2025 ACX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of ACX

Across Protocol (ACX) operates as a cross-chain bridge solution optimized for Layer 2 scaling through Optimistic Rollup technology. The ACX token serves as the governance mechanism for the Across protocol, enabling community participation in decisions affecting protocol functionality and DAO treasury management. As of December 19, 2025, ACX has achieved a market capitalization of approximately $32.95 million with a circulating supply of around 658.89 million tokens, currently trading at $0.05001 per token. This asset, recognized for its innovative capital-efficient bridge design utilizing a single liquidity pool and competitive relay mechanisms, continues to play an increasingly important role in facilitating seamless cross-chain asset transfers across major Layer 2 networks including Ethereum, Arbitrum, Optimism, and Polygon.

This comprehensive analysis will examine ACX's price trajectory and market dynamics, incorporating historical performance data, market supply and demand factors, ecosystem development, and macroeconomic conditions. The report aims to provide investors with professional price forecasts and actionable investment strategies to navigate the evolving cross-chain infrastructure landscape.

I. ACX Price History Review and Current Market Status

ACX Historical Price Evolution

- June 2023: ATL (All-Time Low) reached at $0.03440846, marking the lowest point in ACX's trading history.

- December 2024: ATH (All-Time High) reached at $1.69 on December 6, 2024, representing a significant peak in the token's valuation.

- December 2025: Price has declined substantially from the all-time high, currently trading at $0.05001 as of December 19, 2025.

ACX Current Market Position

As of December 19, 2025, ACX is trading at $0.05001, reflecting a 24-hour price increase of 1.68% ($0.000826). The token's market capitalization stands at approximately $32.95 million with a fully diluted valuation of $50.01 million. ACX maintains a circulating supply of 658.89 million tokens out of a total supply of 1 billion tokens, representing 65.89% circulation rate.

The 24-hour trading volume reached $83,227.69, with the daily price range fluctuating between $0.04656 (low) and $0.05096 (high). Over a 7-day period, ACX has experienced a -9.6% decline, while the 30-day performance shows a -18.83% decrease. The one-year performance reflects a significant -92.09% decline from previous levels.

The token is actively traded across 28 exchanges and maintains a holder base of 7,225 addresses. ACX is available on multiple blockchain networks including Ethereum, Arbitrum, Polygon, and Optimism, enabling cross-chain functionality aligned with the Across Protocol's core infrastructure.

Click to view current ACX market price

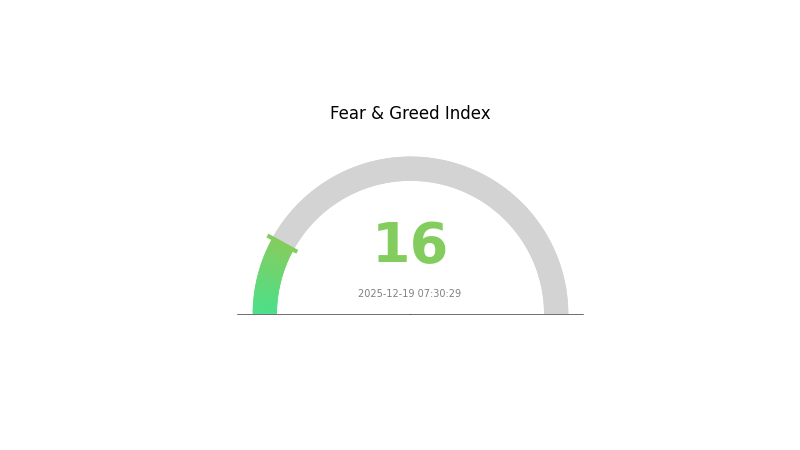

ACX Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This historically low reading signals significant market pessimism and capitulation. When fear reaches such extreme levels, seasoned investors often view it as a potential buying opportunity, as markets tend to reverse after prolonged fear cycles. However, caution remains warranted. Monitor key support levels closely and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment and make informed trading decisions based on comprehensive market data and analysis tools available on the platform.

