2025 ARB Price Prediction: Analyzing Future Trends, Market Factors, and Growth Potential for Arbitrum's Native Token

Introduction: ARB's Market Position and Investment Value

Arbitrum (ARB), as a leading Ethereum scaling solution, has achieved significant milestones since its inception in 2023. As of 2025, Arbitrum's market capitalization has reached $2.67 billion, with a circulating supply of approximately 5.3 billion tokens, and a price hovering around $0.5047. This asset, often referred to as the "Layer 2 Efficiency Catalyst," is playing an increasingly crucial role in enhancing Ethereum's scalability and reducing transaction costs.

This article will provide a comprehensive analysis of Arbitrum's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. ARB Price History Review and Current Market Status

ARB Historical Price Evolution

- 2023: ARB token launched, price reached all-time high of $4.00 on March 23

- 2024: Market consolidation, price fluctuated between $0.50 and $1.50

- 2025: Bearish trend, price dropped to all-time low of $0.2422 on April 7

ARB Current Market Situation

As of September 10, 2025, ARB is trading at $0.5047, with a 24-hour trading volume of $7,413,038. The token has experienced a 5.78% decrease in the last 24 hours. ARB's market cap stands at $2,672,780,194, ranking it 56th in the overall cryptocurrency market. The circulating supply is 5,295,780,056 ARB, with a total supply of 10,000,000,000 ARB. Despite the recent price decline, ARB has shown positive momentum over the past 30 days, with a 9.4% increase. However, the token is still down 3.55% compared to its price one year ago. The current market sentiment for ARB appears to be neutral, with the token trading above its recent all-time low but still significantly below its all-time high.

Click to view the current ARB market price

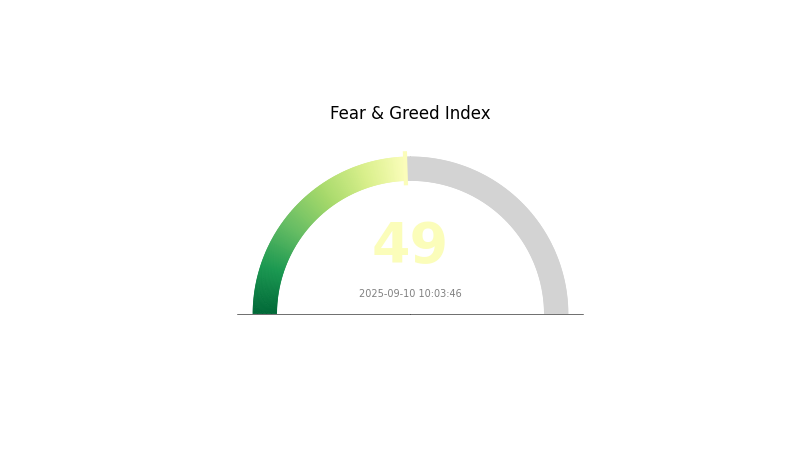

ARB Market Sentiment Indicator

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 49, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. Traders should remain cautious and consider both potential risks and opportunities. As always, it's crucial to conduct thorough research and manage your risk appropriately before making any investment decisions in the volatile crypto market.

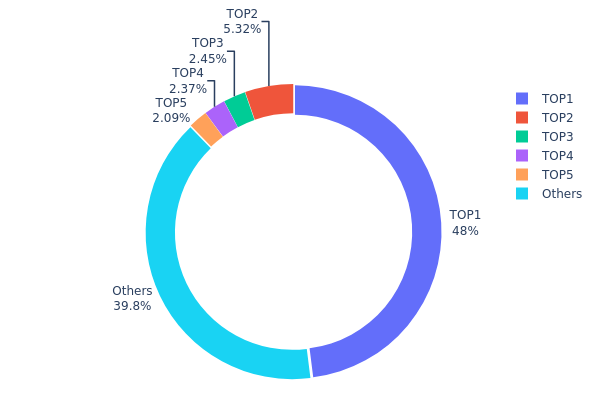

ARB Holdings Distribution

The address holdings distribution data reveals a significant concentration of ARB tokens. The top address holds 48.01% of the total supply, amounting to 94,264.43K tokens. This level of concentration is noteworthy and could potentially impact market dynamics. The subsequent four largest holders collectively account for an additional 12.2% of the supply, with individual holdings ranging from 2.08% to 5.31%.

Such a concentrated distribution raises concerns about centralization and potential market manipulation. The dominant position of the top address could lead to increased volatility if large transactions occur. However, it's important to note that 39.79% of the tokens are distributed among numerous smaller holders, which provides some balance to the overall ecosystem. This distribution pattern suggests a moderate level of decentralization, albeit with a significant centralized component that warrants careful monitoring by market participants.

Click to view the current ARB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x611f...dfb09d | 94264.43K | 48.01% |

| 2 | 0x91d4...c8debe | 10440.53K | 5.31% |

| 3 | 0xb0a2...113d64 | 4815.50K | 2.45% |

| 4 | 0x0529...c553b7 | 4644.94K | 2.36% |

| 5 | 0xffa8...44cd54 | 4096.00K | 2.08% |

| - | Others | 78071.65K | 39.79% |

II. Key Factors Influencing ARB's Future Price

Supply Mechanism

- Token Distribution: Arbitrum has a total supply of 10 billion ARB tokens, with 5.29 billion currently in circulation.

- Historical Pattern: The gradual release of tokens has historically impacted price volatility.

