2025 ALICE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ALICE

ALICE (ALICE), as the native functional token of My Neighbor Alice—a multiplayer farm game featuring blockchain-based NFT assets and decentralized ownership—has established itself as a unique player in the gaming and metaverse ecosystem since its launch in 2021. As of December 2025, ALICE's market capitalization has reached approximately $16.64 million, with a circulating supply of around 92.08 million tokens and a current price hovering near $0.1807. This asset, recognized for its innovative integration of gaming mechanics, community governance, and tokenized in-game economies, is playing an increasingly vital role in the intersection of gaming and blockchain technology.

This article will comprehensively analyze ALICE's price movements and market trends through 2030, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

ALICE Token Market Analysis Report

I. ALICE Price History Review and Market Status

ALICE Historical Price Evolution

- March 2021: Project launch and initial growth phase, price reached all-time high of $40.93 on March 15, 2021

- 2021-2024: Extended bear market cycle, price declined significantly from peak levels

- December 2025: Price reached all-time low of $0.17075 on December 19, 2025, representing a decline of approximately 99.58% from the historical peak

ALICE Current Market Situation

As of December 21, 2025, ALICE is trading at $0.1807, reflecting a 1.06% increase over the past 24 hours. The token demonstrated marginal upward momentum with hourly gains of 0.11%, though longer-term performance remains under pressure with a 7-day decline of 17.2%, 30-day decline of 21.54%, and 1-year decline of 83.55%.

The current market capitalization stands at approximately $16.64 million, with a fully diluted valuation of $18.07 million. Daily trading volume reached $74,907.47, indicating relatively modest liquidity. The circulating supply comprises 92,083,333 tokens out of a maximum supply of 100,000,000 tokens, representing 92.08% circulation ratio. The token maintains a market dominance of 0.00056% and ranks 933rd by market cap.

The 24-hour trading range shows a high of $0.1844 and low of $0.1788. The token is currently listed on 31 exchanges and held by 8,766 unique addresses, indicating a distributed but relatively modest holder base.

Click to view current ALICE market price

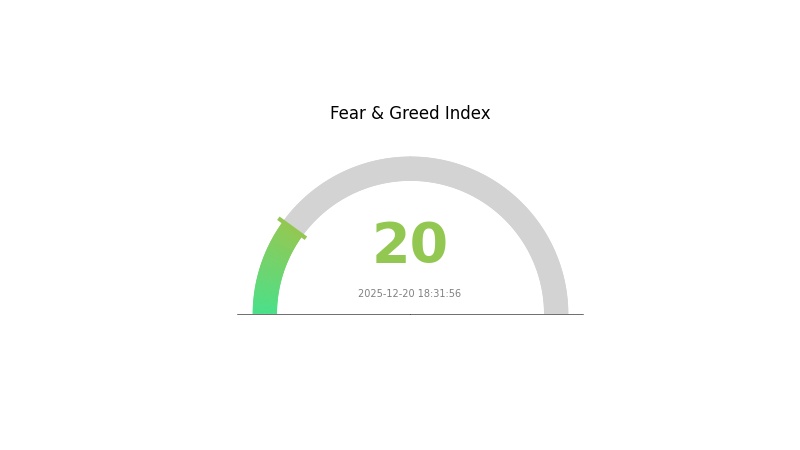

ALICE Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates widespread market pessimism and risk aversion among investors. During periods of extreme fear, panic selling often intensifies, creating significant downside pressure on asset prices. However, seasoned traders recognize that extreme fear can present contrarian opportunities. Those with strong conviction and adequate risk management may consider accumulating quality assets at depressed valuations. Monitor key support levels closely and ensure your portfolio is properly diversified. Trading in such volatile conditions requires disciplined position sizing and strict stop-loss management.