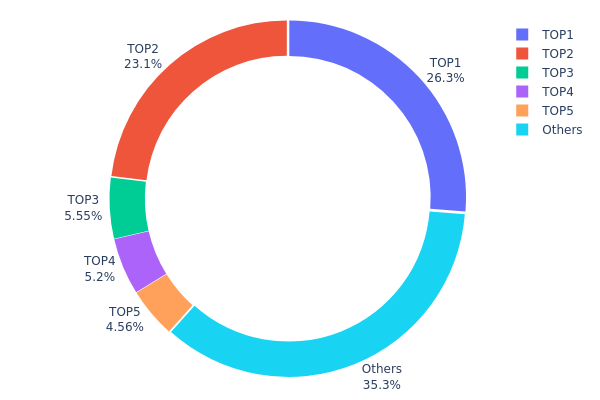

ACX Holding Distribution

The ACX holding distribution chart illustrates the concentration of token ownership across addresses, serving as a critical metric for assessing market structure and decentralization. By analyzing the allocation percentages among top holders and the remaining addresses, investors can evaluate the potential for price manipulation, market stability, and the overall health of the token's ecosystem.

Current data reveals notable concentration characteristics in the ACX market. The top two addresses collectively control 49.37% of total holdings, with the leading address alone accounting for 26.28% of the circulating supply. When expanding the analysis to the top five addresses, this figure rises to 64.66%, indicating significant token concentration among a limited number of holders. Conversely, the remaining addresses hold 35.34% of the total supply, suggesting a relatively fragmented secondary tier of ownership. This distribution pattern presents a moderate-to-high concentration risk that warrants careful monitoring.

The current holding structure carries meaningful implications for market dynamics and price stability. High concentration among top addresses creates potential vulnerability to large-scale liquidations or coordinated sell-offs, which could trigger substantial price volatility. However, the substantial 35.34% share held by dispersed addresses provides some resilience against single-actor manipulation. This bifurcated structure reflects a market in transition, where institutional or strategic accumulation coexists with broader community participation. The concentration level suggests that ACX maintains moderate decentralization characteristics, though the market remains dependent on the actions and intentions of principal stakeholders to sustain price discovery and orderly trading conditions.

Click to view current ACX holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8180...fda44a | 262821.12K | 26.28% |

| 2 | 0xb524...f03715 | 230900.21K | 23.09% |

| 3 | 0xc186...48beda | 55498.89K | 5.54% |

| 4 | 0xdf53...b2a0d5 | 51993.92K | 5.19% |

| 5 | 0xf977...41acec | 45648.37K | 4.56% |

| - | Others | 353137.49K | 35.34% |

Core Factors Affecting ACX's Future Price

Supply Mechanism

- Circulating Supply Changes: ACX experienced significant fluctuations in its reported circulating supply. At launch, the circulating supply was reported as 138 million tokens, but this figure was subsequently altered, raising concerns about transparency in supply metrics.

- Current Impact: These supply adjustments have contributed to downward price pressure and investor skepticism regarding token distribution authenticity.

Macroeconomic Environment

- Monetary Policy Impact: Global interest rate fluctuations play a significant role in ACX's price trajectory. Rising policy rates in major economies create headwinds for risk assets, including altcoins. Conversely, expectations of monetary policy relaxation can provide support.

- Crypto Asset Legitimization: The broader acceptance and legalization of cryptocurrency assets globally, coupled with developments like Bitcoin ETF approvals, influence market sentiment and capital flows into the DeFi sector.

- Geopolitical Risk Factors: Persistent geopolitical tensions can create market volatility that affects investor demand for alternative assets.

Market Sentiment and Governance Concerns

- Governance Issues: Ongoing governance concerns surrounding the Across Protocol project represent a key headwind for ACX's price performance.

- Technical Weakness: The token has demonstrated weak technical performance, underperforming the broader cryptocurrency market during recent trading sessions.

- Altcoin Market Dynamics: Investor sentiment toward altcoins directly impacts ACX's price movements, particularly during periods of market rotation away from smaller-cap tokens.

Three: 2025-2030 ACX Price Prediction

2025 Outlook

- Conservative Forecast: $0.03446 - $0.04994

- Neutral Forecast: $0.04994

- Optimistic Forecast: $0.06243 (requiring sustained market interest and positive sentiment)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with incremental growth trajectory

- Price Range Prediction:

- 2026: $0.04101 - $0.07079 (12% upside potential)

- 2027: $0.05015 - $0.08507 (26% cumulative growth)

- 2028: $0.06165 - $0.10622 (48% cumulative expansion)

- Key Catalysts: Ecosystem development milestones, adoption rate improvements, macroeconomic recovery, and increased institutional participation

2029-2030 Long-term Outlook

- Base Case: $0.07491 - $0.13357 (80% appreciation by 2029)