- Current Impact: The remaining token supply may create selling pressure as they enter circulation.

Institutional and Whale Dynamics

- Institutional Holdings: Major venture capital firms like Polychain Capital and Pantera Capital have invested in Arbitrum.

- Corporate Adoption: Arbitrum's Layer 2 scaling solution has attracted numerous DApps and protocols.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions continue to influence crypto market sentiment.

- Inflation Hedging Properties: ARB's performance as an inflation hedge remains to be fully established.

Technical Development and Ecosystem Growth

- Ethereum Integration: Arbitrum's role as a leading Ethereum Layer 2 solution significantly impacts its value proposition.

- Ecosystem Applications: The platform hosts a growing number of DApps, particularly in DeFi and gaming sectors.

III. ARB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.48917 - $0.50430

- Neutral prediction: $0.50430 - $0.56734

- Optimistic prediction: $0.56734 - $0.63038 (requires favorable market conditions and increased Arbitrum adoption)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by gradual growth

- Price range forecast:

- 2027: $0.45018 - $0.68506

- 2028: $0.40125 - $0.98975

- Key catalysts: Ecosystem expansion, Layer 2 scaling solutions gaining traction, and improved interoperability

2029-2030 Long-term Outlook

- Base scenario: $0.82925 - $1.03241 (assuming steady growth in DeFi and Web3 applications)

- Optimistic scenario: $1.03241 - $1.23558 (with widespread Layer 2 adoption and increased institutional interest)

- Transformative scenario: $1.23558 - $1.47635 (with breakthrough technological advancements and mainstream acceptance)

- 2030-12-31: ARB $1.47635 (potential peak based on bullish projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.63038 | 0.5043 | 0.48917 | 0 |

| 2026 | 0.73754 | 0.56734 | 0.4255 | 12 |

| 2027 | 0.68506 | 0.65244 | 0.45018 | 29 |

| 2028 | 0.98975 | 0.66875 | 0.40125 | 32 |

| 2029 | 1.23558 | 0.82925 | 0.57218 | 64 |

| 2030 | 1.47635 | 1.03241 | 0.79496 | 104 |

IV. Professional ARB Investment Strategies and Risk Management

ARB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Ethereum scaling solutions

- Operation suggestions:

- Accumulate ARB during market dips

- Stake ARB tokens to participate in governance and earn rewards

- Store tokens in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Ethereum network upgrades and their impact on Arbitrum

ARB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Layer 2 solutions

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ARB

ARB Market Risks

- High volatility: ARB price can experience significant fluctuations

- Competition: Other Layer 2 solutions may gain market share

- Ethereum upgrades: Changes to Ethereum may impact Arbitrum's value proposition

ARB Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of Layer 2 solutions

- Compliance requirements: Future regulations may impact Arbitrum's operations

- Cross-border restrictions: International regulatory differences may limit adoption

ARB Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the Arbitrum network

- Scalability challenges: Unforeseen issues in handling increased transaction volume

- Interoperability concerns: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

ARB Investment Value Assessment

Arbitrum (ARB) presents a compelling long-term value proposition as a leading Ethereum scaling solution. However, short-term volatility and competition in the Layer 2 space pose significant risks.

ARB Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a balanced approach, combining holding and active trading strategies ✅ Institutional investors: Evaluate ARB as part of a diversified Layer 2 portfolio, focusing on long-term potential

ARB Trading Participation Methods

- Spot trading: Buy and sell ARB on Gate.com's spot market

- Staking: Participate in ARB staking programs for governance rights and potential rewards

- DeFi integration: Explore opportunities within the Arbitrum ecosystem using ARB tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Could ARB reach $100?

While possible in the long term, it's unlikely ARB will reach $100 soon. The current price is far below this target, making it a challenging goal in the near future.

How much will Arbitrum cost in 2030?

Based on current market trends and a projected 5% annual growth rate, Arbitrum is predicted to cost approximately $0.66 in 2030.

Is ARB a good long-term investment?

ARB shows promise for long-term growth. Predictions suggest potential price increases, with estimates reaching $2.40 by 2028. Consider its innovative technology and market adoption for investment decisions.

What is ARB's potential long-term value?

ARB's long-term value is significant due to Arbitrum's modular L2 platform, strong governance, and Ethereum integration. It supports multiple rollups and app-chains, enhancing scalability. The $2 billion treasury adds financial stability.

2025 ETH Price Prediction: Institutional Adoption and Layer 2 Scaling Solutions Could Drive Ethereum to New Heights

2025 ARB Price Prediction: Analyzing Market Trends and Potential Growth Factors for Arbitrum's Native Token

How does on-chain data analysis reveal Ethereum's market trends?

2025 BOBA Price Prediction: Analyzing Market Trends and Growth Potential in the Layer-2 Scaling Solution Ecosystem

2025 OP Price Prediction: Bullish Trends and Key Factors Driving Optimism's Future Value

How Does On-Chain Data Analysis Reveal Trends in Crypto Market Behavior?

Unlocking Hamsters' Potential in the Web3 Ecosystem

What is INC: A Comprehensive Guide to Understanding Incorporation and Its Business Benefits

Guide: Using a Secure Wallet for Tezos Blockchain Management

What is MASK: A Comprehensive Guide to Understanding Masking Techniques in Machine Learning

What is SOLO: A Comprehensive Guide to Self-Organized Learning Outcomes and Its Impact on Educational Assessment