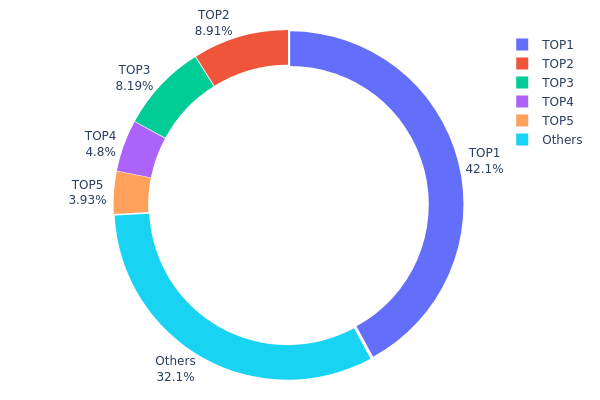

ALICE Holdings Distribution

The address holdings distribution map illustrates the concentration of ALICE tokens across different wallet addresses on the blockchain. This metric serves as a critical indicator for assessing token decentralization, market concentration risk, and the potential for price manipulation. By analyzing how tokens are distributed among top holders versus smaller participants, investors can evaluate the underlying health and resilience of the token's ecosystem.

ALICE demonstrates a notably concentrated holding structure, with the top five addresses controlling approximately 67.86% of the total token supply. The leading address (0xf977...41acec) alone commands 42.05% of all ALICE tokens, representing a substantial concentration point that warrants careful monitoring. While the remaining 32.14% of tokens are dispersed among other addresses, the extreme dominance of the top holder creates a significant imbalance in the distribution landscape. This level of concentration exceeds typical decentralization benchmarks and raises concerns about potential centralization risks inherent in the token's current structure.

The concentration pattern observed in ALICE's holdings distribution presents material implications for market dynamics and price stability. Such pronounced token concentration among a limited number of addresses elevates the risk of market manipulation and creates potential volatility triggers, as large-scale movements by top holders could substantially impact price discovery and market sentiment. Additionally, the heavy reliance on a few key addresses reduces the resilience of the token's on-chain ecosystem, as coordinated actions or unforeseen events affecting major holders could disproportionately influence overall market conditions. This distribution structure suggests that ALICE currently exhibits a relatively centralized on-chain configuration, indicating that decentralization enhancement through wider token distribution would strengthen the asset's market maturity and long-term stability.

View the current ALICE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 37761.91K | 42.05% |

| 2 | 0x5635...faca19 | 7997.65K | 8.90% |

| 3 | 0xf901...e16971 | 7353.35K | 8.18% |

| 4 | 0x44ae...f62ef5 | 4310.12K | 4.80% |

| 5 | 0xc80a...e92416 | 3531.16K | 3.93% |

| - | Others | 28830.67K | 32.14% |

II. Core Factors Affecting ALICE's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: US inflation data released in November 2025 showed CPI year-over-year at 2.7% and core CPI at 2.6%, both below market expectations, indicating significant easing of inflation pressure. The Federal Reserve faces policy flexibility as inflation risks decline, though rate cuts may be measured rather than aggressive. The Bank of Japan raised rates to 0.75%, the highest level since 1995, though maintaining an overall loose monetary environment with negative real rates. These divergent central bank policies create complex conditions for risk assets including cryptocurrencies.

-

Inflation Hedge Characteristics: In the current environment where inflation pressures are moderating but remain above target levels, ALICE's role as a potential hedge depends on whether deflationary or stagflationary conditions emerge. The divergence between US and Japanese monetary policies, combined with persistent geopolitical uncertainties, creates mixed signals for inflation expectations going forward.

-

Geopolitical Risk Factors: EU decisions regarding frozen Russian assets and ongoing geopolitical tensions introduce macroeconomic uncertainty. These factors can influence global risk sentiment and capital flows into alternative assets like cryptocurrencies, potentially affecting ALICE price volatility.

Market Sentiment and Risk Appetite

Overall market conditions are characterized by significant volatility and positioning risk. Large derivatives expiring (approximately $23 billion in options contracts) can amplify price movements. Market participants show conflicting signals, with institutional cash holdings at historical lows (3.9%) while simultaneously expressing concerns about asset bubble risks, particularly in technology sectors. Such compressed positioning increases the likelihood of sharp reversals that could impact cryptocurrency valuations broadly.

Market carries risk; investment requires caution. This content is for reference only and does not constitute personal investment advice.

III. 2025-2030 ALICE Price Forecast

2025 Outlook

- Conservative Forecast: $0.1487-$0.1813

- Base Case Forecast: $0.1813

- Optimistic Forecast: $0.2012 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth momentum as the project gains traction in the DeFi and gaming sectors.