- Optimistic Scenario: $0.09025 - $0.13877 (2030 peak scenario with 123% total growth from 2025 baseline)

- Transformative Scenario: $0.11191 (2030 average price, assuming breakthrough innovations, mainstream adoption acceleration, and favorable regulatory environment)

Market Context: ACX exhibits a structurally positive long-term trajectory through 2030, with predictions suggesting consistent year-over-year appreciation. Traders monitoring ACX on Gate.com should note that this token demonstrates resilience patterns aligned with broader cryptocurrency market cycles and emerging asset class maturation.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06243 | 0.04994 | 0.03446 | 0 |

| 2026 | 0.07079 | 0.05618 | 0.04101 | 12 |

| 2027 | 0.08507 | 0.06349 | 0.05015 | 26 |

| 2028 | 0.10622 | 0.07428 | 0.06165 | 48 |

| 2029 | 0.13357 | 0.09025 | 0.07491 | 80 |

| 2030 | 0.13877 | 0.11191 | 0.06715 | 123 |

Across Protocol (ACX) Investment Strategy and Risk Management Report

IV. ACX Professional Investment Strategy and Risk Management

ACX Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol believers and cross-chain bridge infrastructure investors with medium to long-term investment horizons

- Operation Recommendations:

- Accumulate ACX during market downturns when prices experience significant corrections, as demonstrated by the current 92.09% year-over-year decline, which may present entry opportunities for strategic positioning

- Participate in Across Protocol governance through ACX token staking to gain exposure to protocol decisions while earning potential governance rewards

- Dollar-cost averaging (DCA) approach: allocate fixed capital monthly to reduce the impact of price volatility and establish positions at varying price levels

(2) Active Trading Strategy

- Price Action Monitoring:

- Track 24-hour price movements: currently trading at $0.05001 with a 1.68% positive change, indicating potential short-term momentum

- Monitor weekly and monthly trends: the -9.6% 7-day decline and -18.83% 30-day decline suggest ongoing bearish pressure that requires careful technical analysis

- Wave Trading Key Points:

- Resistance levels: historical high of $1.69 (December 6, 2024) provides long-term resistance; immediate resistance near $0.05096 (24-hour high)

- Support levels: immediate support at $0.04656 (24-hour low); critical support at all-time low of $0.03440846 (June 1, 2023)

ACX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation, focusing on protocol infrastructure exposure with minimal leverage

- Active Investors: 3-8% of crypto portfolio allocation, allowing for moderate position accumulation during market dislocation

- Professional Investors: 5-15% of crypto portfolio allocation, with structured hedging strategies and active governance participation

(2) Risk Hedging Solutions

- Portfolio Diversification: combine ACX holdings with other cross-chain infrastructure tokens and core layer-1/layer-2 assets to reduce single-protocol concentration risk

- Position Sizing: maintain strict stop-loss orders at 15-20% below entry points to manage downside risk effectively, particularly given the token's high volatility profile

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides secure, user-controlled custody with multi-chain support for ACX tokens across ETH, Arbitrum, Polygon, and Optimism networks

- Self-Custody Method: transfer ACX to your own wallet addresses for long-term holding, maintaining private key security and independence from exchange counterparty risk

- Security Considerations: enable two-factor authentication on all exchange accounts; use hardware security best practices; never share seed phrases or private keys; verify contract addresses before token transfers to avoid phishing scams

V. ACX Potential Risks and Challenges

ACX Market Risk

- Extreme Volatility: ACX has experienced a 92.09% decline over the past year, demonstrating extreme price sensitivity to market sentiment and bridge protocol developments; this volatility exposes holders to substantial liquidation risk

- Liquidity Constraints: 24-hour trading volume of only $83,227.68 relative to a market cap of $32.95 million indicates relatively thin liquidity, which can result in significant slippage on large trades and difficulty exiting positions during market stress

- Low Trading Frequency: with only 28 exchanges listing ACX and a relatively concentrated holder base of 7,225 addresses, market depth may be insufficient for institutional capital deployment

ACX Regulatory Risk

- Jurisdiction Uncertainty: cross-chain bridge protocols face evolving regulatory scrutiny regarding their role in asset transfers and potential application of securities regulations to governance tokens

- Compliance Evolution: as different jurisdictions establish clearer frameworks for DeFi protocols, changes in regulatory treatment could materially impact ACX token utility and trading accessibility

