern. The top five addresses collectively control approximately 87.4% of the total token supply, with the leading address alone accounting for 40.78% of holdings. This level of concentration is substantial, indicating that the token's liquidity and price stability are heavily dependent on the actions of a small number of stakeholders. The second-largest holder maintains a 21.43% share, while the third through fifth positions hold 11.49%, 7.44%, and 6.26% respectively. The remaining addresses classified as "Others" account for only 12.6% of the supply, further emphasizing the pronounced concentration at the top tier.

This concentrated holdings structure presents notable implications for market dynamics and token sustainability. High concentration levels increase the risk of sudden price volatility, as major holders possess significant influence over token supply and demand. The dominance of the top address—potentially representing a burn address, team allocation, or major investor—warrants particular scrutiny. While such concentration may reflect legitimate tokenomics design or strategic governance structures, it simultaneously suggests limited decentralization and reduced resilience against potential large-scale liquidations. For investors and stakeholders, this distribution underscores the importance of monitoring the activities and intentions of major holders, as their decisions could substantially impact token valuation and market sentiment.

Click to view current BFC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 1631415.93K | 40.78% |

| 2 | 0x2f95...2aa535 | 857483.50K | 21.43% |

| 3 | 0x4d5a...c83206 | 459987.20K | 11.49% |

| 4 | 0x08d1...c031ca | 297936.99K | 7.44% |

| 5 | 0xfa24...a9247c | 250698.60K | 6.26% |

| - | Others | 502477.79K | 12.6% |

II. Core Factors Influencing BFC's Future Price

Regulatory Environment

- Regulatory Discussions: Ongoing regulatory discussions in the cryptocurrency market are shaping investor sentiment and asset valuations. Changes in regulatory frameworks represent a key factor that could influence BFC's price trajectory.

Macroeconomic Environment

-

Monetary Policy Impact: Economic growth, inflation rates, and interest rate adjustments represent significant macroeconomic factors affecting market movements. Strong economic growth typically influences cryptocurrency market performance.

-

Market Sentiment and Valuation: Investor sentiment and market valuation assessments play crucial roles in determining BFC's price. Market participants' perception of future prospects directly impacts asset pricing.

-

Scarcity and Market Prospects: Scarcity factors and the overall market outlook for the asset serve as key drivers for price movements. The perceived future potential of BFC within the cryptocurrency ecosystem influences investment demand.

Technology Development and Ecosystem

- Technical Progress: Ongoing technological advancements in the cryptocurrency market contribute to the evolving landscape. Technical improvements and protocol enhancements support the broader ecosystem development for projects like BFC.

Three、2025-2030 BFC Price Forecast

2025 Outlook

- Conservative Forecast: $0.0197 - $0.02052

- Neutral Forecast: $0.02052

- Optimistic Forecast: $0.02791 (requires sustained market stability and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecasts:

- 2026: $0.01671 - $0.03027

- 2027: $0.02343 - $0.03487

- 2028: $0.01863 - $0.03385

- Key Catalysts: Increased institutional adoption, protocol upgrades, improved market liquidity on platforms like Gate.com, and broader cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base Case: $0.02077 - $0.04024 (assumes continued moderate growth with normal market cycles)

- Optimistic Case: $0.0378 - $0.04024 (assumes accelerated adoption and positive macroeconomic conditions)

- Transformational Case: $0.03635+ (assumes breakthrough technological developments, significant ecosystem expansion, and mainstream market penetration)

- 2030-12-20: BFC trading near $0.0378 (representing 77% cumulative growth from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02791 | 0.02052 | 0.0197 | 0 |

| 2026 | 0.03027 | 0.02421 | 0.01671 | 18 |

| 2027 | 0.03487 | 0.02724 | 0.02343 | 32 |

| 2028 | 0.03385 | 0.03105 | 0.01863 | 51 |

| 2029 | 0.04024 | 0.03245 | 0.02077 | 58 |

| 2030 | 0.0378 | 0.03635 | 0.02471 | 77 |

Bifrost (BFC) Professional Investment Strategy and Risk Management Report

IV. BFC Professional Investment Strategy and Risk Management

BFC Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Institutional investors, long-term believers in blockchain interoperability solutions, and risk-averse retail investors seeking exposure to middleware infrastructure.

-

Operational Recommendations:

- Establish a core position during market downturns when BFC trades near historical support levels ($0.01634183).

- Implement dollar-cost averaging (DCA) over 6-12 month periods to reduce timing risk and average entry costs.

- Maintain positions through market volatility cycles, leveraging the current 58.74% circulating-to-fully-diluted supply ratio.

(2) Active Trading Strategy

-

Technical Analysis Approach:

- Monitor 24-hour volatility bands: Current range between $0.02047-$0.02064 provides short-term support/resistance levels.

- Utilize volume analysis on the $11,526.10 daily trading volume to identify breakout opportunities.

-

Wave Trading Key Points:

- Take profit opportunities when price approaches the 24-hour high of $0.02064.

- Consider accumulation when price touches the 24-hour low of $0.02047.

- Monitor the historical all-time high of $0.778815 (August 19, 2021) as a long-term resistance reference point.

BFC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, focusing on dollar-cost averaging entries only.

- Aggressive Investors: 3-5% portfolio allocation, with tactical rebalancing on price movements exceeding ±3% in 24-hour periods.