- Price Range Predictions:

- 2026: $0.1492-$0.2276 (5% upside potential)

- 2027: $0.1906-$0.2534 (15% upside potential)

- Key Catalysts: Enhanced protocol functionality, expanded partnerships, growing user adoption in gaming and metaverse applications, and improved market sentiment toward Web3 projects.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.2250-$0.3009 (assumes steady ecosystem growth and moderate market expansion by 2028)

- Optimistic Scenario: $0.2661-$0.3087 (assumes accelerated adoption, successful platform upgrades, and broader crypto market recovery by 2029)

- Bull Case Scenario: $0.2271-$0.3564 (assumes breakthrough in mainstream adoption, significant venture capital inflows, and ALICE establishing itself as a leading gaming and metaverse asset by 2030)

- 2025-12-21: ALICE trading at baseline levels with 59% cumulative upside potential through 2030 under favorable market conditions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20124 | 0.1813 | 0.14867 | 0 |

| 2026 | 0.22761 | 0.19127 | 0.14919 | 5 |

| 2027 | 0.25343 | 0.20944 | 0.19059 | 15 |

| 2028 | 0.30086 | 0.23143 | 0.12497 | 28 |

| 2029 | 0.30873 | 0.26615 | 0.19961 | 47 |

| 2030 | 0.35643 | 0.28744 | 0.22708 | 59 |

ALICE Investment Strategy and Risk Management Report

IV. ALICE Professional Investment Strategy and Risk Management

ALICE Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: GameFi enthusiasts, NFT collectors, and passive income seekers

- Operational Recommendations:

- Accumulate ALICE tokens during market downturns, leveraging the current 83.55% year-over-year decline to build positions at historically low prices

- Participate in staking mechanisms to earn a percentage of platform revenue from land sales, asset sales, and trading fees

- Engage in governance activities by holding tokens for voting on platform development and operational decisions

(2) Active Trading Strategy

-

Market Analysis Focus:

- 24-hour price movements: Currently showing +1.06% positive momentum despite recent 30-day decline of -21.54%

- Weekly volatility tracking: Monitor the -17.2% 7-day performance for entry/exit signals

- Volume analysis: Current 24-hour trading volume of approximately $74,907 indicates moderate liquidity

-

Wave Trading Key Points:

- Identify support levels near the 52-week low of $0.17075 (established December 19, 2025)

- Recognize resistance at historical highs of $40.93 (established March 15, 2021) for long-term perspective

- Use daily price ranges ($0.1788-$0.1844) as micro-trading bands

ALICE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional/Speculative Investors: 8-15% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance ALICE holdings with stable gaming tokens and broader crypto exposure to mitigate project-specific risks

- Position Sizing: Implement strict stop-loss orders at 15-20% below purchase price to protect against sudden market corrections

(3) Secure Storage Solutions

- Recommended Approach: Utilize Gate.com's secure custody solutions for active trading positions, which provide institutional-grade security and convenient access

- Self-Custody Option: For long-term holdings, transfer ALICE tokens to personal Ethereum or BSC wallets after verification, ensuring private key management and backup protocols

- Security Precautions: Enable two-factor authentication on all exchange accounts, never share private keys, and maintain cold storage backups for significant holdings

V. ALICE Potential Risks and Challenges

ALICE Market Risk

- Extreme Volatility: The token has experienced an 83.55% decline over the past year, demonstrating susceptibility to severe market downturns and speculative pressures

- Low Trading Liquidity: With only $74,907 in 24-hour volume and a market cap of $16.6 million, ALICE exhibits limited liquidity that could magnify price swings during significant trades

- Concentration Risk: Gaming tokens face intense competition; player migration to competing GameFi platforms could reduce ALICE utility and demand

ALICE Regulatory Risk

- Gaming Compliance Uncertainty: Regulatory frameworks governing play-to-earn games and NFT gaming remain undefined in many jurisdictions, creating potential policy risks

- Geographic Restrictions: Future regulations in key gaming markets could prohibit or restrict ALICE token distribution, staking, or governance participation

- Securities Classification: If regulatory authorities classify ALICE governance functions as security-like instruments, compliance requirements could significantly increase operational costs