- Operational Constraints: regulatory actions against competing bridges or increased compliance requirements could affect the Across Protocol's operational freedom and market positioning

ACX Technology Risk

- Bridge Security Vulnerabilities: cross-chain bridges remain attractive targets for sophisticated attackers; security exploits at bridge protocols can result in catastrophic loss of locked funds and protocol reputation damage

- Smart Contract Risk: the protocol's reliance on optimistic rollup technology and complex relay mechanisms introduces potential smart contract bugs or unforeseen technical issues

- Liquidity Pool Concentration: the protocol's single liquidity pool design, while efficient for capital utilization, creates concentrated risk if the pool experiences significant impairment or is exploited

VI. Conclusion and Action Recommendations

ACX Investment Value Assessment

Across Protocol represents a specialized infrastructure investment focused on cross-chain liquidity. The project demonstrates technical innovation through capital-efficient design and competitive relay mechanisms. However, current market conditions reflect significant challenges: the 92.09% year-over-year decline, thin trading liquidity, and concentrated holder base present both heightened risk and potential recovery opportunity. ACX is primarily suitable for investors with specific infrastructure exposure objectives rather than general cryptocurrency investors. The token's governance utility provides long-term value proposition tied to protocol adoption, but near-term price pressures require careful risk management.

ACX Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of crypto portfolio as an infrastructure exploratory position; prioritize learning about cross-chain bridge mechanisms and governance participation before expanding allocation; use Gate.com for secure trading and asset management

✅ Experienced Investors: Implement structured accumulation during oversold conditions (support near $0.03-0.04 range); combine with other L2/cross-chain infrastructure exposure; actively participate in protocol governance to understand development roadmap and competitive positioning

✅ Institutional Investors: Conduct deep technical due diligence on bridge security mechanisms and liquidity pool structure; consider ACX as part of systematic DeFi infrastructure exposure; evaluate protocol's competitive positioning relative to alternative bridging solutions

ACX Trading Participation Methods

- Gate.com Spot Trading: Direct ACX purchase and sale with real-time price discovery; suitable for standard accumulation and liquidation; access to multiple trading pairs and competitive spreads

- Gate.com Portfolio Management: consolidate ACX holdings with other crypto assets; utilize Gate Web3 Wallet for secure cross-chain holdings; monitor governance participation opportunities

- Governance and Staking: engage with Across Protocol governance through ACX token participation; potentially earn protocol rewards while maintaining exposure to development decisions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

Will ACH reach $1?

Alchemy Pay (ACH) has the potential to reach $1 with significant market growth and adoption. Achieving this target requires substantial market cap expansion. Current projections suggest it's an ambitious but achievable goal for ACH.

What is acx crypto?

ACX is the governance token of Across Protocol, a decentralized cross-chain bridge enabling fast, secure, and capital-efficient asset transfers between multiple blockchains. It facilitates seamless interoperability in the Web3 ecosystem.

Does Axs crypto have a future?

AXS has strong fundamentals and substantial investor interest, indicating a promising future. Continued development and positive market trends support its long-term potential and growth prospects.

What is the price prediction for ACX across protocol?

ACX is projected to reach approximately $0.1270 by 2030, representing potential growth of 166.93%. Price predictions suggest a trading range between $0.03236 and $0.1270 based on market analysis.

What is VELODROME: A Comprehensive Guide to the Revolutionary Decentralized Exchange Protocol

What is VELODROME: The Revolutionary Cycling Track Transforming Professional Racing and Urban Recreation

2025 DYDX Price Prediction: Analyzing Market Trends and Potential Growth Factors

ZEROLEND vs DYDX: Comparing the Top Decentralized Lending Platforms in the DeFi Space

CRO vs DYDX: Comparing Two Leading Crypto Exchanges for Optimal Trading Experience

LISTA vs DYDX: Comparing Two Leading Decentralized Trading Platforms in the Crypto Ecosystem

Comprehensive Guide to Digital Wallet Card Features and Benefits

Top Crypto Wallets for Web3 Trading in 2025: A Comparative Analysis

Is PlatON (LAT) a good investment?: A Comprehensive Analysis of Features, Market Performance, and Future Potential

Is Mythos (MYTH) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in 2024

Is Vanar (VANRY) a good investment?: A Comprehensive Analysis of Growth Potential, Market Position, and Risk Factors for 2024