- Professional Investors: 5-10% allocation within diversified middleware and infrastructure-focused cryptocurrency portfolios.

(2) Risk Hedging Solutions

- Volatility Protection: Maintain cash reserves equivalent to 20-30% of BFC position to capitalize on price dips and execute rebalancing strategies.

- Portfolio Diversification: Combine BFC holdings with other blockchain infrastructure tokens to reduce single-asset concentration risk, given BFC's 56.92% annual decline.

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 wallet for active trading and frequent transactions, with recommended security settings including withdrawal whitelisting and two-factor authentication.

- Cold Storage Approach: Transfer long-term holdings to hardware wallets or secure custodial solutions for positions exceeding $10,000 USD value.

- Security Precautions: Enable multi-signature authorization for withdrawals, maintain separate private key backups offline, and never share seed phrases or private keys with third parties.

V. Potential Risks and Challenges for BFC

BFC Market Risks

- Severe Price Depreciation: BFC has declined 56.92% over the past 12 months, indicating sustained downward pressure and potential loss of investor confidence in the project.

- Limited Market Liquidity: Daily trading volume of $11,526.10 is relatively modest, creating potential slippage risks for larger position entries or exits.

- Low Market Dominance: With only 0.0015% market share and market cap ranking #719, BFC faces intense competition from established middleware and interoperability solutions.

BFC Regulatory Risks

- Evolving Compliance Framework: Blockchain middleware protocols face increasing scrutiny from global regulators regarding cross-chain transactions and token transfer mechanisms.

- Jurisdictional Uncertainty: Changes in cryptocurrency regulations across major markets could impact BFC's adoption and platform accessibility.

- Smart Contract Regulation: Future regulatory requirements for token contracts on Ethereum may impose compliance costs affecting project viability.

BFC Technology Risks

- Smart Contract Vulnerabilities: As an Ethereum-based token, BFC remains exposed to potential vulnerabilities within the contract code deployed at 0x0c7d5ae016f806603cb1782bea29ac69471cab9c.

- Multi-Chain Execution Risk: Bifrost's core middleware functionality carrying transaction data across multiple protocols introduces technical complexity and potential failure points.

- Competing Solutions: Established interoperability protocols and emerging middleware technologies may render BFC's technical approach obsolete.

VI. Conclusions and Action Recommendations

BFC Investment Value Assessment

Bifrost presents a specialized investment opportunity within the blockchain middleware sector, supporting multi-chain technology deployment. However, the project faces significant headwinds reflected in its 56.92% annual decline, limited market penetration (0.0015% dominance), and modest trading volumes. The current price of $0.02052 represents a 73.67% discount from the all-time high, potentially indicating either a compelling value opportunity or sustained rejection of the project's market utility. Long-term viability depends on successful Bifrost protocol adoption across multiple blockchain ecosystems and demonstrated advantages over alternative middleware solutions.

BFC Investment Recommendations

✅ Beginners: Start with minimal allocations (under 1% portfolio weight) using dollar-cost averaging strategies on Gate.com, focusing on 12-month holding periods rather than active trading.

✅ Experienced Investors: Consider 2-5% tactical allocations during oversold conditions (price approaching $0.01634183 historical low), combining with established middleware portfolio components.

✅ Institutional Investors: Evaluate 5-10% infrastructure portfolio weighting only after conducting comprehensive due diligence on Bifrost protocol adoption metrics, developer activity, and competitive positioning within the interoperability landscape.

BFC Trading Participation Methods

- Spot Trading: Purchase and hold BFC directly on Gate.com using limit orders near identified support levels to optimize entry prices.

- Dollar-Cost Averaging: Execute fixed-value purchases (e.g., $50-$200) at regular monthly intervals to systematically build positions while reducing market timing risk.

- Portfolio Rebalancing: Utilize BFC price volatility to maintain target allocation percentages, selling during rallies above $0.02100 and accumulating during declines below $0.02000.

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

What is the future potential of BFIC coin?

BFIC Coin shows strong future potential with projected growth trajectory. Based on market analysis, BFIC is expected to reach $0.4458891 by 2026. The token's potential is driven by increasing adoption and positive market trends in the crypto sector.

What factors influence BFC coin price movements?

BFC coin price is influenced by market sentiment, trading volume, news events, and overall crypto market conditions. Regulatory announcements, technological developments, and macroeconomic factors also significantly impact price fluctuations.

What is the expected price range for BFC in 2025?

BFC is expected to trade between $0.01737 and $0.02141 in 2025. If it reaches the upper target of $0.02141, it could rise by 5.82% based on current market predictions.

What are the risks and uncertainties in BFC price prediction?

BFC price prediction faces several key uncertainties: high market volatility causing rapid price fluctuations, limited liquidity affecting trade execution, regulatory changes in crypto markets, and unpredictable macroeconomic factors. Additionally, project developments, competitive dynamics, and sentiment shifts create prediction challenges.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Starting Bitcoin: Introducing It on Social Media

2025 Token Unlock Timeline: Key Dates to Know

Optimal Times to Minimize Ethereum Transaction Fees

Maximizing Gains: Effective Strategies for Profitable Flash Loans in DeFi

Guide to Participating in Wormhole Airdrop and Claiming Rewards