ALICE Technology Risk

- Smart Contract Vulnerability: As a blockchain-based token, ALICE depends on underlying smart contract security; historical exploits in gaming protocols demonstrate ongoing technical risks

- Platform Scalability: Game performance and user experience depend on blockchain network capacity; network congestion could impact gameplay and token utilization

- Ecosystem Dependency: ALICE's value is entirely dependent on My Neighbor Alice game adoption and usage; failure to maintain active player bases would severely impact token utility

VI. Conclusions and Action Recommendations

ALICE Investment Value Assessment

ALICE represents a speculative investment opportunity in the GameFi sector, combining elements of play-to-earn mechanics with governance tokenomics and NFT-based asset ownership. The token's dramatic 83.55% yearly decline reflects broader GameFi market challenges, including shifts in player sentiment, regulatory uncertainty, and competition from alternative gaming ecosystems. However, the project's integration of social features, decentralized asset ownership, and revenue-sharing mechanisms provides a distinct value proposition for engaged gaming communities. Investors should approach ALICE as a high-risk, high-reward asset suitable only for experienced participants with strong risk tolerance and diversified portfolios.

ALICE Investment Recommendations

✅ Beginners: Research the My Neighbor Alice gameplay mechanics and community engagement levels before purchasing small amounts. Consider using Gate.com's educational resources and gradual position building (dollar-cost averaging) over several months rather than lump-sum purchases.

✅ Experienced Investors: Implement disciplined technical analysis using price action patterns, volume profiles, and volatility metrics. Establish clear entry points near support levels ($0.17075) and predetermined exit strategies at resistance zones. Actively participate in governance to understand platform direction and long-term viability.

✅ Institutional Investors: Conduct comprehensive due diligence on player retention metrics, daily active users, and transaction volumes on the My Neighbor Alice platform. Evaluate team experience, development roadmap progress, and competitive positioning within the broader GameFi landscape before significant capital allocation.

ALICE Trading Participation Methods

- Exchange Trading: Execute spot trades on Gate.com with competitive trading pairs, leveraging the platform's advanced order types, real-time market data, and secure custody options

- Staking and Governance: Lock ALICE tokens in the project's staking mechanisms to earn platform revenue percentages while participating in decentralized governance decisions

- NFT Asset Integration: Acquire in-game NFT assets (islands, houses, pets) using ALICE tokens to participate directly in the My Neighbor Alice ecosystem and benefit from potential asset appreciation

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors should make careful decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making any investment decisions. Never invest more than you can afford to lose.

FAQ

What is the future of Alice Coin?

Alice Coin is projected to experience bearish momentum, with technical analysis forecasting a potential decline to $0.1624 by January 2026. Market indicators suggest ongoing downward pressure in the near term.

Why is Alice coin falling?

Alice coin is experiencing selling pressure and testing lower support levels. The broader GameFi sector is also facing similar downward trends currently.

What factors influence ALICE token price movements?

ALICE token price is primarily driven by user growth and game participation demand. Increased players boost token demand and price. Seasonal trends, market sentiment, and overall crypto market conditions also significantly impact price movements.

What is the current market cap and trading volume of ALICE?

As of 2025-12-20, ALICE's market cap is $20,683,795, with a 24-hour trading volume of $8,835,406.

How does ALICE compare to other similar tokens in the market?

ALICE ranks 181 by market cap among similar tokens. It demonstrates moderate price volatility with solid fundamentals. Compared to top-tier tokens, ALICE offers unique utility and growth potential in its ecosystem.

2025 ELDE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

2025 CATI Price Prediction: Expert Analysis and Market Forecast for Catizen Token

2025 CATI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 GUN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 COPI Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Digital Asset Landscape

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

What are crypto regulatory compliance and monitoring risks in 2026?

Is Stella (ALPHA) a good investment?: A Comprehensive Analysis of Risk, Market Potential, and Investment Viability

LVLY vs STX: A Comprehensive Comparison of Two Leading Digital Asset Platforms

Is Yala (YALA) a good investment?: A Comprehensive Analysis of Performance, Risks, and Future Potential

What is on-chain data analysis? How to track active addresses, transaction volume, whale movements, and network fees on Sui blockchain